Rough Seas

Image Source: Pixabay

My day will consist of taking my daughter somewhere spontaneous, trying to figure out how to get off Bonobos’ text marketing lists, and wrapping up this note to you.

On Wednesday, we had a market narrative shift emerge, and it wasn’t very pretty. Selling pressure in the Russell 2000 exploded, driving that index into negative momentum conditions on Thursday morning. The Russell cracked under its 50-day exponential moving average (EMA) on Friday.

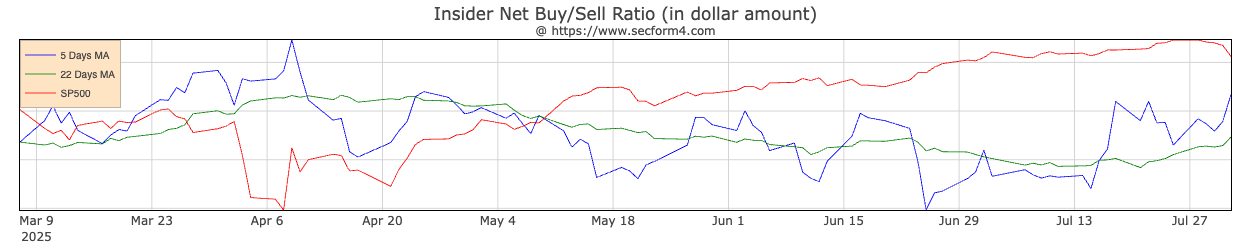

Whether this is just a retest and some risk-off behavior after a two-month momentum run remains to be seen, but I’ll be keeping a close eye on the Aggregate Insider Buying to Selling Ratio over at SECForm4.com.

Meanwhile, the strongest levels of insider buying in dollars compared to selling in dollars came back during the cancellation of Liberation Day. We’re seeing an uptick in purchases.

(Click on image to enlarge)

This would be a contrarian signal -- and seems to suggest that the narrative could swing back on the weak job numbers and potential expectations that the Fed must cut rates in September. Isn’t the market a wonderful wealth machine, everyone?

Our reading on the S&P 500 is yellow as well. Additionally, we’ve seen our core FNGD signal tick above its 20-day moving average.

There are certainly other things that have this market on edge as well.

Consumer cyclicals are dumping in tandem, regional banks have been showing recent weakness, and momentum in technology that isn’t the Magnificent Seven has been weak (especially software applications, which may be a signal of concerns about the labor markets).

And what about American International Group (AIG)? It recently reached its lowest levels seen since the Liberation Day fiasco. If you haven’t watched this, today’s the day to do it.

You know me, I’m going to tell you that an opportunity to buy will come at some point because all roads point to monetary expansion, the likelihood of greater quantitative support efforts by the Fed, and the reality that monetary policy abroad has been easing while Michael Howell’s liquidity measurement expands to new highs.

Keep your eye on the dollar -- it rises when people start to hoard it, and there may be an underlying refinancing issue emerging somewhere. As always, I expect we’ll wake up one day in the future and have another event in Japan, similar to last August. I’m not in the room with policy makers, and life’s too short to worry about SoftBank.

Have a great day, and stay positive.

More By This Author:

Central Banks Just Showed Their HandWhere I've Hidden My Gold

No, You Won't Be Buying A U.S.-Made iPhone