Spot Ether ETFs See $533M Inflows, Extend Streak To 13 Sessions

Image Source: Pixabay

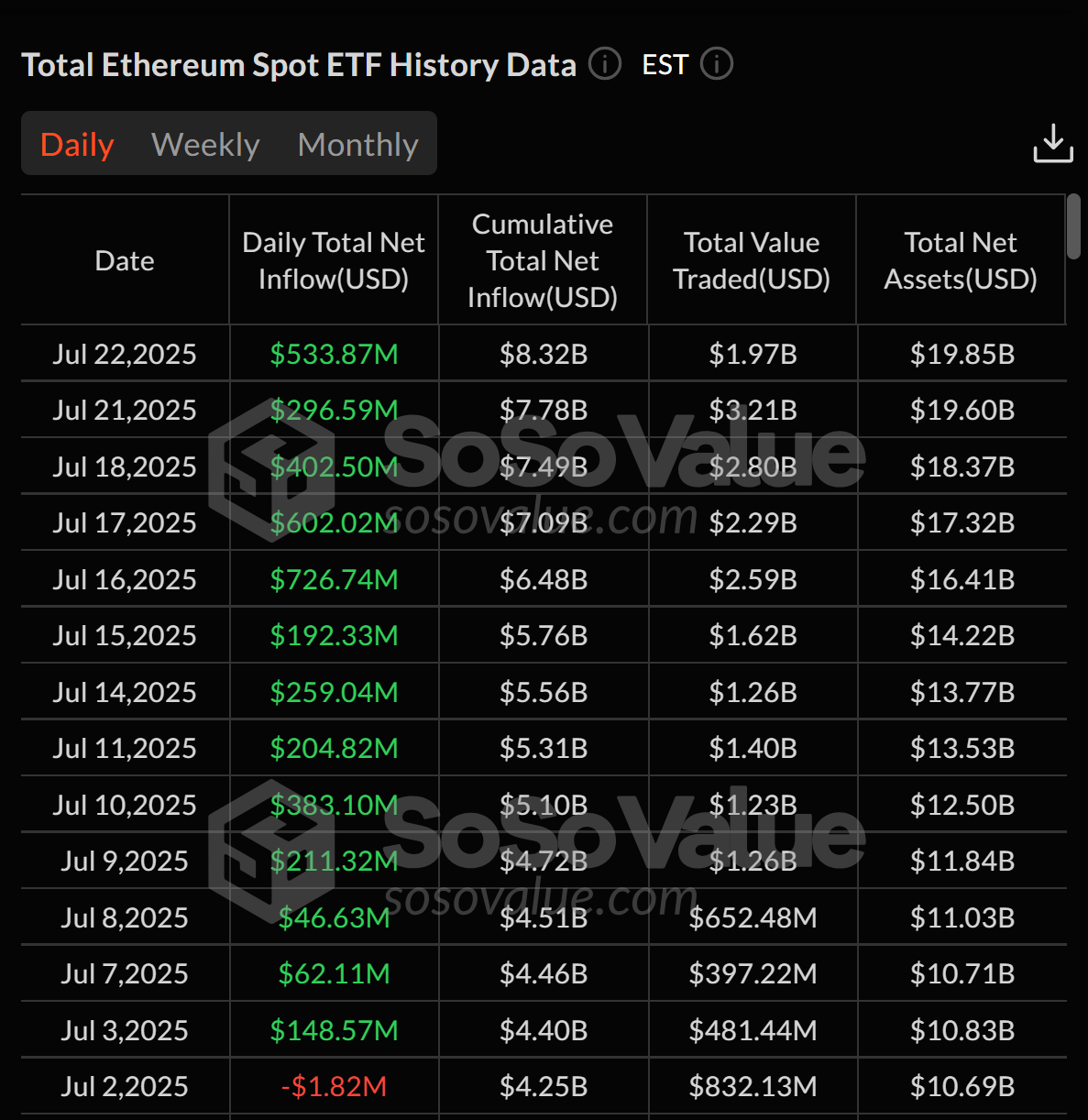

Spot Ether ETFs continued their bullish run on Tuesday, recording $533.87 million in daily net inflows. The consistent gains pushed the 13-day cumulative inflow to over $4 billion. The trend reflects growing market interest and rising institutional exposure to Ethereum-based products.

BlackRock’s iShares Ethereum Trust led with $426.22 million, pushing its assets over the $10 billion mark. Fidelity’s FETH followed with $35 million in net inflows, adding to the surge. Other funds contributed the remaining $72.65 million, further widening the positive momentum.

Total assets under management across all Spot Ether ETFs reached $19.85 billion, now accounting for 4.44% of Ethereum’s market cap. Since July 2, cumulative inflows more than doubled from $4.25 billion to $8.32 billion. The demand rise remains steady as institutional activity grows and macro conditions support risk assets.

(Click on image to enlarge)

Source- SoSoValue

Spot Ether ETFs Lead Market Activity

Spot Ether ETFs have shown significant momentum throughout July, bolstered by consistent inflows and increasing institutional attention. July 16 marked a record day with $726.74 million in inflows, followed by $602.02 million on July 18. The 13-day streak underlines a sharp shift in investor preference toward Ethereum exposure.

The inflows reflect a shift in sentiment as ETH gains ground on BTC in portfolio allocation. Ethereum’s market cap is 19% of Bitcoin’s, yet Ethereum ETPs hold just under 12% of Bitcoin ETP assets. This gap suggests further room for institutional ETH allocations to expand in the coming months.

According to analysts, ETH demand could reach $20 billion within the next year based on ETP and balance sheet projections. At current prices, this equals 5.33 million ETH, while projected issuance is only 0.8 million ETH. This imbalance implies strong demand fundamentals which may continue to drive ETF inflows.

3 more fresh wallets have withdrawn 10,703 $ETH($39.6M) from #Kraken today.

— Lookonchain (@lookonchain) July 23, 2025

That means 5 fresh wallets have accumulated a total of 76,987 $ETH ($285M) today.https://t.co/7eJs62leO6 pic.twitter.com/RfD848iiZs

Bitcoin ETFs Record Net Outflows Amid Cooling Momentum

Spot Bitcoin ETFs recorded a net outflow of $67.93 million on Tuesday, reversing earlier gains from July. Bitwise’s BITB led the withdrawals with $42.27 million, while Ark’s ARKB followed with $33.18 million. Grayscale’s GBTC recorded a small inflow of $7.51 million, diverging from the broader trend.

Despite strong inflows earlier in the month, Bitcoin ETFs saw weaker activity this week. July 10 and 11 brought in over $2.2 billion combined, but momentum has slowed. The recent outflows contrast sharply with the sustained inflow streak seen in Spot Ether ETFs.

The divergence between Spot Ether ETFs and Bitcoin ETFs highlights shifting investor focus. As ETH products gain popularity, BTC vehicles face consolidation. The data suggests that ETH-based funds are now attracting stronger and steadier capital inflows.

More By This Author:

Bitwise ETF Faces Sudden Pause After SEC GreenlightStrategy Unveils New STRC Stock Offering To Expand Bitcoin Holdings

Trump Media Stock: Bets Big On Bitcoin With $2 Billion Treasury Shift