SMH Is In Wave 5 Extension As Semiconductors Aim For 400 Area

Image Source: Unsplash

SMH is the VanEck Semiconductor ETF, giving concentrated exposure to major global semiconductor companies like NVIDIA, TSMC, and Broadcom. It holds about 25 stocks and is known for higher volatility because a few large chipmakers dominate the fund. Investors use SMH to bet on long-term growth in chips, AI, and tech hardware, but it can swing sharply due to the cyclical nature of the semiconductor industry.

(Click on image to enlarge)

SMH Daily Chart

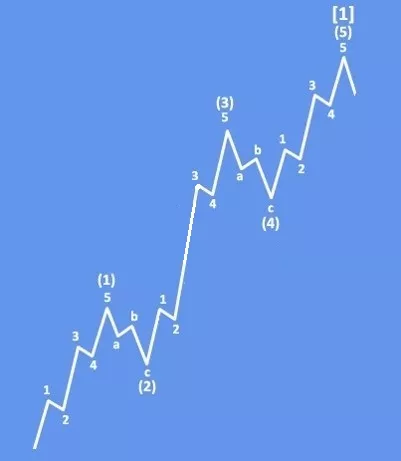

VanEck Semiconductor ETF (SMH) is trading within a five-wave bullish impulse from the April lows. Based on Elliott Wave theory, the ETF appears to be in the final Wave 5, which can still extend above the October highs toward the 400 area. Short-term pullbacks are possible, but the broader trend remains bullish. With current risk-on sentiment, semiconductor stocks could continue higher into late 2025 or even early 2026.

Basic Impulsive Bullish Pattern shows that SMH can be trading in final 5th wave, but there can be still space for more upside to complete a lower degree five-wave bullish impulse within that 5th wave.

More By This Author:

GBP/USD Extends Rally As Bullish Impulse Builds

Aussie Resumes Its Recovery

Dollar Breaking Out Of A Wedge Ahead Of US PCE

For a detailed view and more analysis like this, you can watch our latest video analysis recorded on December 09: DIRECT ...

more