Stock Market This Week - Saturday, March 23

Image Source: Pixabay

I love dividends, which is probably obvious because I often write about them. I spend time each week following and analyzing dividend stocks. They are a main component of investor returns. Consequently, it was nice to read that global dividend payments reached $1.66 trillion in 2023. This is a large number and more than the Gross Domestic Product (GDP) of many companies. It is also larger than the whole market capitalization of many stock exchanges.

Here are some additional interesting statistics. According to the Janus Henderson Global Dividend Index, 86% of companies increased or maintained their dividends in 2023. Banks contributed half of the growth. Twenty-two countries, including the United States, Canada, Germany, France, Italy, Mexico, and Indonesia, experienced record payouts.

The same dataset shows that Microsoft Corporation (MSFT) is the largest dividend payer. Microsoft, Apple (AAPL), Exxon Mobil Corp (XOM), and the China Construction Bank have been in the top ten since at least 2017.

The top 20 companies paid $236.1 billion in dividends. The value is down compared to 2021 and 2022 because many international firms pay variable and special dividends.

Stock Market Overview

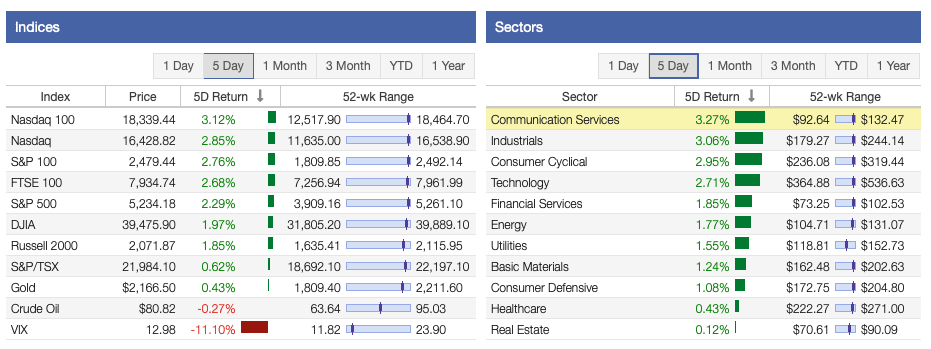

Recent data from Stock Rover illustrated an excellent week for the stock market. The Nasdaq Composite led the way, followed by the S&P 500 Index, the Dow Jones Industrial Average (DJIA), and the Russell 2000. All four witnessed positive returns.

All 11 sectors saw positive returns this week. The Communication Services, Industrials, and Consumer Cyclical sectors were the top performers of the week. However, the Consumer Defensive, Healthcare, and Real Estate sectors were the worst performers.

Oil prices were flat at $81. The VIX plunged 11%+ to 12.98, well below its long-term average. Gold ended the week at ~$2,167 per ounce.

(Click on image to enlarge)

Image Source: Stock Rover

The markets have continued to move upward due to the American economy’s strength and the continuation of the bull market. The S&P 500 has overall led the way, followed by the Nasdaq, the DJIA, and the Russell 2000.

10 of the 11 sectors have seen positive returns throughout the year thus far. The top performers in 2024 have been Communication Services, Energy, and Industrials, while the Consumer Cyclical, Utilities, and Real Estate sectors have been trailing overall. Only the Real Estate sector has shown a negative return because of high-interest rates.

(Click on image to enlarge)

Image Source: Stock Rover

Our dividend growth investing strategy started the year down. Overall, larger market capitalization stocks have been performing better than smaller ones. The table below shows their performance by category. However, it should be noted that dividends and passive income streams have continued to grow.

(Click on image to enlarge)

Image Source: Stock Rover

Stock Market Valuation This Week

The S&P 500 Index trades at a price-to-earnings ratio of 28.41X, and the Schiller P/E Ratio is about 35.0X. These multiples are based on trailing twelve months (TTM) earnings. The long-term means of these two ratios are approximately 16X and 17X, respectively.

Overall, the market is still overvalued despite the recent correction, the bear market, and the recent rebound seen in the markets. Earnings multiples of more than 30X are overvalued based on historical data.

More By This Author:

UK High Yield Dividend Aristocrats 20243 Dividend Stocks To Buy And Hold Forever

Air Products & Chemicals: An Undervalued Dividend Champion

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more