The $71 Hedge Institutions Just Deployed

Image Source: Unsplash

The VIX sits at 13.8. Everyone sees calm waters ahead.

They're reading the wrong chart.

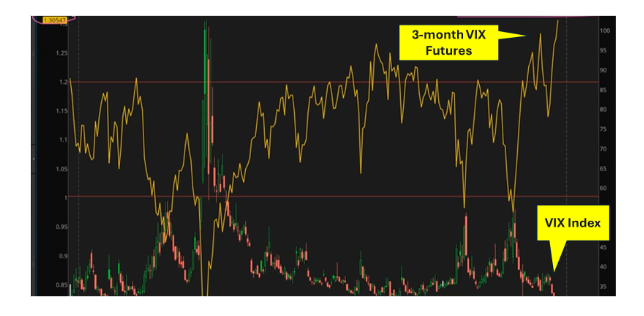

The 3-month VIX tells a different story.

It's pricing at 17.65.

That's a 30% premium over current levels. This gap signals something big building beneath the surface.

Institutions are hedging at levels not seen in over four years.

The question isn't whether volatility is coming…It's whether you'll be ready when it does.

The Number Everyone's Ignoring

Spot VIX measures 30-day volatility expectations. At 13.8, it's hitting lows not seen since last year. Charts look pristine. The rally feels unstoppable.

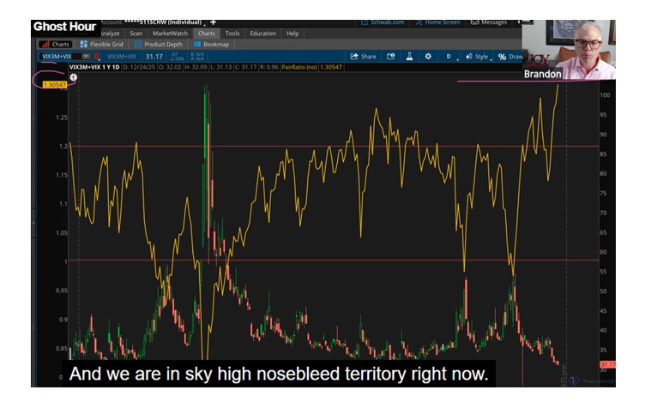

But look at the VIX 3-month to VIX ratio. It just hit 1.30 at the top of its range.

The last time we saw this level was August 2021. Before that, February 2021. Both times marked the top before significant corrections.

This isn't some obscure technical indicator. It's institutional positioning data telling you what smart money expects next.

VIX futures paint the picture clearly. December contracts trade at 17. January contracts sit at 18.5. The market is pricing a 37% premium for volatility just weeks from now.

That's called steep contango. It means one thing: institutions expect volatility to surge heading into year-end and January 2026.

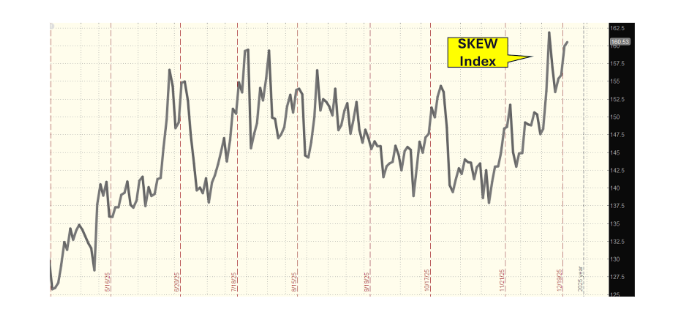

What The Skew Index Reveals

Skew—the measure of put buying versus call buying—just hit 1.60. That's near the highest levels in 30 years of data.

When skew reaches these extremes, it means institutions are aggressively buying downside protection. They've been building these positions since mid-November. The activity hasn't stopped.

Here's what makes this signal critical. Institutions aren't hedging because they think a crash is imminent. They hedge when the risk-reward of protection becomes compelling.

Right now, volatility trades at multi-year lows while forward expectations sit at multi-year highs. That disconnect creates the perfect setup for explosive moves.

The calendar adds fuel. The turn from 2025 to 2026 brings year-end rebalancing flows, holiday liquidity gaps, and tax-loss harvesting. These factors create choppy conditions where volatility spikes happen fast.

The 71-Cent Solution

Most traders think hedging means buying SPY puts. Those cost a fortune right now because institutions have already bid up protection.

There's a smarter approach. VIX call spreads capture the same institutional thesis at a fraction of the cost.

The Trade:

Buy VIX February 18th 20 call

Sell VIX February 18th 25 call

Net cost: $0.71

This spread expires in 56 days. That timeline captures the January volatility surge futures markets are already pricing. The strikes sit within range of where VIX should trade based on current futures levels.

VIX options settle in cash. You can hold through expiration without assignment risk. They stop trading Thursday but expire Wednesday morning.

The Math:

At VIX 21: You're up 60%

At VIX 25: You hit max profit—nearly 300% return

Your stock portfolio corrects 5-10%. This VIX spread offsets meaningful losses without bleeding capital every month you're not using it.

Why This Setup Works

You can't stay hedged all year. It destroys returns. But when institutions hedge at multi-year highs while volatility sits at multi-year lows, that's your signal to act.

This pattern appears maybe four or five times annually. We're in one now.

The atomic hedge concept means maintaining bullish exposure. You want markets to rise. You're just refusing to be fully exposed when every measurable signal points to elevated near-term risk.

The 90-day rubber band—that VIX 3M to VIX ratio—has stayed elevated above 1.20 for weeks. Historical data shows most corrections during these setups range 5-10%. Forward volatility is pricing exactly that outcome.

S&P 500 down 5% from current levels puts us around 5,750. That's not catastrophe. That's normal market behavior institutions are already positioned for.

What to Expect in 2026

Volatility expectations at four-year highs don't resolve by drifting lower. They resolve through events. Sharp moves. The kind that catches portfolios off guard.

Institutions see this coming. That's why they're paying up for protection despite spot VIX at lows. They're not timing a crash. They're buying insurance when it's cheap relative to what's being priced further out.

The question isn't whether January brings volatility. Futures markets already price that in. The question is whether you'll capture the move or watch it happen.

My Ghost Prints Console scours through thousands of options trades every day, highlighting the ones that we can turn into actionable trades.

It sounds almost like sorcery.

More By This Author:

Consumer Sentiment Crashes To 20-Year LowThe SLV Trade Everyone's Getting Backwards Right Now

Nasdaq's Warning Signal