Stock Market This Week - Saturday, Nov. 25

Image Source: Pixabay

The stock market extended its gains for the fourth straight week on lower inflation expectations, the U.S. Federal Reserve holding rates constant for the second consecutive meeting, lower oil and gas prices, sub-4% unemployment rates, and decent Gross Domestic Product (GDP) growth.

Whether we are in the sweet spot for a bull market or not is tough to say because investors remain tentative. Fears of a future recession that has not yet arrived seem to outweigh any belief in the current economy.

That said, the data is the data, and future inflation will probably go lower. With immigration returning to normal after COVID-19, labor costs should normalize. Moreover, the Producer Price Index (PPI) was negative in October. If producer costs are dropping, one can expect consumer prices to follow.

The net result is positive news for income investors. Inflation and high interest rates have hammered the Utilities, Consumer Defense, Real Estate, and Healthcare sectors. Consequently, as a group, they are undervalued, and I have been buying. I added to Medtronic (MDT) during the market correction, which was briefly yielding 4%. The stock has bounced back on good third-quarter results. But it’s still undervalued, and the dividend yield is 3.5%.

Stock Market Overview

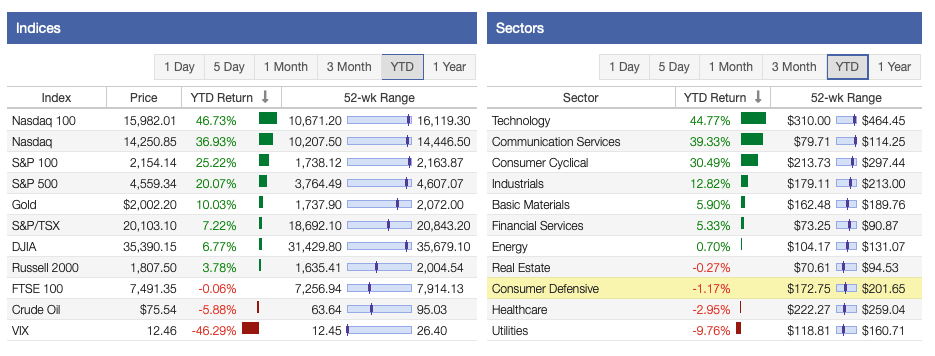

Data shows that the stock market had a positive week, the fourth one in a row. The Dow Jones Industrial Average (DJIA) led the way after lagging most of the year. Its performance was followed by the S&P 500 Index, the Nasdaq Composite, and the Russell 2000.

All 11 sectors had gained for the second week in a row. Healthcare, Consumer Defensive, and Communication Services were the top three sectors this past week. However, the Industrials, Utilities, and Energy sectors finished at the bottom, but with positive returns.

Oil prices continued to trend lower before reaching ~$75.50 per barrel. Demand remains weak, supply is strong, and the quantity in storage is increasing. These trends suggest oil prices will remain under pressure. In addition, OPEC+ is having difficulties agreeing to output levels. As a result, gas prices are 10% less than last year in the United States.

The VIX fell nearly 10% to well below its long-term average. Traders are obviously bullish. Gold advanced broke $2,000 per ounce on a weaker dollar.

(Click on image to enlarge)

Source: Stock Rover

As previously mentioned, the Nasdaq is performing the best for the year, followed by the S&P 500 Index, the Dow 30, and the Russell 2000. Bullish sentiment is still strong for technology and growth stocks. The Nasdaq Composite has recovered almost all its losses in the recent correction. The S&P 500, DJIA, and Russell 2000 are all positive year-to-date.

In addition, seven of the 11 sectors are up year-to-date. The three best-performing sectors overall are Technology, Communication Services, and Consumer Cyclical. But the worst-performing sectors overall are Consumer Defensive, Healthcare, and Utilities. Lower interest rates are causing the Real Estate sector to bounce back.

Source: Stock Rover

The dividend growth investing strategy has returned to positive results across all categories. The recent market volatility has lowered returns, but the trend has reversed. The table below shows their performance by category.

|

Category |

YTD Return (%) |

|---|---|

|

Dividend Kings |

-0.81% |

|

Dividend Aristocrats |

+2.96% |

|

Dividend Champions |

+0.51% |

|

Dividend Contenders |

+3.82% |

|

Dividend Challengers |

+2.60% |

Source: Stock Rover

Stock Market Valuation This Week

The S&P 500 Index trades at a price-to-earnings ratio of 25.19X, and the Schiller P/E Ratio is about 30.86X. These multiples are based on trailing twelve months (TTM) earnings. The long-term means of these two ratios are approximately 16X and 17X, respectively.

The market is still overvalued despite the recent correction, the bear market, and the recent rebound seen in the markets. Earnings multiples of more than 30X are overvalued based on historical data.

More By This Author:

3 Stocks To Buy For Thanksgiving 2023Stock Market This Week – Sunday, Nov. 19

Dividend Safety Analysis: Cisco Systems

Disclaimer: Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. ...

more