Stock Market This Week - Sunday, Dec. 3

Image Source: Unsplash

If you watch specific news channels or listen to certain podcasts, you may have heard that the economy is about to enter a recession. However, I like to look at the data. The United States currently has sub-4% unemployment, the third quarter GDP came in at +5.2%, job growth is still happening, the stock market is up, interest rates are down, inflation is nearly 3%, and the federal budget deficit is falling.

Overall, these are excellent pieces of data that are not suggestive of a recession. Also, they are all positive and good for stocks.

Chairman Powell likes to keep perspective. He indicated that interest rates may go higher, and it is premature to discuss cuts. In any case, the Fed will keep rates elevated for the period. However, the market is bullish; yields on Treasury bonds have declined quickly and stocks are responding positively, especially interest rate-sensitive industries.

Analysts and most retail investors were wrong about International Business Machines (IBM). The negativity surrounding the stock has stretched back for years. But the structural changes of buying RedHat, divesting Kyndryl, and acquiring Apptio seem to have worked.

RedHat is helping sales of hybrid cloud. The managed infrastructure business was not profitable and had declining revenue, and exiting it was a plus. Apptio allows IBM to gain traction in artificial intelligence. In addition, the monopoly in mainframes creates a moat. As a result, the share price is now $160.55, the highest since 2017.

The time to buy IBM was when the yield was over 5% and, in a few instances, over 6%. But it is still yielding 4%+. However, the stock is probably fairly valued now. Although I am not buying shares at the moment, I am an owner and did buy when the stock was down, and ultimately, my patience paid off.

Stock Market Overview

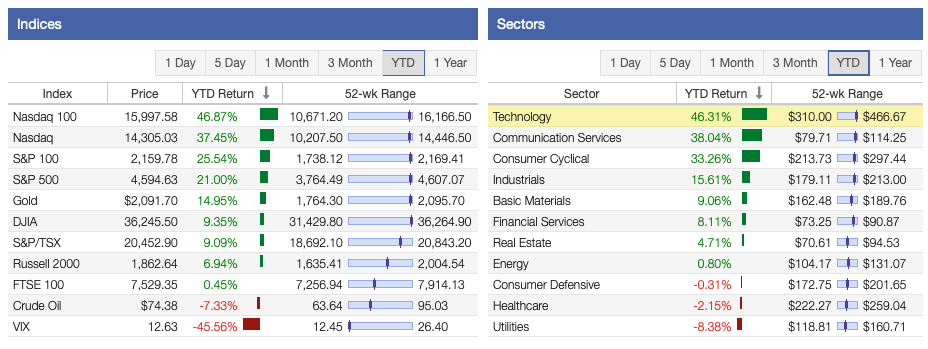

Data from Stock Rover shows that the stock market experienced another week of gains, the fifth one in a row. The end-of-year market rally is obviously here. The Russell 2000 led the way after lagging most of the year. Its performance was followed by the Dow Jones Industrial Average (DJIA), the S&P 500 Index, and the Nasdaq Composite.

10 of the 11 sectors rose this week. The Real Estate, Basic Materials, and Financial Services were the top three risers. The Real Estate sector is benefiting from lower interest rates. However, the Healthcare, Energy, and Communication Services sectors finished at the bottom. The Communications Services sector also saw a down week.

Oil prices continued downward and finished the week at ~$74.40. Demand remains weak, supply is strong, and the quantity in storage is increasing. These trends suggest oil prices will remain under pressure. Even though OPEC+ agreed to more production cuts, it is unlikely that the countries will stick to it. Lower oil prices mean some countries must pump more to finance bloated budgets or wars. As a result, gas prices are less than they were at the same time last year in the United States.

The VIX is still below its long-term average. Traders are obviously bullish. Gold advanced 4.5%, reaching $2,092 per ounce, an all-time high.

(Click on image to enlarge)

Source: Stock Rover

Overall, the Nasdaq is performing the best for the year, followed by the S&P 500 Index, the Dow 30, and the Russell 2000. Bullish sentiment is still strong for technology and growth stocks. The Nasdaq Composite has recovered all its losses and then some. The S&P 500, DJIA, and Russell 2000 are all positive year-to-date.

In addition, nine of the 11 sectors are up year-to-date. The three best-performing sectors overall are Technology, Communication Services, and Consumer Cyclical. But the worst-performing sectors overall are Consumer Defensive, Healthcare, and Utilities. Lower interest rates are causing the Real Estate sector to bounce back.

(Click on image to enlarge)

Source: Stock Rover

The dividend growth investing strategy has returned to positive results across all categories. All the categories now have positive returns for the year. The table below shows their performance by category.

|

Category |

YTD Return (%) |

|---|---|

|

Dividend Kings |

+0.99% |

|

Dividend Aristocrats |

+4.60% |

|

Dividend Champions |

+2.57% |

|

Dividend Contenders |

+5.55% |

|

Dividend Challengers |

+5.76% |

Source: Stock Rover

Stock Market Valuation This Week

The S&P 500 Index trades at a price-to-earnings ratio of 25.38X, and the Schiller P/E Ratio is about 31.10X. These multiples are based on trailing twelve months (TTM) earnings. The long-term means of these two ratios are approximately 16X and 17X, respectively.

Overall, the market is still overvalued despite the recent correction, the bear market, and the recent rebound seen in the markets. Earnings multiples of more than 30X are overvalued based on historical data.

More By This Author:

Alliant Energy Stock: An Undervalued High-Quality UtilityStock Market This Week - Saturday, Nov. 25

3 Stocks To Buy For Thanksgiving 2023

Disclaimer: Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. ...

more