Semiconductor Channel Breakout

Image Source: Pexels

A solid day for indices delivered a good week for semiconductors. After a four-month decline, there was a clear breakout that took out the October swing high. Strength in the semiconductors has and will likely continue to feed into the Nasdaq and S&P 500.

(Click on image to enlarge)

Strength in the semiconductors delivered key breakouts for both the Nasdaq and the S&P 500, negating what had been picture-perfect short trades for these indices at resistance. It will be interesting to see if there is any upside follow-through off the back of this reversal driven by short covering.

Technicals are net positive for both the Nasdaq and S&P 500.

(Click on image to enlarge)

(Click on image to enlarge)

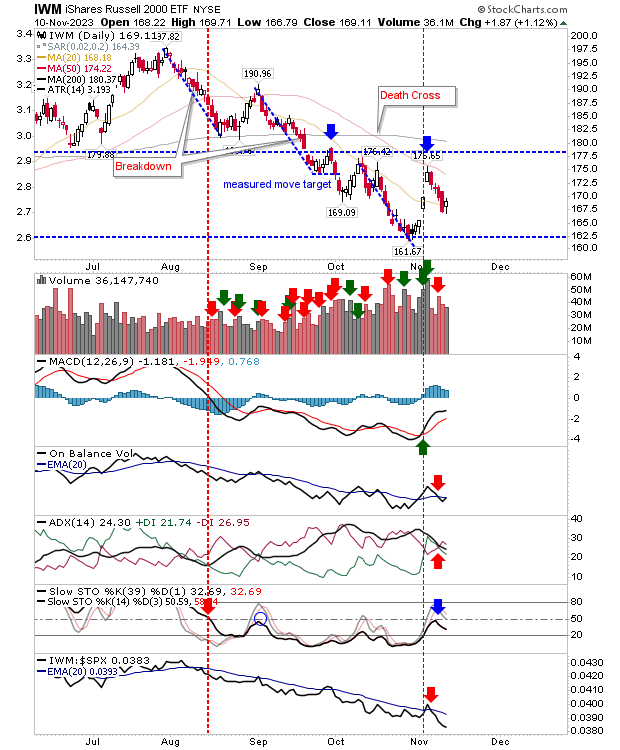

The Russell 2000 (IWM) closed with a bullish harami, a solid reversal pattern. A short-term 'buy' with a stop below Friday's low offers itself as a short-term trade. Technicals remain mixed, with stochastaics particularly favoring the bearish side of the story. It will take a number of days of buying to reverse this bearish momentum.

(Click on image to enlarge)

For the coming week, we have the Nasdaq and the S&P 500 in the process of building a right-hand side of a base which kicked off from the July swing high. It's an easier path for these indices than that of the Russell 2000. The latter index needs a solid advance to take it back to the 50-day MA at a minimum, and really, it should take out the 200-day MA, too.

More By This Author:

The Week Starts With Selling, But It's Not Too Damaging

Sellers Come In After Last Week's Gains

A Weekly Trend Break For The S&P 500

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more