Tesla: Jumping On Deliveries News Now, And Maybe AI Moves Later

Image Source: Unsplash

Tesla Inc. (TSLA) may just be the most undervalued AI play on the planet. In fact, I believe Musk will make a meaningful pivot into AI very shortly, observes Keith Fitz-Gerald, editor of 5 With Fitz.

Meanwhile, Tesla's Q2 deliveries report was recently released, and the company beat estimates as price cuts boosted sales. Good. This’ll probably be the last of the “bad” news for a while.

Tesla Inc. (TSLA)

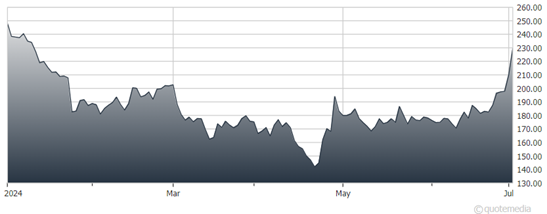

I hope you’ve been buying. The stock has returned nearly 50% since April, when shares were around $140 and I told readers to get on board. Now, it was recently seen trading at around $250.

To be fair, though, the stock is still down nearly 40% year-to-date -- but so what? Tesla stock has returned 1,308.71% over the past five years versus 101.38% from the SPDR S&P 500 ETF trust (SPY).

Meanwhile, I am often asked “What do I do with XYZ?” -- usually when folks have purchased something on a whim or as a result of clickbait masquerading as investing research. And usually when the stock in question has lost them a lot of money.

My answer is always the same: Mistakes are tuition. So, it’s important that you don’t beat yourself up too badly. We all make ‘em from time to time, including me. What you want to focus on is moving forward.

The first question to ask yourself is whether or not the reasons you bought something are still valid. If so, then there is every reason to wait it out. That’s why, for example, investing greats Warren Buffett and Ron Baron don’t flit from stock to stock and why I suggest you don’t, either.

The second question to ask yourself is whether there is an alternative investing choice that can help you make up lost ground. If so, can you put that money into another company, fund, or investment that potentially offers a faster path to profitability, more stability, or even the opportunity to reinvest via dividends, which is almost always a great idea. If so, then making a switch could be the better choice.

Keep it stupidly simple.

About the Author

Keith Fitz-Gerald has been called “somebody you should pay attention to” by #1 New York Times bestselling author and personal finance expert Suze Orman, “always insightful” by Constellation Research CEO Ray Wang, and a “market visionary” by Forbes. He has more than 3,000 prime-time appearances to his credit on the Fox Business Network, CNBC, Dubai One, BBC, and other networks around the world.

Mr. Fitz-Gerald’s commentary and market analysis have been featured in such notable publications as the Wall Street Journal, The Times (of London), Wired, and more. He is the principal of the Fitz-Gerald Group which provides consulting services to professional wealth managers and personally writes the popular, free “5 with Fitz” which is read by more than 25,000 individual investors, financial advisors, and hedge fund pros around the world daily.

Mr. Fitz-Gerald believes anybody can be wildly successful in the financial markets when armed with the right knowledge, education, and tactics.

More By This Author:

Q2 2024 Scorecard: S&P, Nasdaq Strong; Dow, Russell Not So MuchBrookfield Infrastructure: As Tech Pulls Back, Will High-Yielding Value Plays Take The Lead?

SPYG: Target This ETF As Investors Ponder Inflation, Growth Outlook

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more