The Big 7 Are The Stock Market And We’re In The 9th Inning

FANGMAN- Sums up the last few years nicely. Mega-cap owns the world. I guess I can add Tesla to this...#megacaps pic.twitter.com/eWWKAyp7Q3

— Greg Rieben (@gregrieben) November 19, 2021

The fully diluted market cap of $AAPL $MSFT $GOOG $GOOGL $AMZN $TSLA $FB $NVDA is more than $12 trillion as of today’s close (Fri 11/19) - about 30% of the entire S&P. So these 7 really can carry the market on their own at least for awhile… pic.twitter.com/bzpCM0mZsG

— Top Gun Financial (@TopGunFP) November 20, 2021

Day by day it is becoming clearer to me that the stock market is in the last throes of the great bull market that began on March 9, 2009. That’s because more and more smaller and lesser known stocks are falling by the wayside, although strength in The Big 7 is masking this in the major indexes.

This same kind of action was in effect on Friday. The S&P fell 14 basis points, but this was constituted by a 2 basis point gain from the S&P 100 ETF (OEF) – the largest 100 stocks in the index – versus a 65 basis point drop for the S&P Equal Weight ETF (RSP).

The NASDAQ rose 40 basis points, closing above 16 thousand for the first time ever at 16,057. However, the bifurcation between the biggest stocks in the market and rest was evident here as well. QQQ was up 56 basis points, led by AAPL (+1.70%), TSLA (+3.71%), NVDA (+4.14%), and FB (+1.95%). However, the popular Ark Innovation ETF (ARKK) of smaller tech stocks was off 51 basis points.

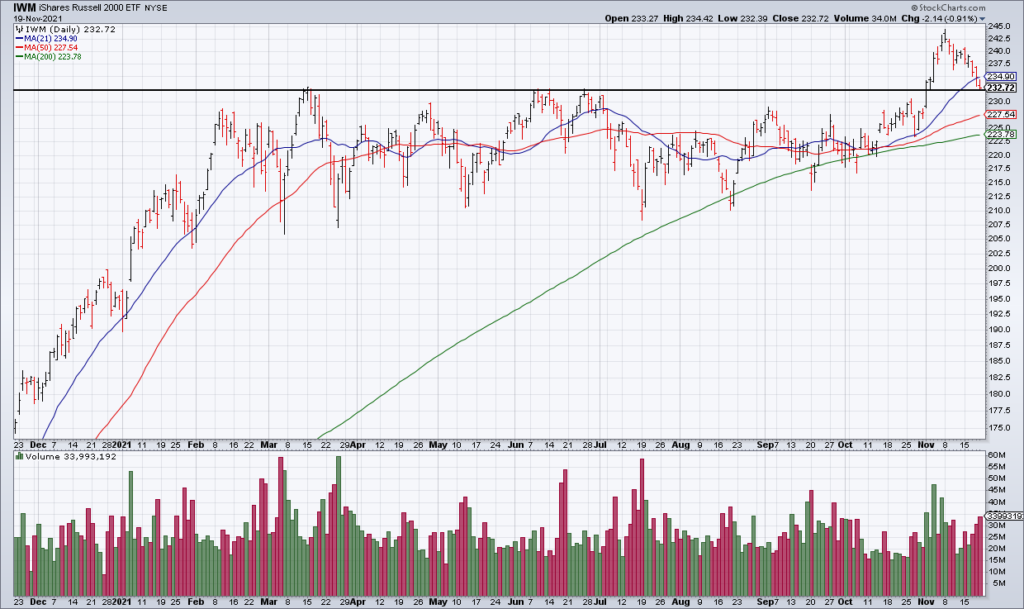

The Russell 2000 ETF (IWM) of smaller stocks was off 91 basis points and is threatening a false breakout if it can’t hold $232.50. Overall breadth on the NYSE + Nasdaq was 2,949 Advancers to 5,080 Decliners. Only 35% of all issues traded on the exchanges were up on the day.

If the market bifurcation feels bad now, imagine what it felt like in '99. These were the sector returns in the ~4 months leading up to the March '00 $NDX peak pic.twitter.com/6Ozko247eq

— Jonathan Krinsky,CMT (@jkrinskypga) November 19, 2021

This is precisely the sort of thing we saw during the topping phase of the Dot Com Bubble in late 1999 and early 2000, as Jonathan Krinsky so nicely illustrated in the above tweet.

If you talk to the average investor, or even the average financial professional, they will probably tell you that this is the best of times. Little do they know that we are actually in the 9th inning of the greatest bubble in financial history.

I don’t know what the catalyst will be that will cause The Big 7 to roll over and end the bull market. Perhaps it will be interest rates. What I do know, however, is that they won’t keep going up everyday for no reason. At some point, big investors will decide that enough is enough and start selling, and that will be all she wrote.