Teradyne: What Earnings And The Market Reaction Say About The Semiconductor Sector

Image Source: Pexels

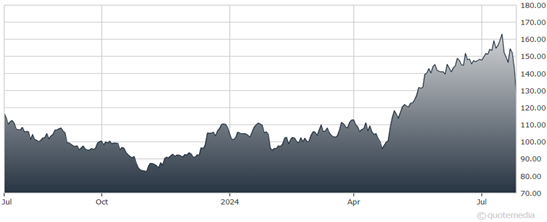

Throughout 2024, Teradyne Inc. (TER) has been a large beneficiary of rising revenue and EBITDA estimates across the entire semiconductor sector. With the semi industry and Big Tech seeing a very harsh selloff, I’m inclined to think that risk/reward has improved for long-focused investors, advises Larry Cheung, founder of Letters from Larry.

Micron Technology Inc. (MU), Qualcomm Inc. (QCOM), and Texas Instruments Inc. (TXN) have all broadened their total addressable markets with their AI solutions. This has led to recovering demand for semiconductor testing systems, which is Teradyne's core product suite.

While I don’t yet have a specific interest in Teradyne’s stock itself, I think their post-earnings data and price action gives clues to the overall health of other key iShares PHLX SOX Semiconductor Sector Index Fund (SOXX) names.

Teradyne Inc. (TER)

I interpret Teradyne's post-earnings outcomes as neutral/mildly positive despite the adverse share price reaction. Their semiconductor testing solutions confirm to me that demand from very important sector clients such as Micron, Qualcomm, and Texas Instruments continues to be robust. It’s just that expectations were very high ahead of the earnings outcome.

Specifically, Teradyne’s revenue and EPS outlook reaffirms the following to me for the group:

- The sector has high expectations, but for the most part is still meeting them in-line. This is good news. High expectations are fine as long as they can be met.

- If a company is trading at elevated levels and valuation (EV/EBITDA) ahead of earnings, there is more vulnerability for a stock price reset before continuing its longer-term positive trend.

- Investors are currently very focused on the outlook and guidance. A quarterly revenue/EPS beat is not necessarily enough, depending on the stock’s setup ahead of the earnings print.

About the Author

Larry Cheung, CFA is the founder of a leading Substack publication named Letters of Larry: U.S. and China Investment Strategy. He is also a Youtube creator with over 100,000+ followers and has a research focus on US and China macroeconomics, financial markets, and company-specific fundamental analysis.

As a chartered financial analyst, he is passionate about helping his followers grow their wealth through long-term investing and thoughtful tactical trading. He can be found as @LarryCheungCFA on Twitter, Instagram, Youtube, and Substack.

More By This Author:

What I'm Watching In This "And Then There Were None" MarketEEM: An Emerging Markets ETF To Consider As Wild Market Rotation Plays Out

Tech Stocks: No, You Shouldn't Sell Your Winners Due To A Couple Rough Days

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more