S&P 500 Risk Profile - Wednesday, Jan. 18

The US stock market has stabilized recently and trades moderately above its recent low. The recovery inspires hope that the worst is over. Maybe, but a review of various metrics suggests that there’s a good case for staying defensive until stronger evidence emerges the latest bounce is the start of an extended rebound.

Granted, current market conditions have improved since the previous update in October, but it’s not yet obvious that the bear market of 2022 has run out of the road, based on data through yesterday’s close (Jan. 17). A price chart of the S&P 500 Index tells the story. It’s possible that the recent bounce marks the start of a new bull market or a period of relative stability that keeps the market in a trading range. But the market’s technical profile continues to suggest that the bias is still skewed to the downside. The next several weeks may change the analysis, but for the moment the trend remains weak.

The case for caution is also supported by a pair of US equity ETFs that can be used as a proxy for estimating the market’s risk-on/risk-off sentiment bias. This ratio peaked more than a year ago and it continues to point to negative trending behavior for the market.

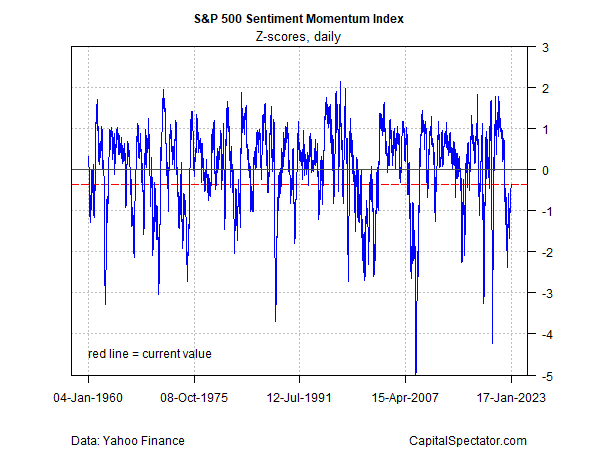

Another profile of market sentiment shows a recovery in recent months, but here too the bias remains bearish, based on CapitalSpectator.com’s S&P 500 Sentiment Momentum Index (for design details see this summary). This indicator can be used on a contrarian basis – deeply negative readings imply the market will rebound, at least temporarily. But for strategic-minded investors with a relatively low to moderate tolerance for risk, the current reading continues to suggest caution is warranted.

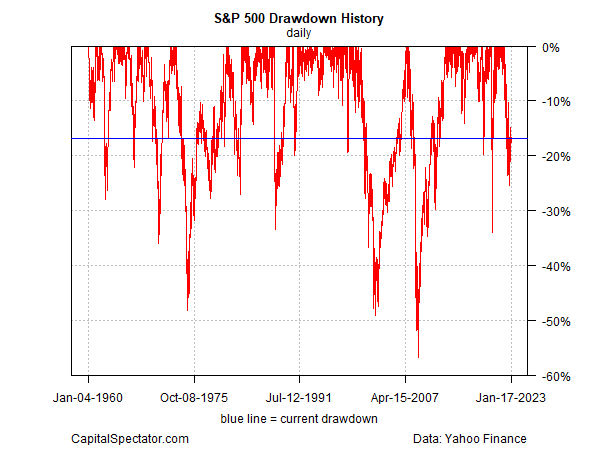

The current S&P 500 drawdown remains relatively steep. Here, too, investors may see this as a useful contrarian indicator, but until the drawdown recovers further the current level will likely keep conservative investors wary.

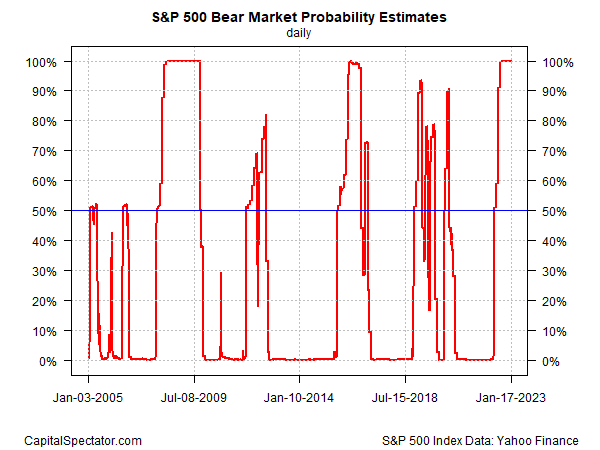

Meanwhile, a methodology for quantitatively estimating bear-market conditions continues to reflect a pessimistic profile, based on the Hidden Markov model (HMM). This indicator first hinted at a bear-market signal by rising above the 50% probability mark last May. The latest reading of 99.9% suggests that the bear market continues. (For some background on how the analytics are calculated in the chart below, see this primer.)

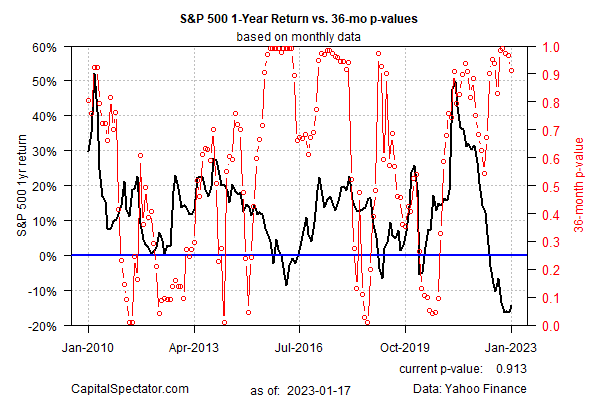

Turning to bubble risk for the S&P 500, this econometric estimate shows that the extreme level is starting to ease but remains elevated. (See this 2014 post for some background on the methodology).

Finally, market valuation continues to pull back from its recent peak but has rebounded a bit lately, based on Professor Robert Shiller’s Cyclically Adjusted PE Ratio (CAPE Ratio), a.k.a. Shiller PE Ratio. The main takeaway: the equity market’s valuation remains elevated vs. the long run of history, although in comparison with recent years, the CAPE ratio is near the lower end of its range. According to analysts at Citi, the latest rebound in valuation is a headwind for stocks in the near term.

More By This Author:

High Beta, Small Cap Value Top US Factor Returns In 2023’s Start

Global Markets Extend 2023 Rally For Second Week

10-Year Treasury Yield ‘Fair Value’ Estimate - Friday, Jan. 13

Disclosures: None.