The Energy Sector Is Hated: Is It Time To Buy?

Photo by American Public Power Association on Unsplash

“If everyone’s thinking alike, then somebody isn’t thinking.” ~ George S. Patton

Exhibit A: After Super Micro Computer’s (SMCI) ninth straight gain on Thursday (and seventh straight weekly gain), investors bid up shares by more than 7% in pre-market trading. Less than an hour later, shares plummeted by more than 20% off their intra-day highs.

Investors should remember that the market is never easy or obvious. Being successful requires investors to “skate to where the puck is going” rather than where it’s been. Is it time for investors to diversify out of the red-hot tech sector and back into the lagging energy sector?

Below are some compelling reasons to entertain oil-related positions:

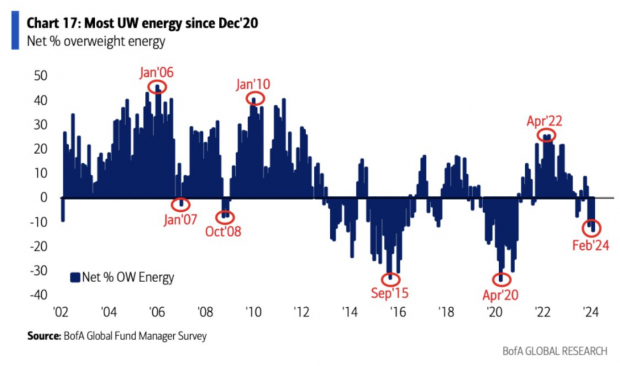

Funds are the Most Underweight Energy Stocks Since the Pandemic

Lack of interest from hedge funds in the energy sector has proven to be a solid contrarian measure historically. The last time funds were this underweight energy stocks was in April of 2020. The result? The United States Oil Fund ETF (USO) doubled over the next few months.

Image Source: Bank of America

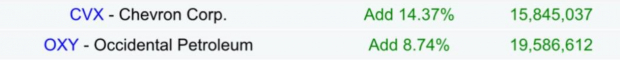

Buffett’s High Conviction OXY play

Berkshire Hathaway’s recent 13F disclosure revealed that “The Oracle of Omaha” maintains its bullish stance on energy companies like Chevron (CVX) and Occidental Petroleum (OXY). Buffett took advantage of lower share prices and increased his CVX allocation by 14% and his OXY position by ~9%. Buffett and Berkshire now have a roughly 10% allocation to the energy space, which is meaningful considering ~50% of the portfolio is tied up in Apple (AAPL). Though Buffett’s high-conviction ideas require patience, he sports an extraordinary track record.

Image Source: Zacks Investment Research

Red Sea Disruptions Persist

Houthi rebels have wreaked havoc on the Red Sea corridor – one of the most critical energy routes globally. While the U.S. Navy is doing its best to attack the Houthis and limit shipping disruptions, the rebel’s drone techniques and surprise attacks have been and will likely continue to be a thorn in the side of shippers in the area.

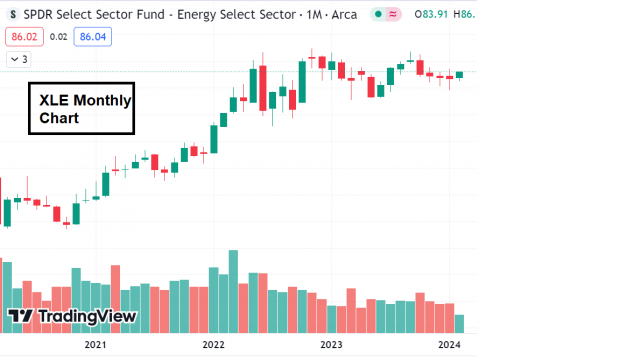

Long-Term Perspective Tells the Story

Amateur investors often suffer from “recency bias” regarding technical analysis and chart studies. Though the energy sector has lagged, if you zoom out to a monthly chart, the bullish trend in the SPDR Select Energy ETF (XLE) and other energy proxies remains fully intact.

Image Source: TradingView

Valuations

Names like OXY and CVX are dirt cheap and have Price-to-Book Values at multi-year lows. Investors may seek value plays If money is to rotate out of the red-hot tech sector.

Image Source: Zacks Investment Research

Recent Relative Price Strength

The first sign of momentum is short-term relative strength. With the S&P 500 flat for the week, energy names like ExxonMobil (XOM) are mostly up 2% or more.

Bottom Line

Investors who avoid conformity and think independently prosper in the long run. Considering the tech sector’s recent extreme bull move, money may rotate into the lagging energy sector.

More By This Author:

3 Top-Rated Stocks To Buy After Comfortably Surpassing Earnings Expectations

3 Audio Video Stocks Worth Watching In A Thriving Industry

DoorDash, Inc. Reports Q4 Loss, Tops Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more