Tech Will Roar Back

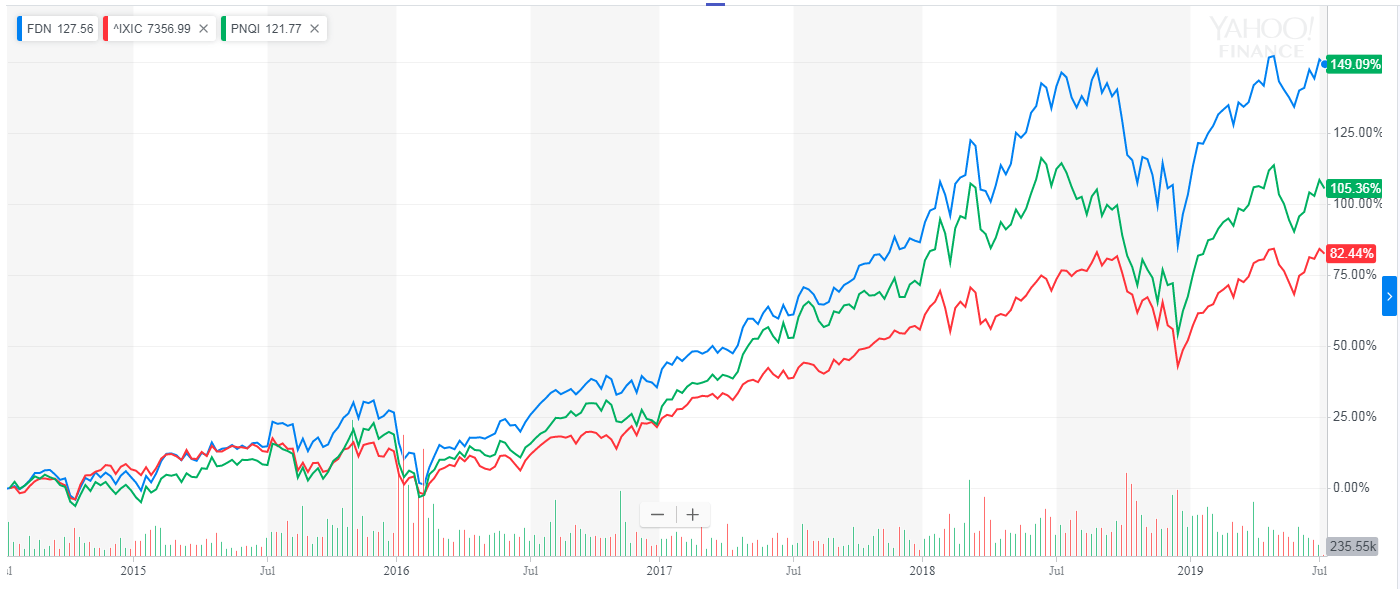

Tech stocks (FDN) (PNQI) have performed incredibly well during the last five years. Be it the FAANGs, biotechs, fintechs, or cloud computing companies, they all had amazing returns. So good, that we are likely witnessing a new tech bubble.

Graph 1 – Tech sector performance 5 years

(Click on image to enlarge)

(Source: Yahoo Finance)

Just to offer some context on my doom-and-gloom, let me recap my current thesis on the macro scenario. It is my conviction that with the current monetary and fiscal policy setup, the bull market still has one more leg-up. If this uptrend rises too fast, due to unrealistic expectations and several accumulated unbalances, it is highly probable that a crash will follow.

When the next downturn comes, technology stocks will go down even faster than they went up. That’s how it works in times of panic. The current regime has allowed bloated valuations, especially in tech stocks. Additionally, money has flowed to corporate credit as never before. When the tide turns, many sailors won’t be prepared for the bad weather.

As I said, when that day comes, tech stocks will be one of the biggest losers. Most of these companies are trading high on expectations and low on fundamentals. When the panic settles, and investment managers have to explain their choices to investors, they’ll ditch the expectations and stick with the tangible reality.

Beautiful destruction

However, in practical terms, even if a downturn bankrupts some of those companies, an asset liquidation will follow, including patents and technology. Surviving companies will be able to get a hand on those developments at a fraction of the cost, and, at the same time, they will have access to an abundant supply of research staff.

The result will be a horizontal S curve, where the downturn will bring a rapid panic, which will be followed by bankruptcies and liquidations. After the fear as subsided, surviving companies will be scavenging through the shipwreck, grabbing the most interesting parts at a fraction of the real development cost.

Sectors for the next decade

There are very promising sectors for the next decades. Companies operating in genetics, artificial intelligence, data storage & processing, logistics, water treatment, waste treatment & recycling, zero-emission vehicles, among others, will have huge growth opportunities. For investors, it will pay to be alert.

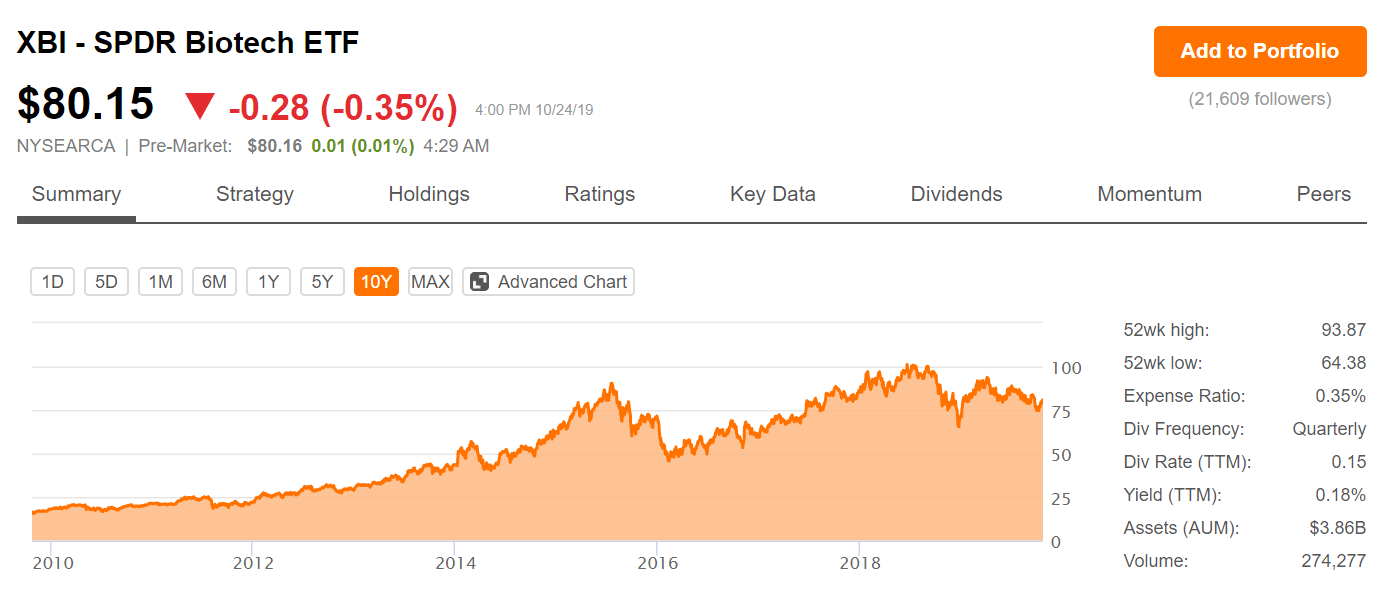

One interesting sector is biotech. That sector went through a boom, back in 2015, and more recently in 2018. It is now trading around 20% below its all-time highs. When the next bear market comes, it will likely trade even lower. A representative ETF for this sector is the SPDR Biotech ETF (XBI).

(Click on image to enlarge)

(Source: Seeking Alpha)

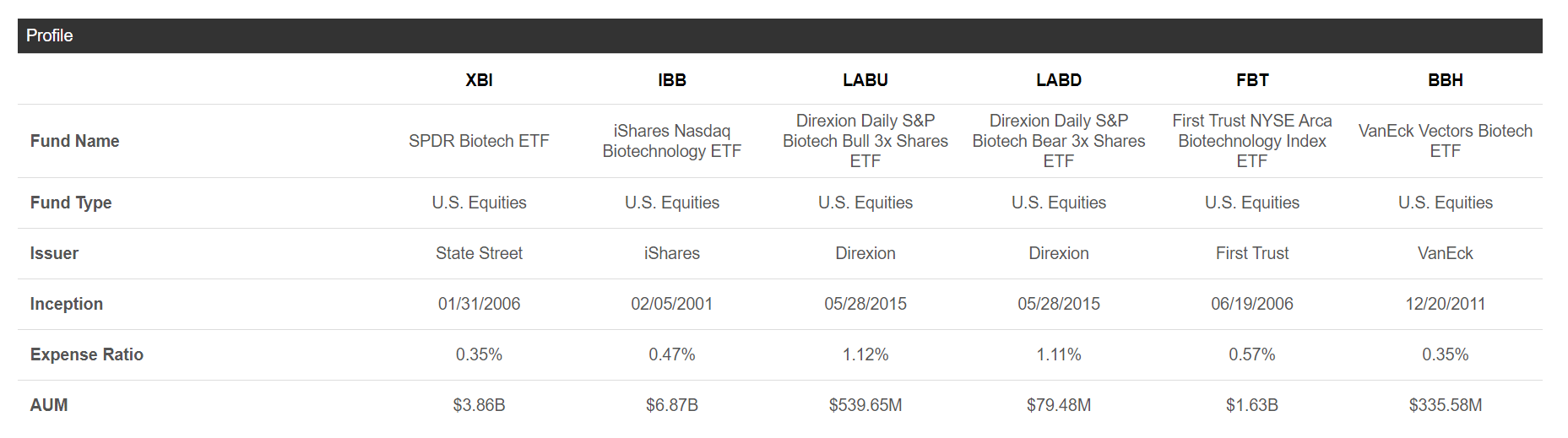

There are other alternatives, but the XBI offers low expense ratios and good liquidity. It is a highly diversified fund, meaning that its top 10 holdings represent less than 18% of the fund.

(Click on image to enlarge)

(Source: Seeking Alpha)

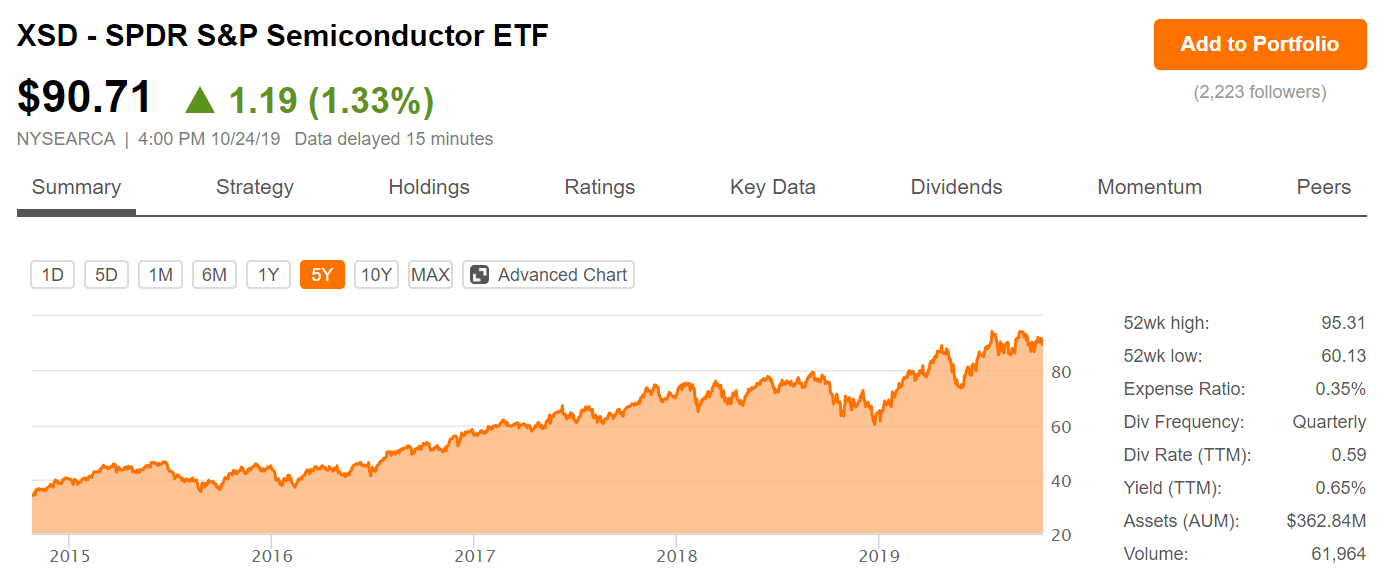

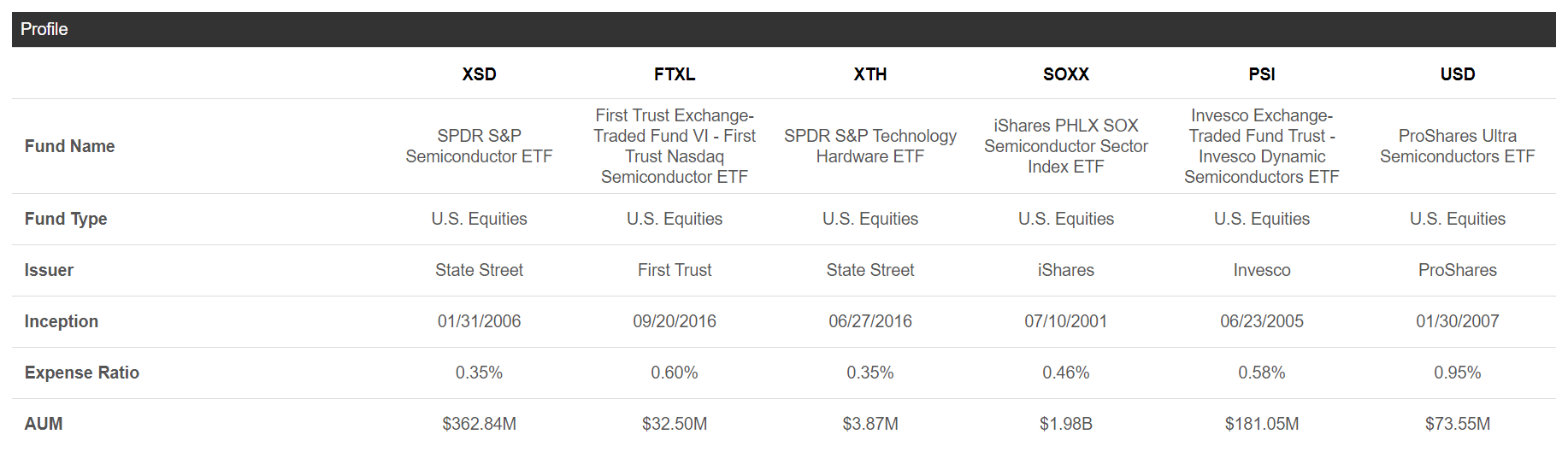

Another interesting sector is semiconductors. Sure, it was a hot sector during the last decade, but it will likely keep growing during the next one. Lots of old-economy industries, like the auto sector, will become increasingly technological, as time progresses. Experts vary on estimates, but they generally agree that autonomous vehicles will send several gigabytes of data to the cloud.

Now, imagine transitioning the current fleet of dumb cars to smart cars. That would mean more servers, more processing capability, more analytics, i.e., it would be the dream of most folks in the semiconductors business. And, that’s just one industry among many. A good way to play that trend might be the SPDR S&P Semiconductor ETF (XSD).

(Click on image to enlarge)

(Source: Seeking Alpha)

Again, this fund has a low expense ratio, and while it offers lower liquidity than the iShares PHLX SOX Semiconductor Sector Index ETF (SOXX), it still seems acceptable.

(Click on image to enlarge)

(Source: Seeking Alpha)

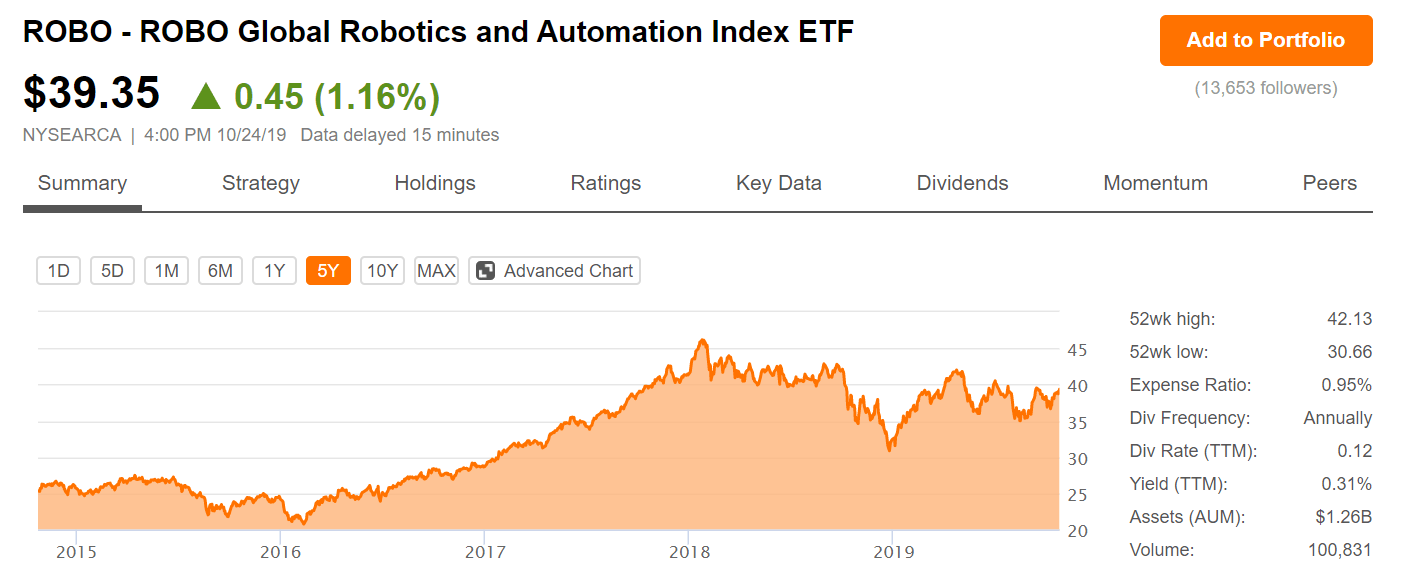

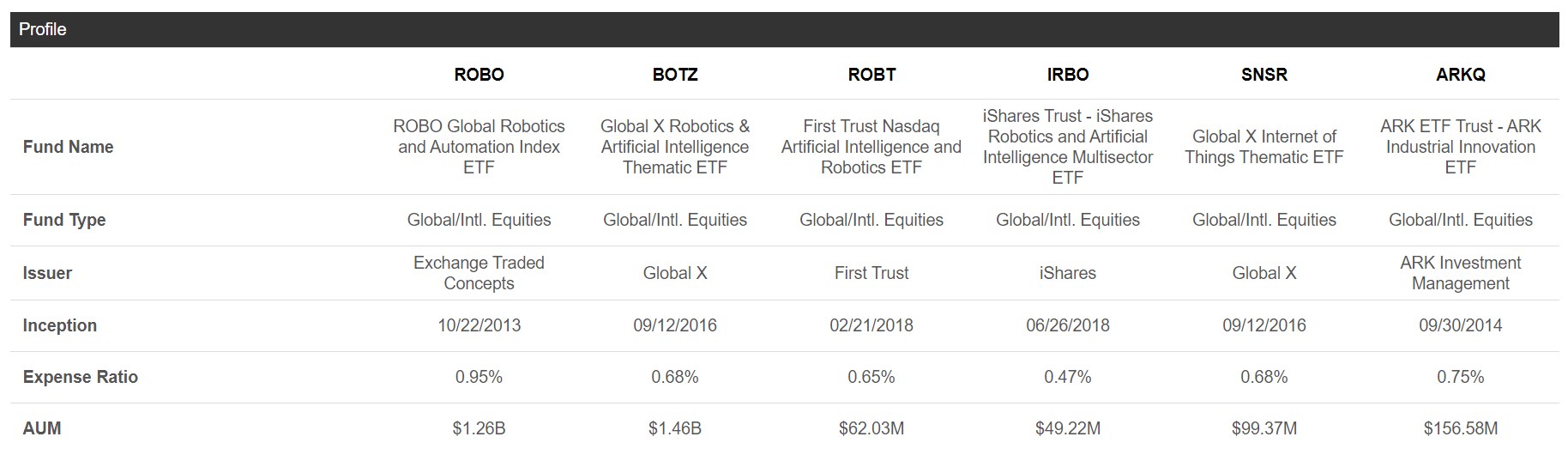

Finally, artificial intelligence is another area poised for huge growth during the next decade. ROBO Global Robotics and Automation Index ETF (ROBO) is a nice proxy to get exposure to the sector.

(Source: Seeking Alpha)

There are other alternatives, but this fund has a good blend of liquidity and diversification. Yes, we will be paying a higher expense ratio, when compared with the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ), but it is worth it if you are looking for higher diversification.

(Click on image to enlarge)

(Source: Seeking Alpha)

Conclusion

In my opinion, it will pay to wait for a downturn and buy those ETFs when they fall out of favor. For a more diligent investor, it may be even more interesting to cherry-pick stocks inside those funds. Actually, it is more likely to find, in these highly diversified funds, a really valuable gem alongside dozens of average companies. During the next months, I will be sifting through those lists trying to find stocks that stand out. However, sticking to a strategy based on buying these ETFs after a downturn is likely to yield good returns anyway.

Disclosure: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information ...

more