The ETF Portfolio Strategist - Sunday, July 25

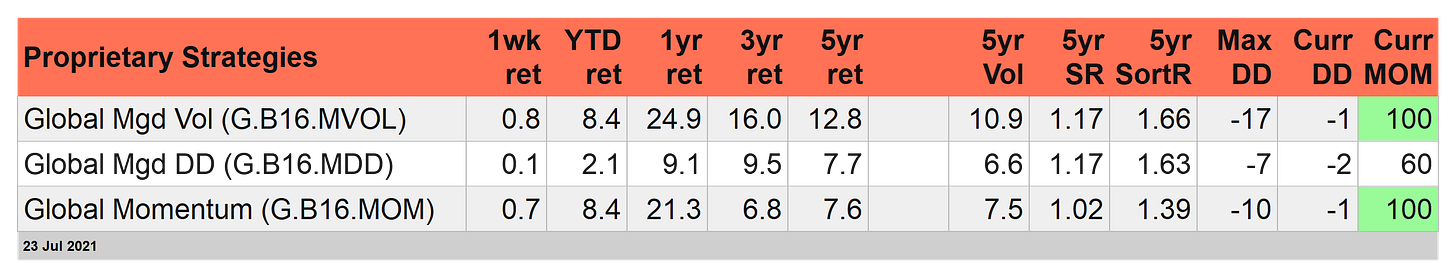

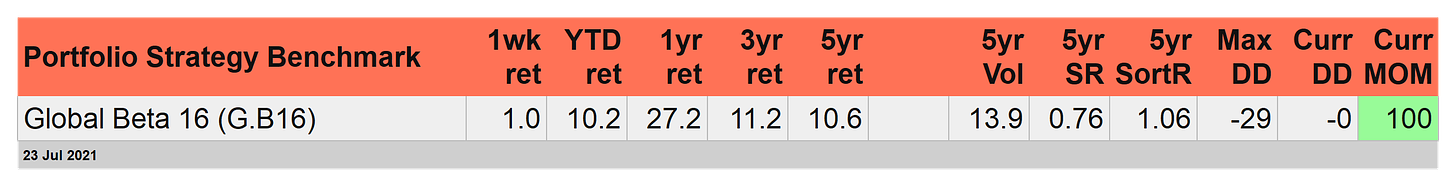

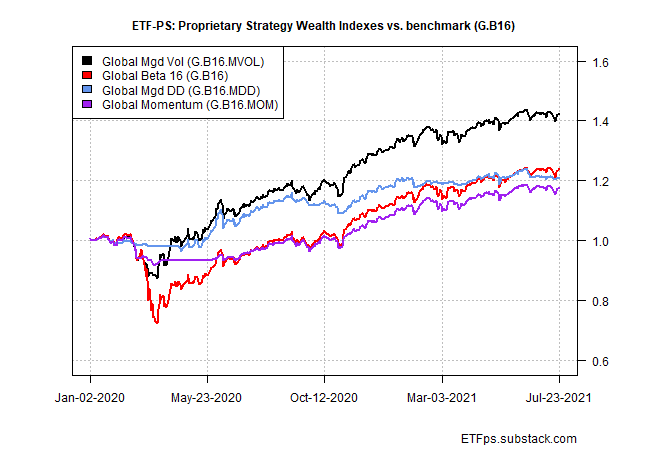

Our trio of proprietary strategies continued to trail their common benchmark last week (through Friday, July 23). The gap ranged from slight to substantial. The best performer among the active risk-managed strategies: Global Managed Volatility (G.B16.MVOL), which gained 0.8% for the trading week. That was just 20 basis points behind the benchmark: Global Beta 16 (G.B16), which earned 1.0% for the week.

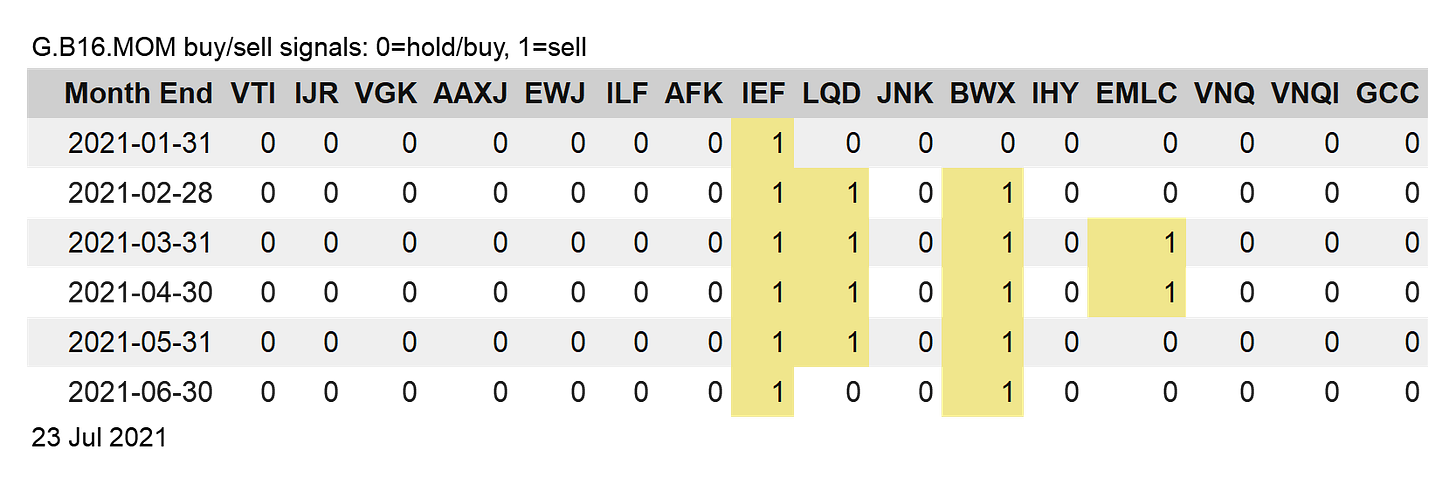

Global Momentum (G.B16.MOM) delivered a touch less for the week via a 0.7% rise. The laggard: Global Managed Drawdown (G.B16.MDD), which rose a thin 0.1%.

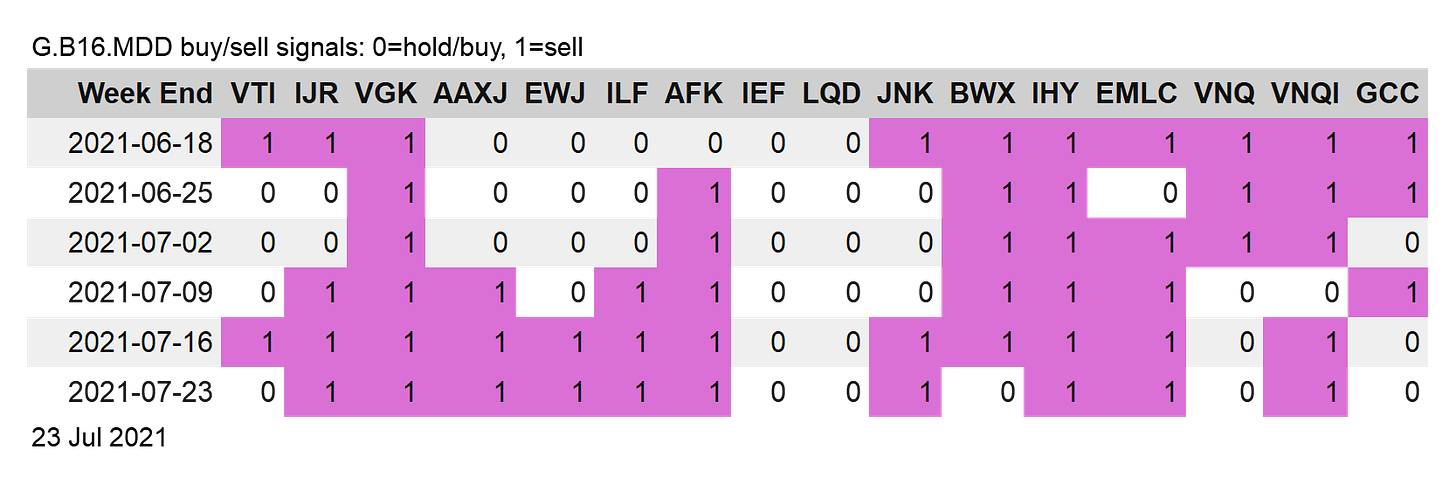

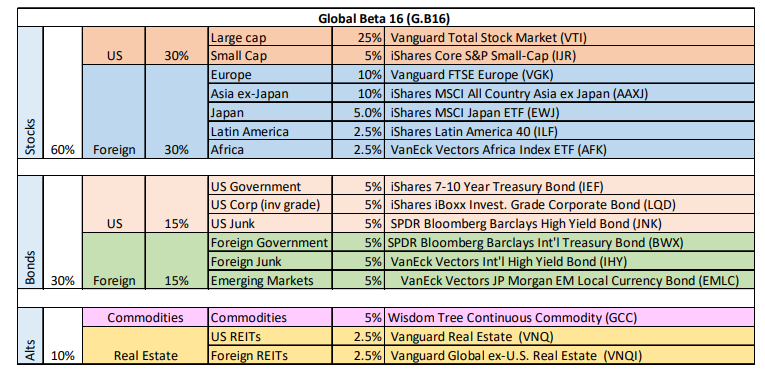

All three proprietary strategies fish in the same ETF waters as G.B16, using the same opportunity set and target weights (during risk-on conditions). The only difference: each strategy has its own risk-on/risk-off model and so any one or more of the 16 target ETFs can be a buy or sell. By contrast, G.B16 continually holds all 16 target funds, rebalancing to the target weights every Dec. 31. (See the table below for the 16-fund opportunity set and target weights.)

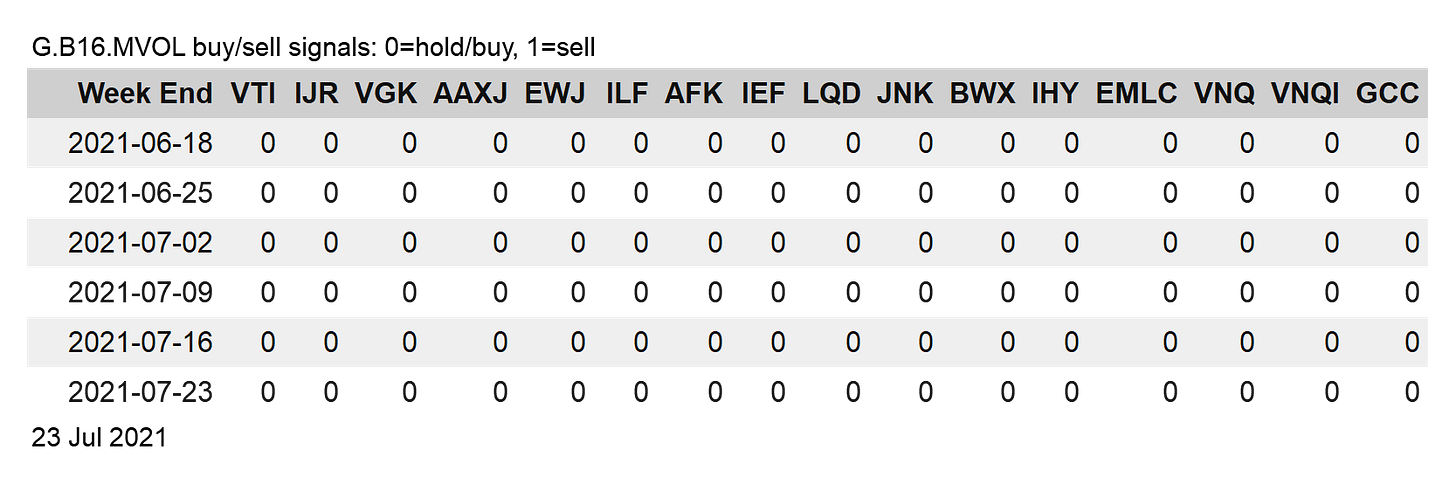

For rebalancing activity, there were slight changes for G.B16.MDD, which shifted to a slightly more aggressive risk-on profile at Friday’s close. Overall, the strategy maintained a defensive bias (10 of the 16 funds remain in a risk-off posture). By contrast, there were no portfolio changes for G.B16.MVOL and G.B16.MOM.