Retire Rich With These Blue-Chip Dividend Etfs

Exchange-Traded Funds (ETFs) offer the best approach for investors to allocate cash and generate strong returns over time. They are often better than stocks because of their diversification.

While dividend ETFs are good, few of them beat the benchmark funds like S&P 500 and the Nasdaq 100 indices in terms of total returns. Total return is usually the best measure for an asset’s performance because it looks at the price return with its dividends included. So, here are some of the best dividend ETFs to buy and hold for a rich investment.

Summary of the best blue-chip dividend ETFs to buy

Some of the best blue-chip dividend ETFs to buy are:

- JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) – 9.35%

- Vanguard High Dividend Yield Index Fund (VYM) – 2.5%

- iShares Core Dividend Growth ETF (DGRO) – 2.20%

- WisdomTree U.S. Total Dividend Fund ETF (DTD) – 2%

- SPDR® S&P Dividend ETF (SDY) –

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

The JPMorgan Nasdaq Equity Premium Income (JEPQ) ETF is one of the best dividend ETF to invest and retire rich with. It is a covered call ETF that aims to complement the returns of the Nasdaq 100 index. It does that by investing in all Nasdaq 100 index companies and then selling call options of the index, which gives it a premium that it distributes monthly to its investors.

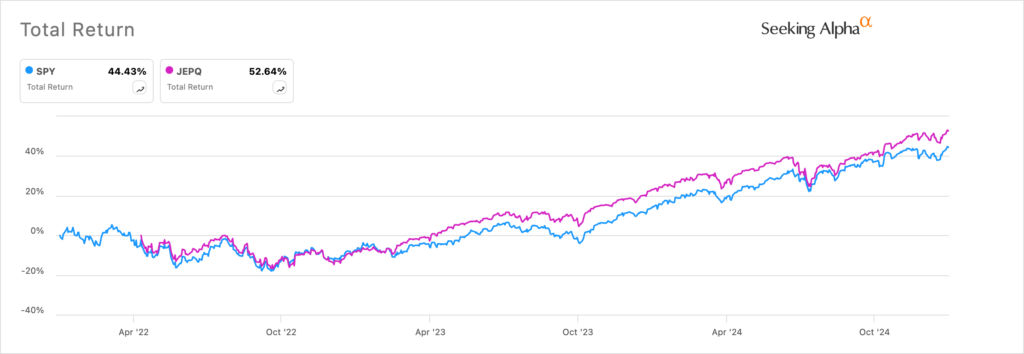

The JEPQ ETF is a good dividend fund because, unlike other covered call funds, it outperforms the market. As shown below, its total return in the last three years was 52%, higher than the SPY return of 44.4%.

(Click on image to enlarge)

SPY vs JEPQ ETF

Vanguard High Dividend Yield Index Fund (VYM)

The VYM ETF is another top fund to buy for a rich retirement. It is a fund that tracks American companies with a record of paying above average dividends to shareholders. It is a highly-diversified company with 553 companies across most sectors, with the most notable ones being firms like Broadcom, JPMorgan, Exxon Mobil, Procter & Gamble, Walmart, and Home Depot.

There are two main reasons you may reconsider investing in VYM though. Its 2.5% dividend yield is not big enough, and it often underperforms the S&P 500 index.

iShares Core Dividend Growth ETF (DGRO)

The iShares Core Dividend Growth ETF is another fund to buy and hold for a rich retirement. It is a fund that focuses on dividend growth, an important thing to consider when investing in dividends.

Most of its companies are in industries like financials, information technology, health care, and consumer staples. The biggest companies in the fund are JPMorgan, Broadcom, Microsoft, Johnson & Johnson, and ExxonMobil.

The DGRO ETF’s main advantage is its dividend growth. Its CAGR dividend growth rate in the past five years was 8.28%, higher than most funds.

WisdomTree U.S. Total Dividend Fund ETF (DTD)

The WisdomTree U.S. Total Dividend Fund ETF is another good dividend ETF to buy and hold for long-term gains. It tracks companies that have a good record of paying dividends and those that have limited chances of cutting. The biggest names in the fund are Microsoft, Apple, Nvidia, Chevron, and Johnson & Johnson.

While this fund is more expensive than the others, it has a close correlation with the SPY ETF. Its total return in the last 12 months was 34% while the SPY gained 45%.

SPDR® S&P Dividend ETF (SDY)

The SPDR® S&P Dividend ETF is a popular fund that invests in companies known as dividend aristocrats. Dividend aristocrats are companies that have a long history of paying and hiking their payouts for at least 25 years. These firms include the likes of Chevron, Realty Income, WEC Energy, Xcel Energy, Kenvue, and Kimberly Clark.

More By This Author:

S&P 500 Slips From Intraday Highs As Investors Lock In Profits After A Strong Week

Gold Prices Reach Record Levels, Targeting $2,800/oz

5 Key Charts Explain Why Ethereum Price Is In Trouble

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more