The ETF Portfolio Strategist - Sunday, Aug. 1

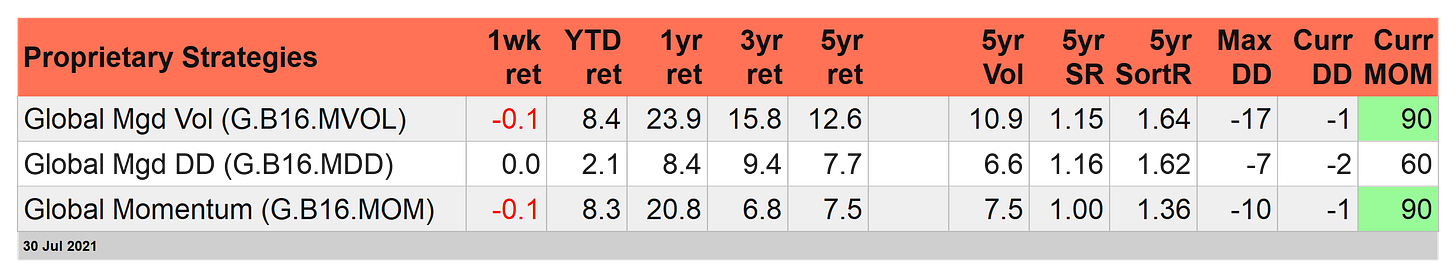

The economic and financial headlines swirled last week, but the net result was essentially no change to a slight downside bias for performance with our proprietary strategies. As usual, the relatively calm surface activity at the strategy level masked a fair degree of turbulence in some corners for the underlying 16-fund opportunity set.

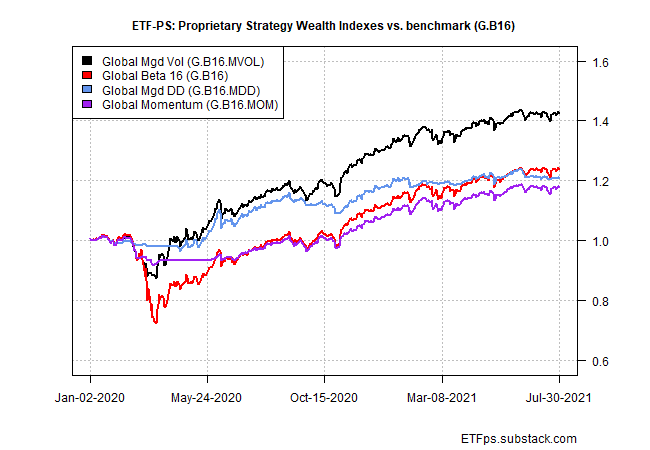

At the top level, two of our three strategies edged lower last week, in line with the benchmark. A third strategy was unchanged. Global Managed Drawdown (G.B16.DD) held steady, slightly outperforming the benchmark’s 0.1% decline for the trading week through July 30.

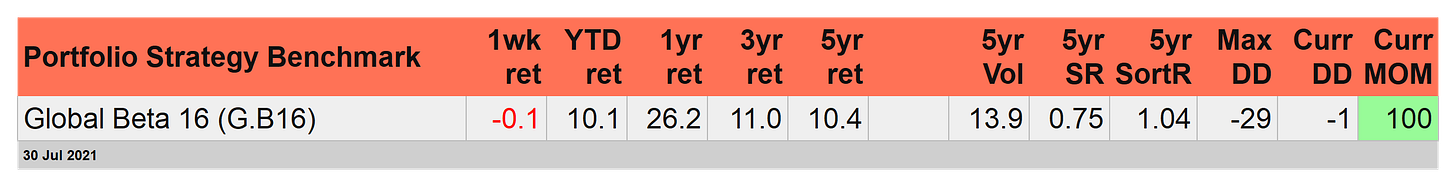

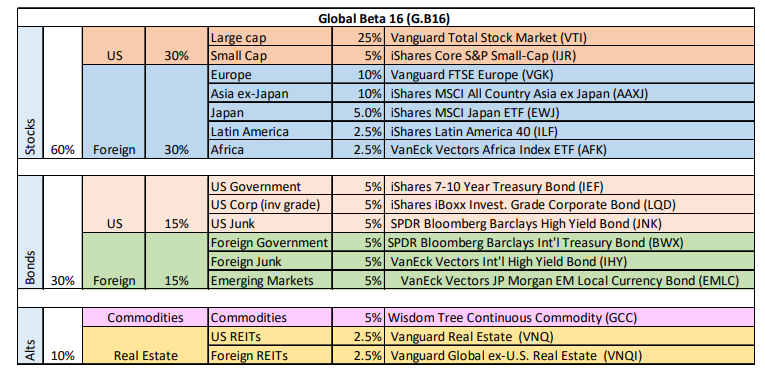

Year-to-date, all three strategies continue to trail the 16-fund benchmark — see G.B16’s asset allocation at the end of this article. Note that these 16 funds also constitute the opportunity set for our three proprietary portfolio strategies.

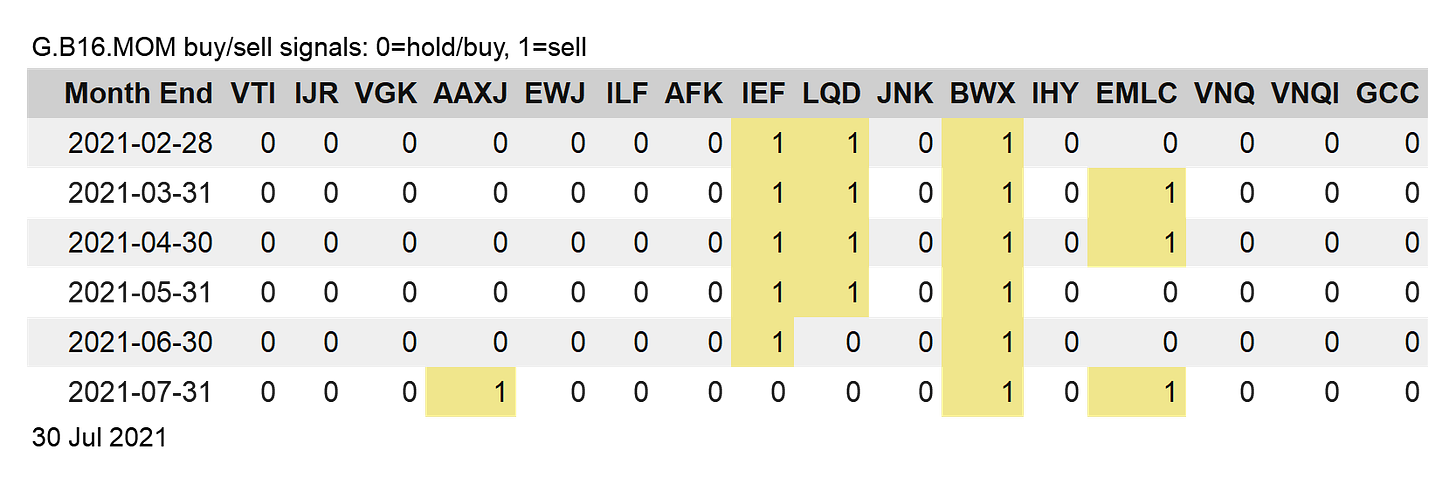

For rebalancing activity, Global Beta 16 Momentum (G.B16.MOM)—using a month-end rebalancing schedule—moved to slightly less aggressive risk profile at July’s close.

The strategy sold iShares MSCI All Country Asia ex Japan (AAXJ) and VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC), while continuing to sidestep SPDR Bloomberg Barclays International Treasury Bond (BWX). Overall, G.B16.MOM continues to reflect a relatively aggressive risk-on profile—13 of 16 funds in its opportunity set are risk-on.

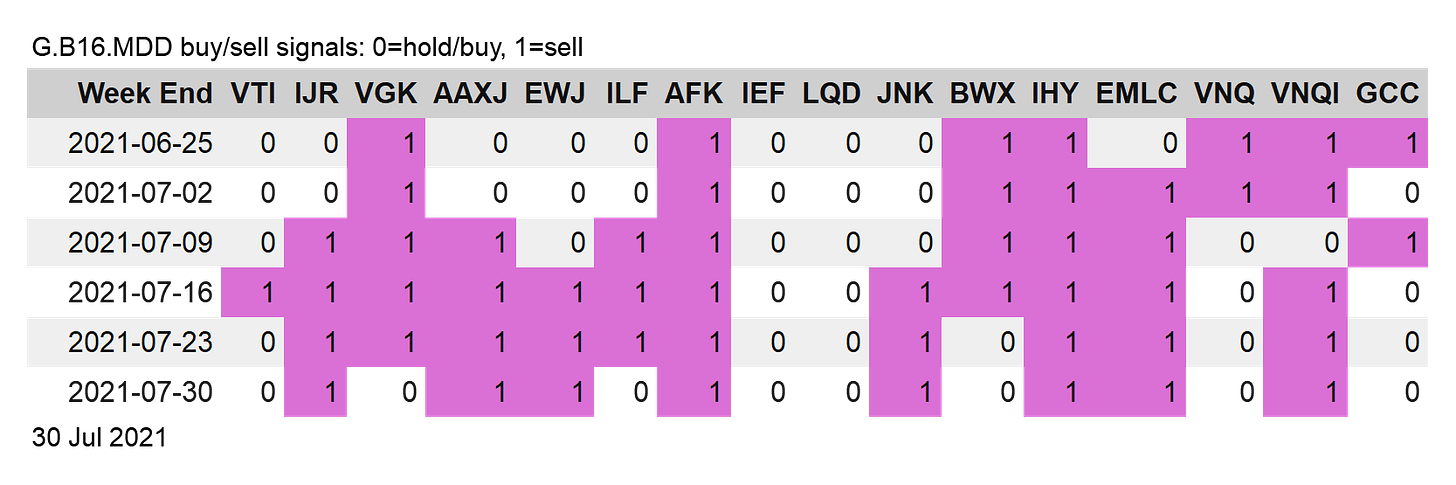

G.B16.MDD shifted to a slightly more risk-on profile at last week’s close. Vanguard FTSE Europe (VGK) and iShares Latin America 40 (ILF) are on the buy list once more for the strategy, although G.B16.MDD is effectively positioned with a neutral outlook; half of the portfolio is designated risk-on, half risk-off.

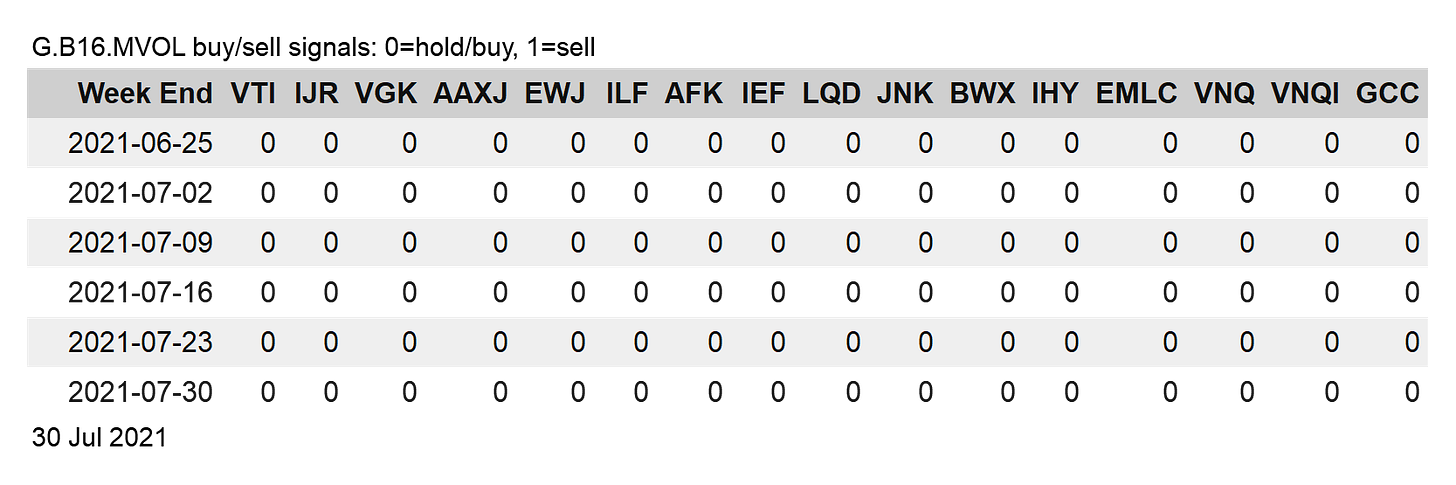

There were no changes to G.B16.MVOL last week and so the strategy remains in an all-out risk-on position.