The Bearish Case Has Rarely Been Stronger

Image Source: Unsplash

While the S&P 500 is near all-time highs, it might surprise you to know that the bearish case has rarely been stronger during my almost 20-year career in the business. I’m going to lay out a bunch of reasons for why this is the case.

(Click on image to enlarge)

(Click on image to enlarge)

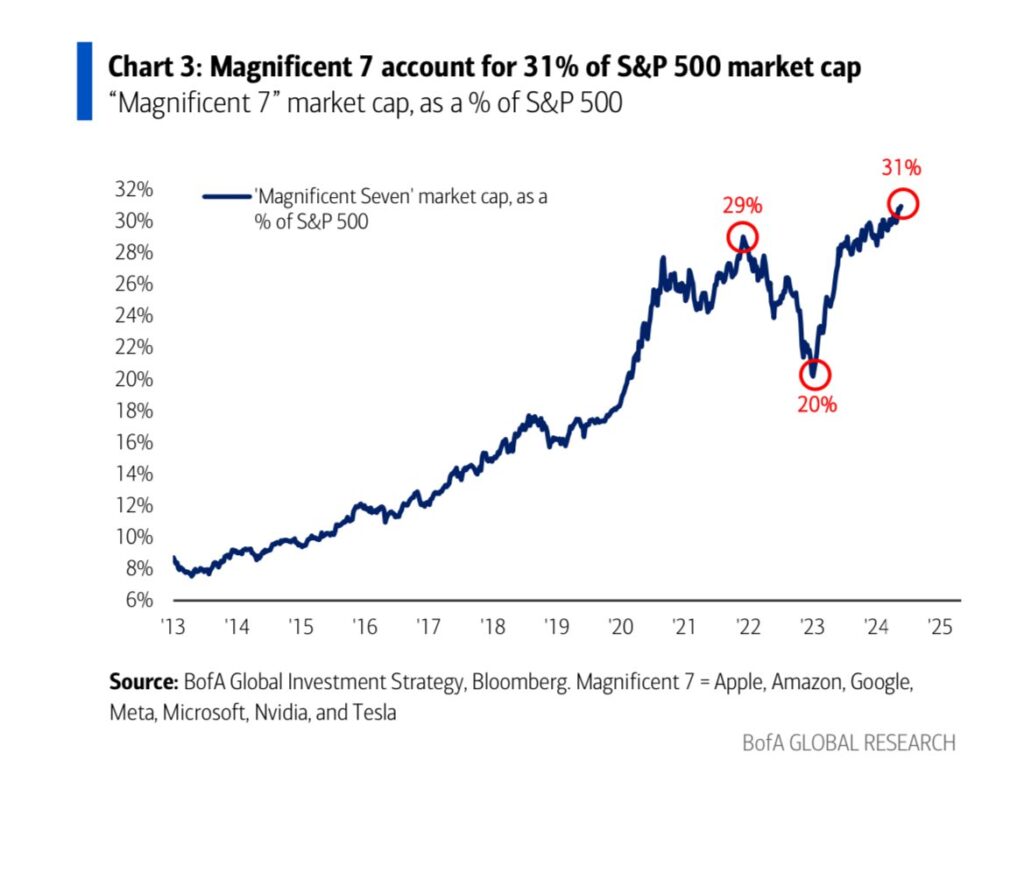

The first reason to be bearish continues to be the narrowness of the rally. The S&P 500 is up more than 9% this year, but more than 50% of that is due to just four stocks: Nvidia (NVDA), Facebook (META), Microsoft (MSFT), and Amazon (AMZN). Indeed, 39% is due to Nvidia alone – and it is quite extended after last week’s huge post earnings pop. The Magnificent 7 now make up 31% of the S&P’s market cap.

(Click on image to enlarge)

The second reason to be bearish is valuation. The S&P 500 now trades at 22x forward earnings, according to Paul LaMonica in this weekend’s Barron’s The Trader Column. Indeed, most of this bull run since October 2022 has been fueled by multiple expansion, not earnings growth, as you can see in the chart above from Liz Ann Sonders.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

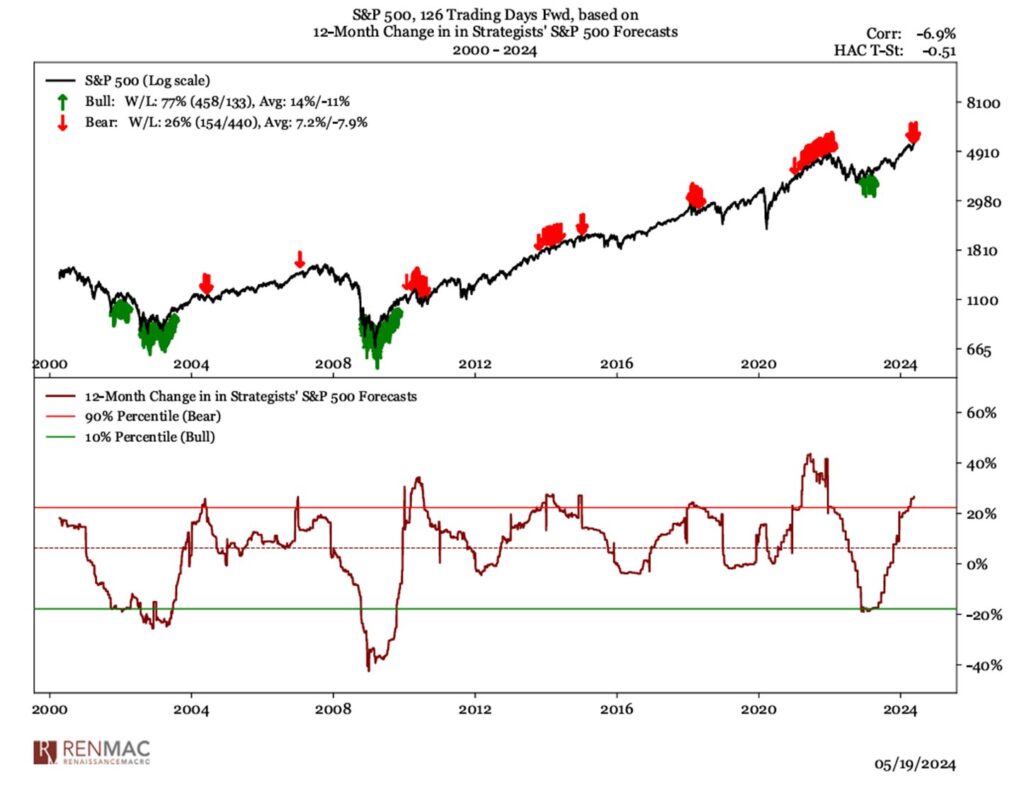

The third reason to be bearish is extremely bullish sentiment. As you can see in the first chart above from Renaissance Macro, strategists' bullishness has just crossed above the 90th percentile based on 12-month changes in S&P 500 forecasts.

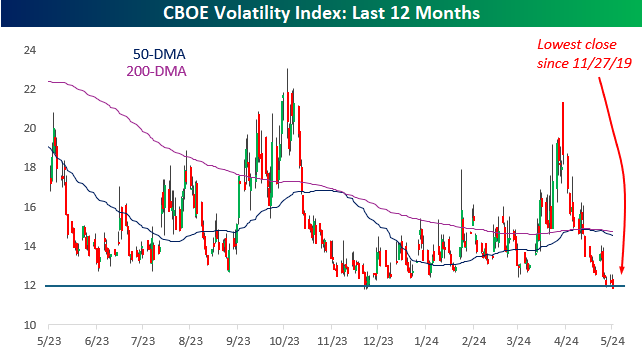

Indeed, one of the last remaining bears – Mike Wilson – capitulated last week, raising his S&P price target by 20% to 5,400. A soft landing is now fully priced in and there is no fear in the market, as can be seen in the VIX.

(Click on image to enlarge)

The fourth reason to be bearish is that Fed continues to be “higher for longer.” Most Fed forecasters now see only one or two rate cuts this year.

The fifth reason to be bearish is the increasingly dangerous geopolitical environment. The war in Ukraine shows no sign of ending after more than two years, and the war in the Middle East carries a decent likelihood of escalation. As Walter Russel Mead pointed out in the WSJ last Tuesday, Biden’s “diplomacy of retreat” is emboldening the world’s bad actors.

The sixth and final reason to be bearish is the upcoming 2024 Presidential Election in November, which is likely to be one of the nastiest in American history. There is a possibility that whichever side loses will not be quick to concede, which could result in some tense moments – or worse.

More By This Author:

Kostin Year End S&P PT: 5200, AMAT, NVDA Earnings Next WeekWalmart: Blowout Quarter, DE: Agricultural Weakness

The S&P Breaks Out To New All Time Highs And The Technicians Declare Victory