Seasonality Is Bullish

SPX Monitoring purposes; Long SPX on 10-29-24 at 5832.92

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD:Long GDX on 10/9/20 at 40.78.

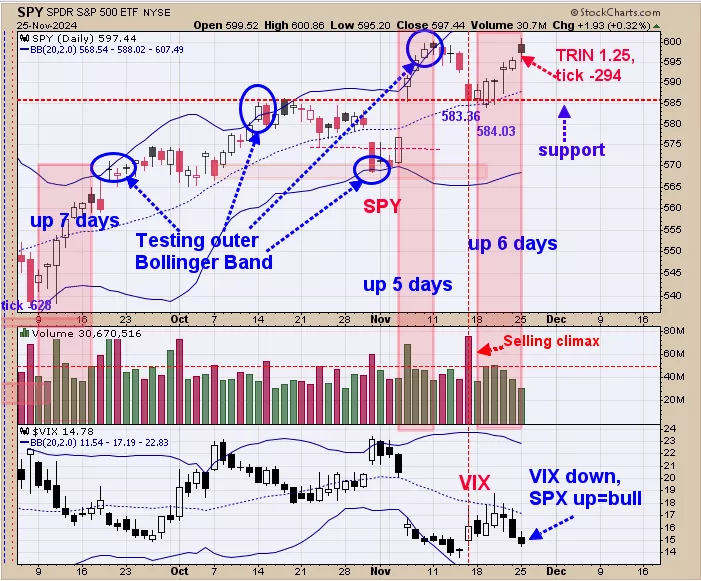

We are up 31.40%; SPX up 25.7% so far this year. We where leaning a little bearish late last week but things improved today.Today’s marks 6 days up in a row and suggests the market will be higher in 10 days or less over 80% of the time. The SPY closed higher today and the VIX closed lower which is bullish.The TRIN closed at 1.25 and the tick at -294 which shows panic and is bullish; Seasonality is bullish into year end. Long SPX on 10/29/24 at 5832.92.

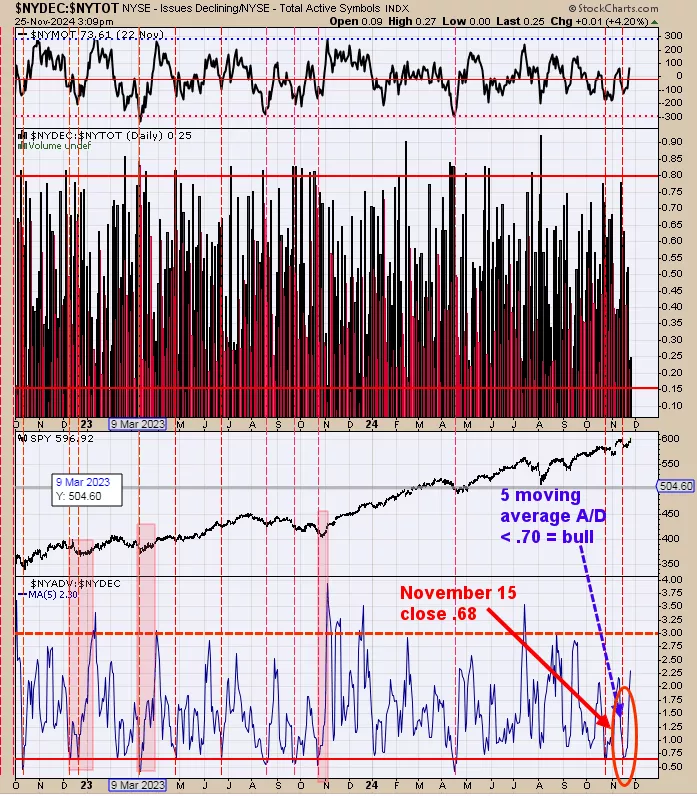

The bottom window is the NYSE advance/NYSE decline with a 5 day average.Short term lows have been found when this indicator reaches below .70.November 15 this indicator closed at .68 and pretty much marked the low in the market.Intermediate bullish signs occur when this indicator goes from .70 to 3.00 in 30 day or less (noted in shaded pink). November 15 marks the start date with a reading of .68 and ideally we would like to see 3.00 or higher by December 15.

(Click on image to enlarge)

We keep referring to the above monthly chart as this chart dictates the long term trend for GDX. The bottom window is the monthly Cumulative up down volume with its Bollinger band; Next higher window is the monthly cumulative advance/decline with its Bollinger band and top window is the monthly GDX. Bullish signal are triggered when all three indexes close above their mid Bollinger band and sell signals when all three close below.The last signal triggered came in May of this year when all three closed above their mid Bollinger bands.As long as all three hold above their mid Bollinger band the buy signal will remain in force.Signals of this type last 1 ½ years to three years.The current signal should last at a minimum to November 2025.

More By This Author:

Spike In VolumeStalling Short Term

Market Could Stall Short Term

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more