The ETF Portfolio Strategist - Sunday, July 18

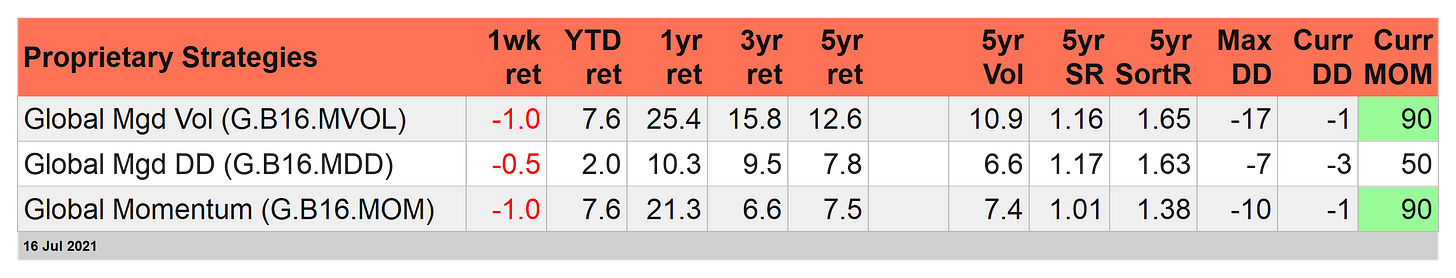

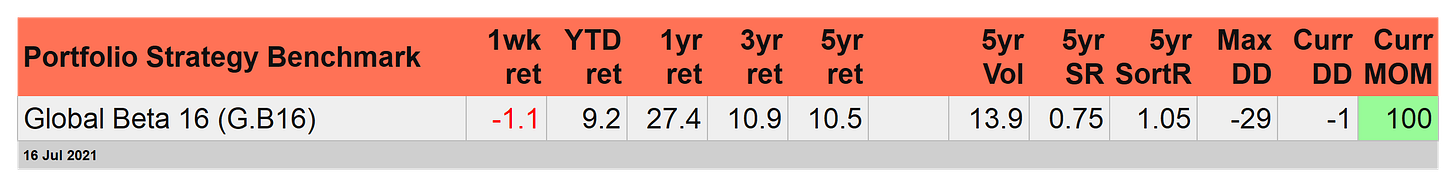

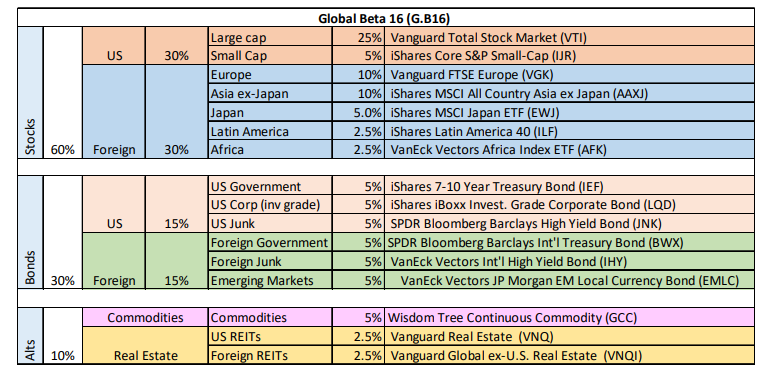

There’s good news and bad news for our trio of proprietary strategies in last week’s performance round-up. Relative to the benchmark (Global Beta 16 (G.B16)), all three outperformed for the trading week through Friday, July 16. Alas, the outperformance was in the form of lesser declines, ranging 0.5% to 1.0% losses. The benchmark shed 1.1%.

For the year so far, however, G.B16 is still comfortably in the lead, posting a strong 9.2% total return. Global Managed Volatility (G.B16.MVOL) and Global Momentum are tied at a 7.6% year-to-date gain while Global Managed Drawdown (G.B16.MDD) is ahead in 2021 by a modest 2.0%.

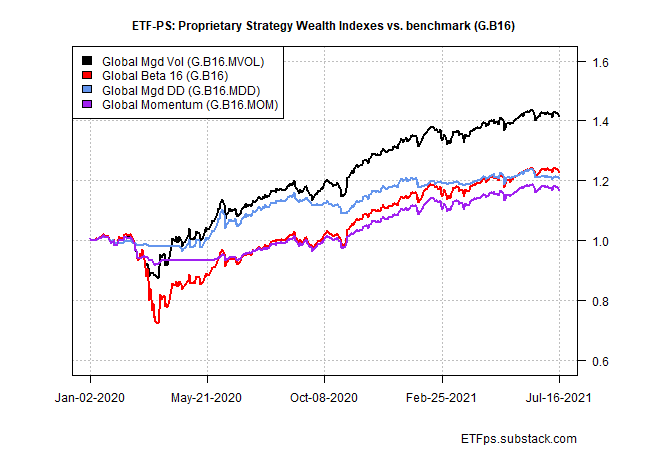

The risk-adjusted results still favor the proprietary strategies by a wide margin. But there may be another headwind brewing: all three prop strategies have been flatlining recently. By contrast, the benchmark continues to trend up, albeit only modestly.

The reason: markets have unleashed on-again/off-again risk signals in recent history, more so than usual, and so the noisy climate has taken a toll on active risk management, at least for our three prop strategies.

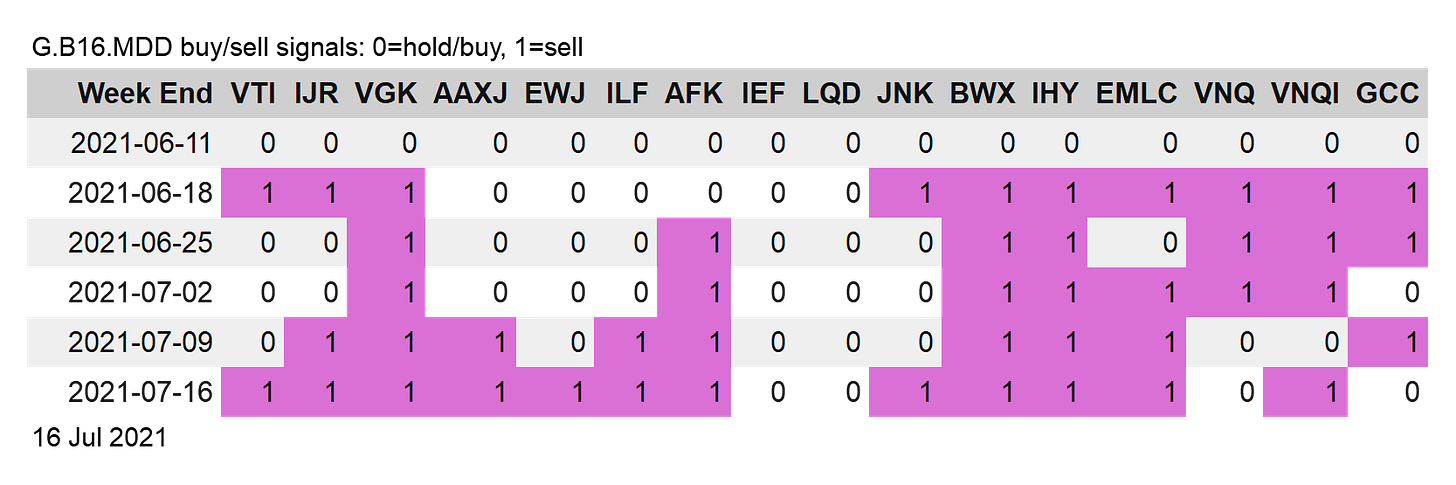

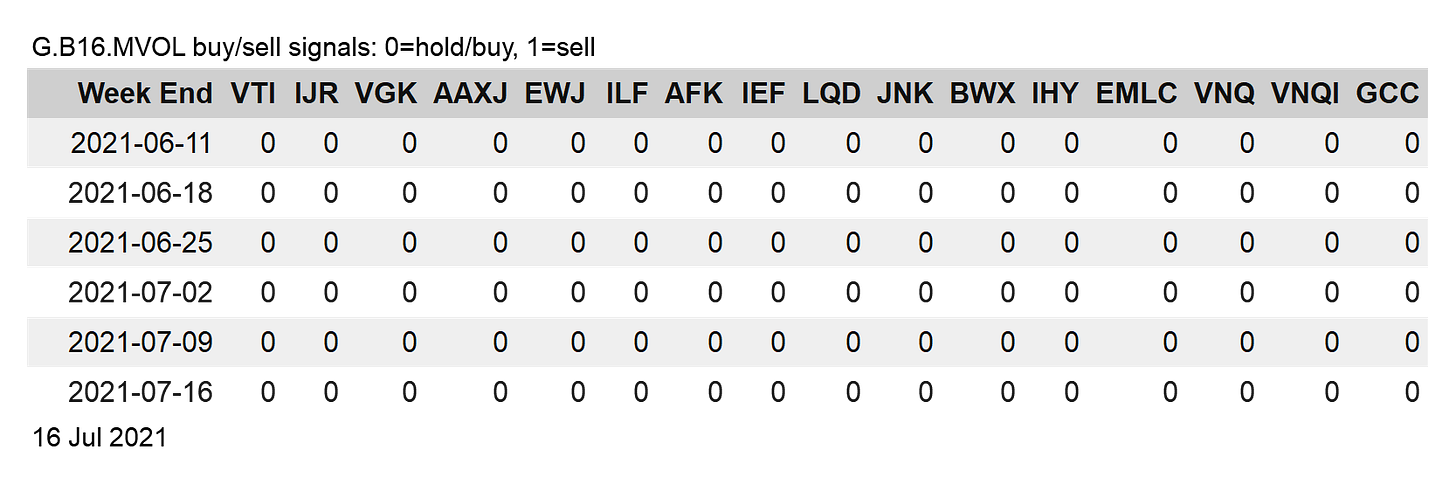

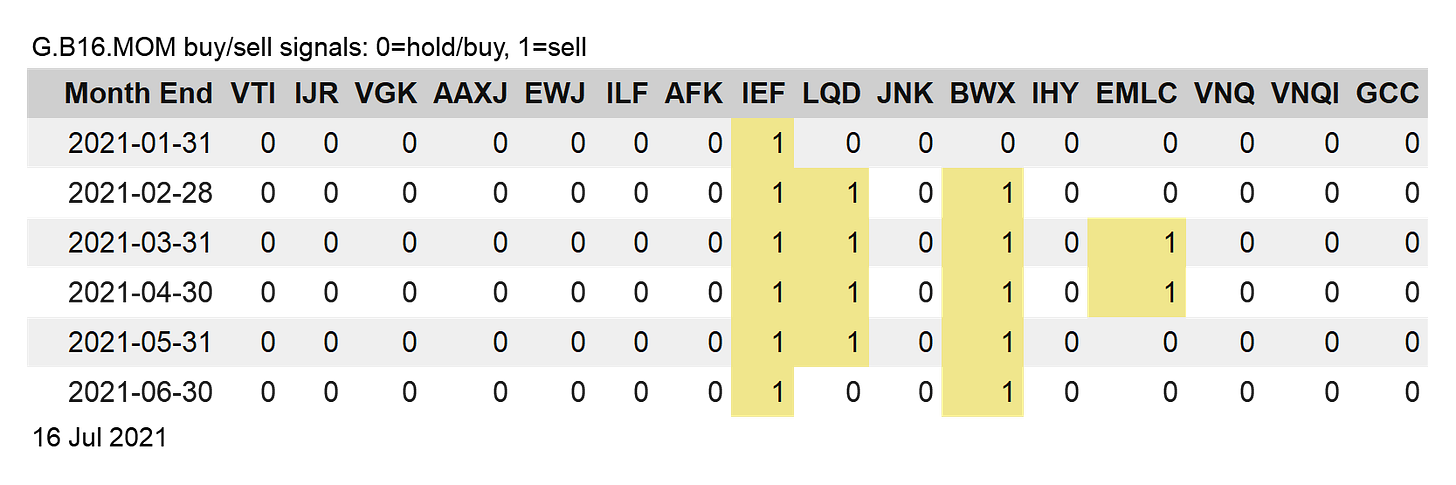

On the rebalancing front, only G.B16.MDD shifted its risk profile last week, becoming more defensive: 12 of the 16 tickers in the opportunity set are now in a risk-off posture, up from 9 in the previous week. No changes were posted for the other two prop strategies.