Tesla Is A Better Semiconductor Biz Than Nvidia

Image Source: Unsplash

Nvidia (NVDA) designs chips. Tesla (TSLA) makes them.

Nvidia sells components. Tesla builds the entire AI stack.

Nvidia captured the infrastructure phase. Tesla owns the application phase.

Institutions bought 25,000 Tesla call contracts on Friday. Today, Tesla surged 6% while Nvidia crawled 1.8% higher.

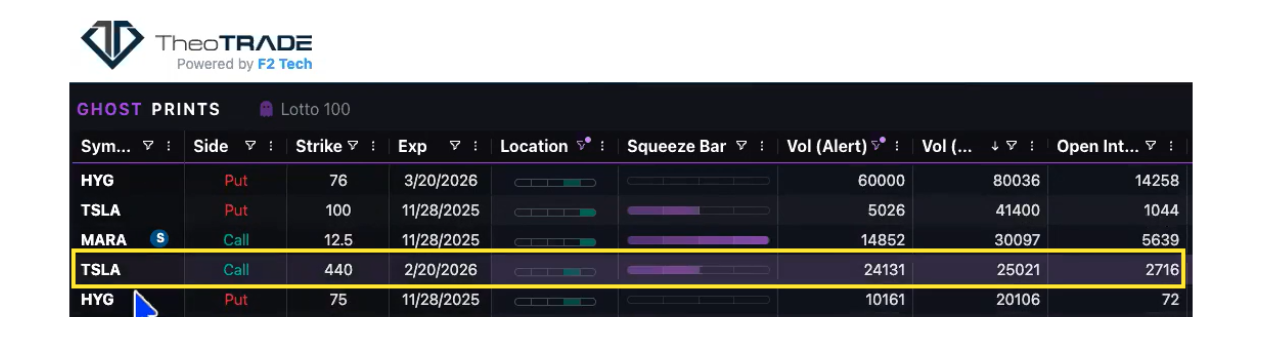

The Ghost Prints Surveillance Console caught the rotation before it happened.

Here's how to position for what comes next.

The Institutional Signal

On Friday, November 22nd, the Ghost Prints Console flagged massive call buying in Tesla. 25,000 contracts at the 440 strike for November expiration. Filled at the ask. Aggressive. Directional.

This wasn't speculation. This was positioning for a specific move higher.

(Click on image to enlarge)

Today, Tesla confirmed the setup. Up 6% while Nvidia managed 1.8%. The market rallied 1.3%, but Tesla outperformed by a factor of four.

The institutional money saw this coming. They positioned before the bounce. Now the question is how to follow their lead without paying $418 per share.

Why TSLL Works Better

Tesla options are expensive. The stock trades at $418. A single call contract requires significant capital. Spreads are wide. Position sizing becomes difficult for smaller accounts.

TSLL solves this problem. It's a 2x leveraged Tesla ETF trading at $17. You get the same directional exposure at a fraction of the cost.

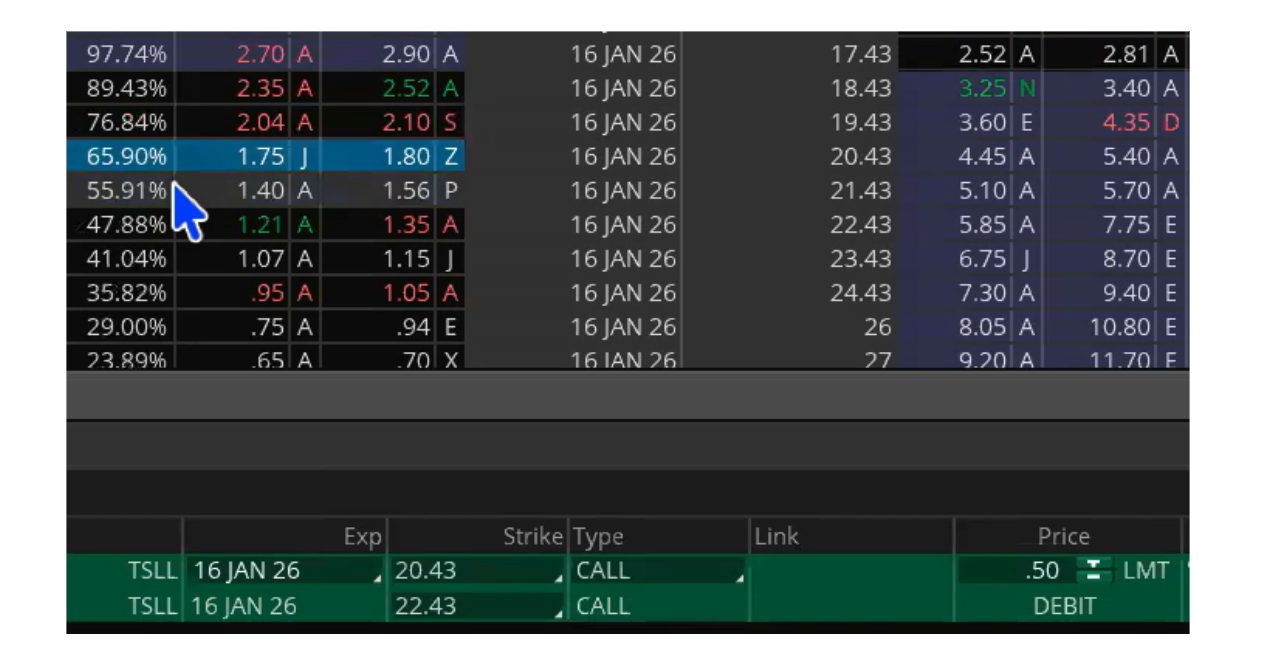

(Click on image to enlarge)

Here's the trade structure:

BUY VERTICAL TSLL 100 16 JAN 26 20.43/22.43 CALL @ 0.48 LMT

- Maximum risk: $48 per spread

- Maximum reward: $152 per spread

- Target: TSLL reaches $22.43 by January 16th

The math is simple. TSLL needs to move from $17 to roughly $21.50 for this spread to work. That requires Tesla to push from $418 to approximately $440 over the next eight weeks.

Tesla moved from $340 to $418 in three weeks. Another $22 over eight weeks is continuation, not moonshot.

The Setup Is Clean

The market bounced today after last week's selloff. If we get follow-through this week, Tesla has room to run toward $440-$450. That puts TSLL directly in range for this spread.

Institutions positioned on Friday. Price confirmed today. Volume supported the move. We're following smart money with a structure that fits smaller accounts.

The trade gives you eight weeks to be right. You need Tesla to continue doing what it's already doing.

More By This Author:

Market Internals Sick Or Healing ?

Will Gold Rally Into Year-End?

Stocks Back On Track Or A Volatility Smackdown?