Stocks Will Try To Rebound On August 12, But That Attempt May Easily Fail

Stocks are trying to mount a rebound of sorts this morning, but one should be skeptical. There hasn’t been much that has changed overnight. The dollar has remained mostly unchanged, and the 10-year Treasury remains a bit higher around 68 bps. This morning we get CPI at 8:30, which could push yields around like PPI yesterday.

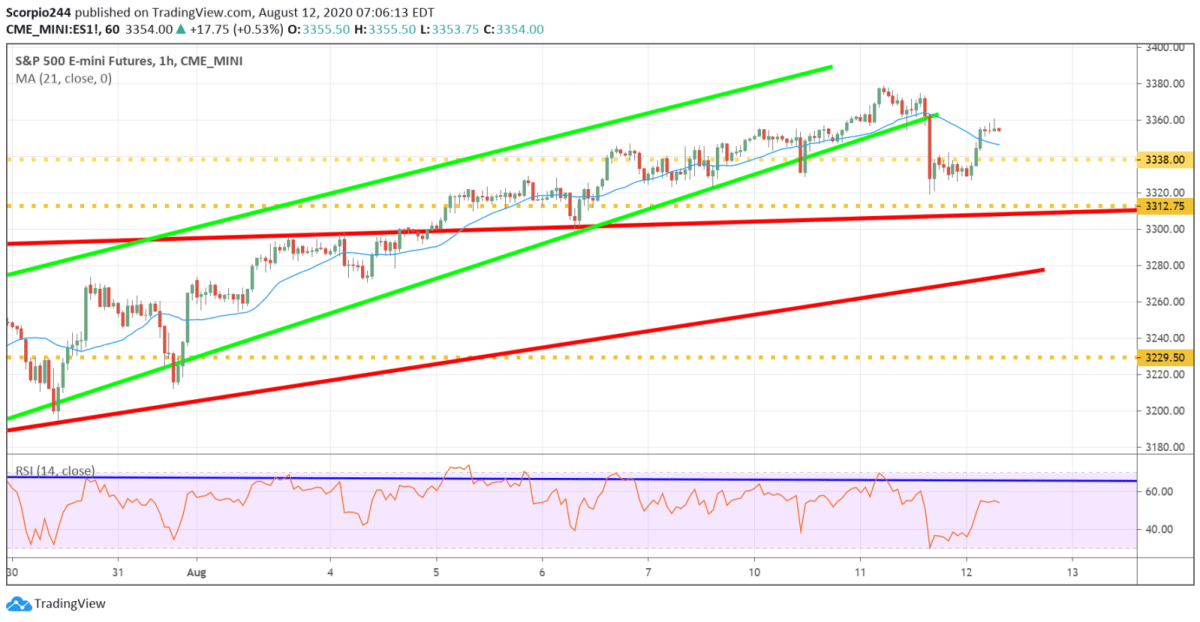

S&P 500 (SPY)

More importantly, the S&P 500 futures are trading higher by 52 bps this morning, getting a boost around the 2 AM eastern time frame. It likely means that we are looking for a gap higher at the opening, which, as we know, probably means that a gap fill will be what follows. If I were a bull, which I am not at this moment, I would grow more concerned if we’re unable to reclaim all of yesterday’s decline and print a new high today. If yesterday’s move lower was not to be taken seriously, then the bulls should be able to rally the index right back to were it was before the sell-off.

Nasdaq (QQQ)

At least from the perspective of the Qs, the ETF is trading around $268 this morning. The region between $268 and $270 has been a substantial level of support and resistance. As long as the Qs are unable to mount a move above that region, I think that serves as a big negative for the direction of the market overall.

The big questions just how successful any rally attempt will be based on how much technology names can rebound. Remember, technology is the most significant component of the S&P 500. Unless financials and industrials can continue to put up significant daily returns, then any rally attempt without technology is likely to fail.

Technology (XLK)

The XLK chart suggests the selling in Tech isn’t finished just yet.

Amazon (AMZN)

Amazon is one of those market leaders that need to be continually watched. As a break below $3000 would likely signal, further selling is on the way.

Nvidia (NVDA)

Nvidia is also a big momentum stock that is approaching an essential support level at $427. That is where the uptrend off the March lows are too. A break of that uptrend would be a terrible signal for the broader health of the market as well.

Tesla (TSLA)

Tesla is rising on the back of its stock -split announcement. I don’t think it changes much in-term of the downtrend it has been. The momentum of the split could push shares higher today, but $1500 is a tough wall for the stock, and I think the stock still needs to consolidate.

Zoom is also looking very weak here, with a drop below $227, triggering further selling to $200.

Citigroup (C)

Citigroup got to significant resistance yesterday around $55 and failed.

Bank of America (BAC)

...As did Bank of America at $28.

JPMorgan (JPM)

…And JPMorgan around $105.

Have a great one!

Disclosure: Michael Kramer And The Clients Of Mott Capital Own Tesla

Disclosure: more

Good read.