The ARKK Pain Trade Continues

Heading into Monday's cash open, Cathie Wood was on track as having the worst stretch for her ETFs in a year.

Her main ETF was about 25% off its recent highs heading into the open. Despite the Nasdaq trying to rally early in the session, by 1 PM on the east coast, ARK's Innovation ETF was near lows of the day, down 3.3%, amid a broader technology-related selloff.

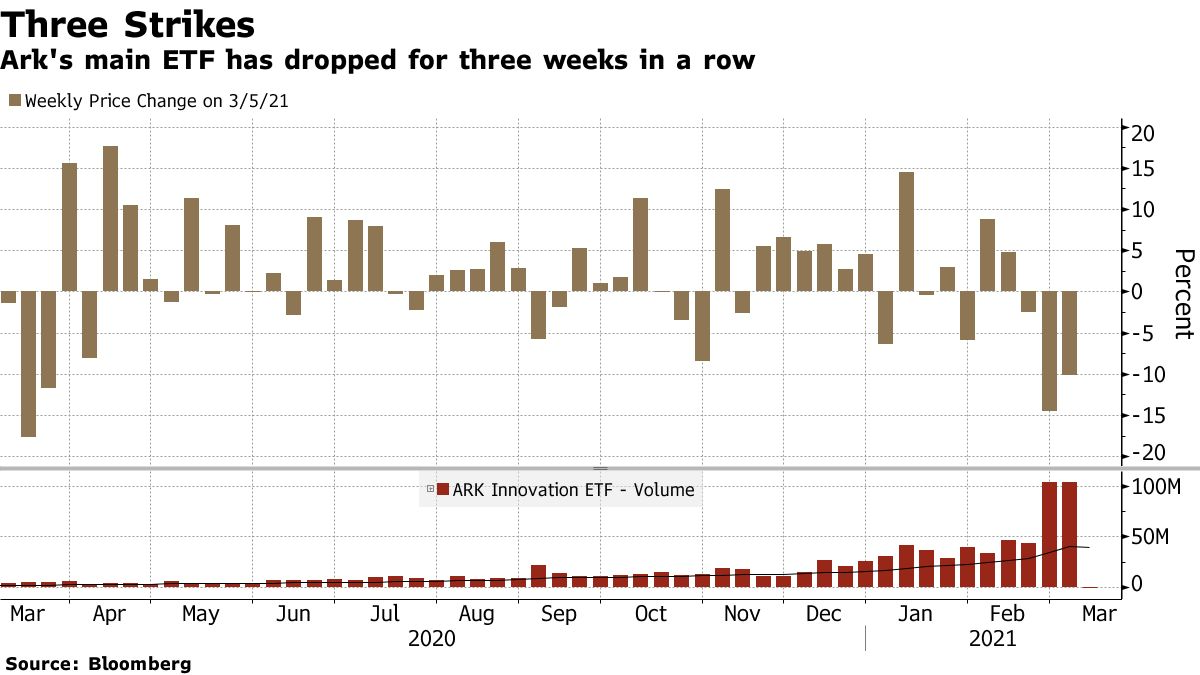

This has now become "the longest stretch of weekly losses for the Ark Innovation ETF" since the Covid selloff last year, according to Bloomberg.

Top holdings of the ARKK fund are also suffering: Tesla, despite making an odd and quite unnatural-looking bounce early in the session, turned red and is down about 2% mid-day. Square and Teledoc health are also lower by 2.76% and 3.5%, respectively, mid-day.

(Click on image to enlarge)

It marks a continued drubbing for the poster child of speculative "technology" plays.

Recall, we noted that all of ARK's funds saw outflows on Friday of last week. And as ARK's trade updates last week seemed to disclose, Wood's strategy doesn't appear to be changing. As we have been pointing out, that strategy appears to be selling large, liquid big cap names and rotating the cash into smaller, speculative, small-cap names.

This can obviously become a negative feedback loop if the "strategy" continues and ARKK continues to plunge.

(Click on image to enlarge)

Recall, last week, well known FinTwit personality @Keubiko penned an article called "Raiders of the Lost ARKK", which laid out exactly how ARK's flagship ETF could find itself in hot water, quickly and without much notice as a result of compounding liquidity issues.

"It will be important to watch the daily flows in and out of this ETF, as outflows are currently modest relative to fund size, but could pick up pace if growth stocks continue to sell off," Keubiko writes. "It appears that, like Janus, the ARK phenomenon is yet another example of the same mistake that investors have been making for decades: plowing into investments and funds AFTER they have had an epic run."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more