SPY: More Gains Ahead

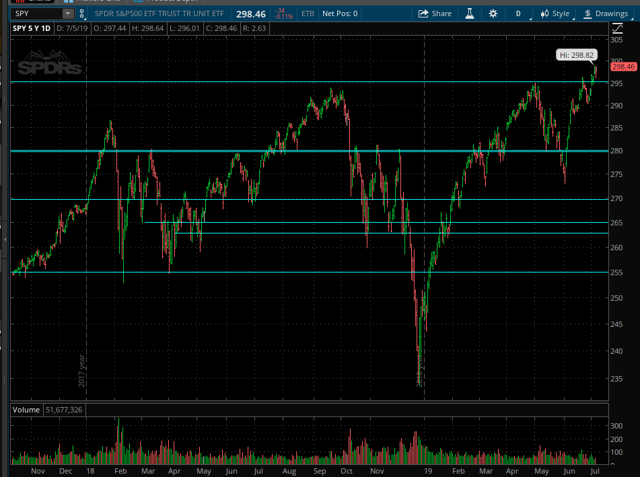

The SPDR S&P 500 ETF (SPY) made new historical highs last week, finally breaking above the critical resistance level of $295 per share. In this context, the main question for investors is whether this is the right time to take profits and reduce portfolio risk, or if we are in the first stages of a new uptrend over the middle term.

(Click on image to enlarge)

Source: Think or Swim

Nobody knows for sure what the future may bring, and we are always dealing with probabilities as opposed to certainties in the stock market. However, the quantitative indicators based on intraday price action, sector breadth, earnings estimates, and momentum look quite bullish for SPY going forward.

The Big Money Seems To Be Buying

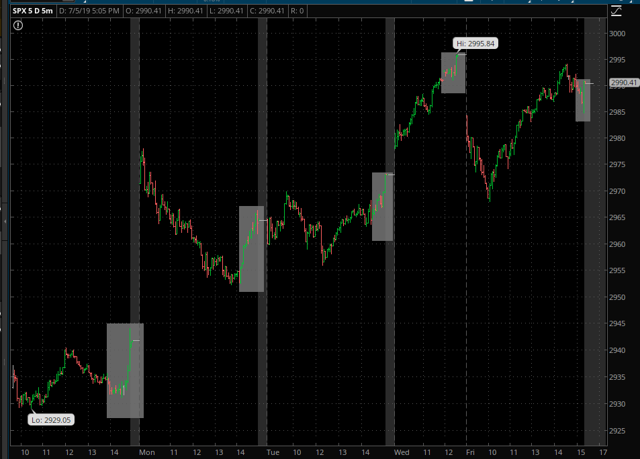

The chart below shows the 5-minute chart for the SPY over the past 5 days. There has been some strong buying pressure near the close recently. Even in days when the market was down, it looks like big buying orders were coming in in the final hours of the trading day.

This is indicating that big sophisticated investors are increasingly bullish on the ETF, which has positive implications in terms of analyzing the supply and demand equation for SPDR S&P 500.

(Click on image to enlarge)

Big investors such as institutions and hedge funds tend to buy near the close. If you are a big investor and you need to place big orders in the market, doing it early in the day would mean showing your cards. If everyone can see your demand, this will probably push prices higher, and you don't want that to happen when you are trying to buy.

For this reason, the big market participants tend to make their moves as late in the trading day as possible. Big money has a major impact on prices over time, so lots of buying pressure near the close of the trending day is generally a bullish driver for prices.

Strong Participation

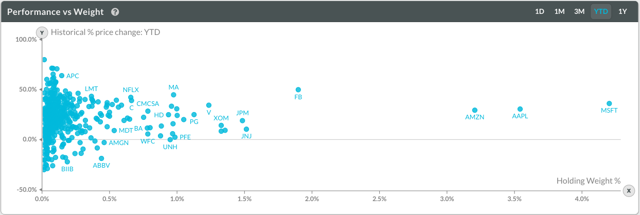

Analyzing the price action for the ETF alone is not enough, because what is going on under the surface is sometimes more important than price action for the ETF itself.

If the ETF is being pushed higher by a small group of big stocks, this generally means that the move is fragile and it can easily lose steam if those few stocks slow down. But that is not the case with SPY nowadays, the chart below shows performance year to date versus weight in the portfolio for the companies in the SPY.

The big names such as Microsoft (MSFT), Apple (AAPL), Amazon (AMZN) and Facebook (FB) are leading the market higher, but there is a large cluster of stocks with a relatively strong performance in the SPY portfolio. In terms of participation, it's good to know that the rally in SPDR S&P 500 is being driven higher by a broad universe of stocks in the portfolio producing solid returns.

(Click on image to enlarge)

Source: Koyfin

Earnings Are Still Supportive

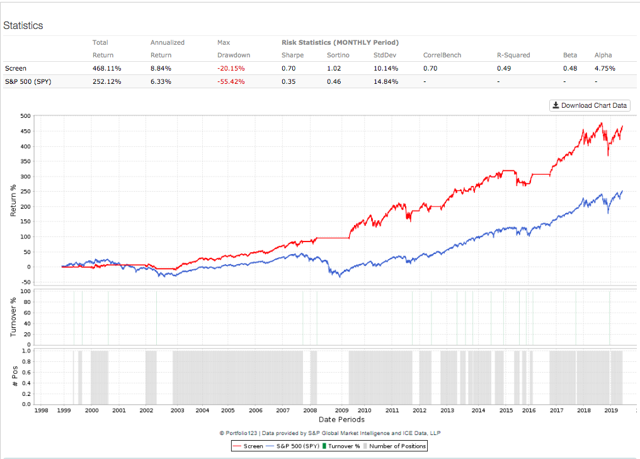

A stock is essentially a share in the ownership of a business, as such, the value of the stock depends on the earnings that the business can generate. Managing market exposure based on earnings estimates can be a remarkably simple and effective strategy to avoid big drawdowns and reduce portfolio risk.

The chart below shows the backtested performance for a strategy that is long on SPY only when earnings estimates for companies in the SPY portfolio are increasing, and it goes to cash when earnings estimates are declining.

The strategy provides some false signals, but it does a great job in terms of providing capital protection during severe bear markets such as 2001 and 2008.

Since January of 1999, the strategy produced a cumulative return of 468% versus 252% for buy and hold investors in SPY over the same period. More importantly, the maximum drawdown - meaning maximum capital loss from the peak - was 20.15% for the strategy based on earnings trends versus a maximum drawdown of 55.42% for buy and hold investors over the same period.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Even if the strategy can't be expected to make the right calls every time, it makes a lot of sense to consider the main trends in earnings expectations when analyzing a position in SPDR S&P 500. There has been some deterioration in earnings estimates due to economic uncertainty recently, but the big trend is still bullish for SPY as of the time of this writing.

Momentum And Relative Strength Are Bullish

Winners tend to keep on winning in the stock market, as rising prices attract more buyers and vice-versa. Besides, money has an opportunity cost. In simple terms, you don't just want to buy investments that are rising in price, you want to buy the investments that are also outperforming other alternatives.

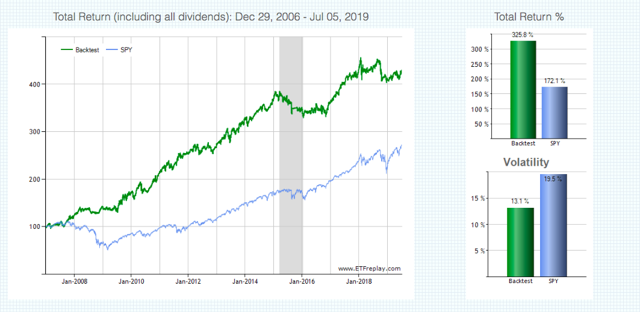

In that spirit, the following quantitative strategy looks for the top 3 ETFs among a universe of 9 instruments that represent some key asset classes.

The ETFs in the investable universe are:

- SPDR S&P 500 for big stocks in the U.S.

- iShares Russell 2000 ETF (IWM) for small U.S. stocks.

- iShares MSCI EAFE ETF (EFA) for international stocks in developed markets.

- iShares MSCI Emerging Markets ETF (EEM) for international stocks in emerging markets.

- Invesco DB Commodity Index Tracking ETF (DBC) for a basket of commodities.

- SPDR Gold Trust ETF (GLD) for gold.

- Vanguard Real Estate ETF (VNQ) for REITs.

- iShares 20+ Year Treasury Bond ETF (TLT) for long-term Treasury bonds.

- iShares 1-3 Year Treasury Bond ETF (SHY) for short-term Treasury bonds.

In order to be eligible, an ETF has to be in an uptrend, meaning that the current market price is above the 10-month moving average. If no ETF is in an uptrend, the portfolio is allocated entirely to cash.

Among the ETFs that are in an uptrend, the system buys the top 3 with the highest relative strength. Relative strength is measured by a ranking system that considers volatility-adjusted returns over 3 and 6 months.

Since January of 2007, the strategy gained 325.8%, versus 172.1% for a buy and hold position in SPY. Maximum drawdown is 14.4% for the strategy versus 55.2% for SPY.

(Click on image to enlarge)

Source: ETFreplay.

As of the most recent update, SPY is one of the top 3 ETFs among the 9 asset classes considered in terms of trend and relative strength. This bodes well for investors in SPY going forward.

The Bottom Line

The future is unpredictable, all we can do as investors is gather the evidence and weight such evidence in order to put the probabilities on our side over the long term. Factors such as big money demand, broad participation, solid earnings estimates, and strong momentum are pointing towards further gains in SPY over the middle term.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more