Retail Investors’ Most Popular Stocks Of 2023 So Far

MARKETS

Retail Investors’ Most Popular Stocks of 2023 So Far

Published

1 hour ago

on

February 23, 2023

By

Graphics/Design:

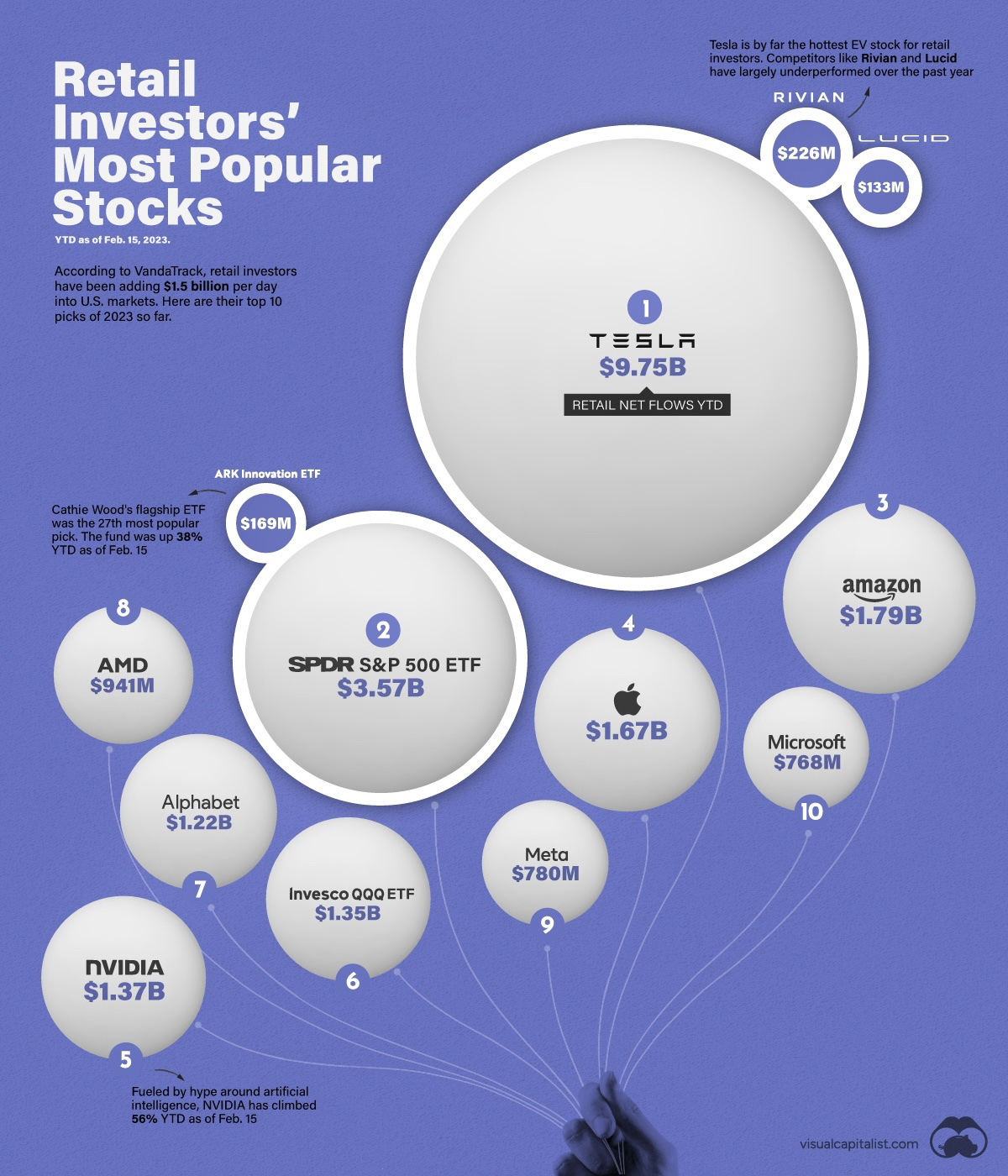

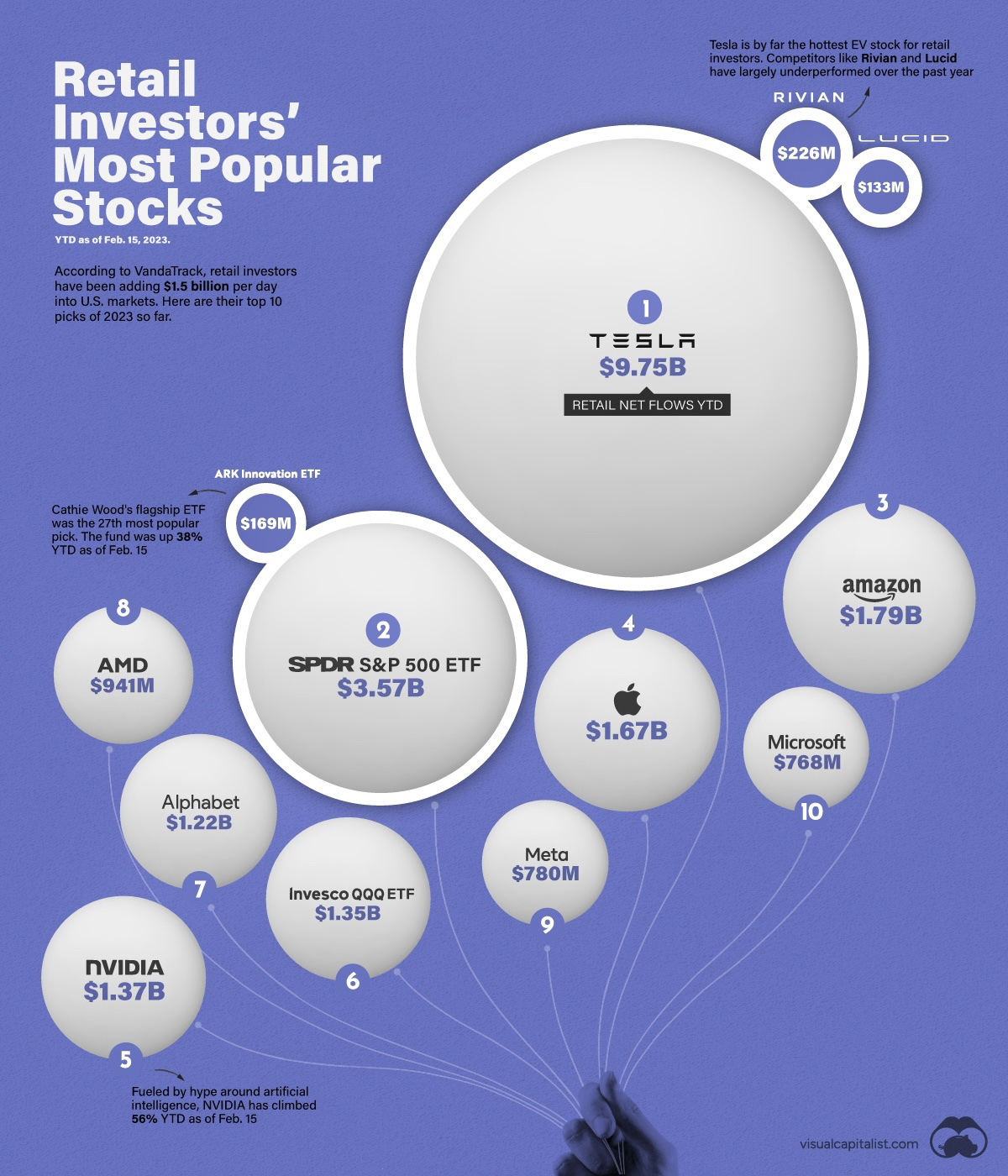

Retail Investors’ Most Popular Stocks of 2023 (YTD)

According to VandaTrack, retail investors are still a force to be reckoned with, adding an average of $1.5 billion each day into U.S. markets.

This is a record-breaking level of inflows, which raises the question: what are investors buying? To find out, we’ve visualized the 10 most popular picks of 2023, as of February 15.

The Top 10 List

Most of the names in this list won’t come as a surprise. They represent eight of the world’s largest and most well-known tech companies, as well as two highly popular U.S. equity ETFs.

| Rank | Name | Ticker | Retail net flows (USD million) |

|---|---|---|---|

| 1 | Tesla | TSLA | $9,751 |

| 2 | SPDR S&P 500 ETF | SPY | $3,572 |

| 3 | Amazon | AMZN | $1,786 |

| 4 | Apple | AAPL | $1,674 |

| 5 | Nvidia | NVDA | $1,367 |

| 6 | Invesco QQQ ETF | QQQ | $1,353 |

| 7 | Alphabet | GOOG/L | $1,218 |

| 8 | AMD | AMD | $941 |

| 9 | Meta | META | $780 |

| 10 | Microsoft | MSFT | $768 |

Looking closer at the numbers, we can see that Tesla’s net retail flows of $9.75 billion are greater than all of the other individual stocks combined ($8.5 billion). This is a sign that investors still have plenty of faith in Tesla, even as its market share is beginning to shrink.

We recently covered Tesla’s profit margins (net profits per vehicle) in a separate infographic.

Perhaps the least common name on a top 10 ranking such as this is AMD. The chipmaker has made for a compelling underdog story in recent years, gaining significant market share from its long-time rival, Intel.

What About the Meme Stocks?

Several meme stocks made it into the broader top 100 list. This includes Bed Bath & Beyond, which ranked 47th with $114 million in net retail flows.

The retailer has been struggling to avoid bankruptcy, recently raising $225 million through an underwritten public offering of preferred shares. A further $800 million could be coming if certain conditions are met.

The company says it’s committed to paying down its overdue debts and will be closing stores to reduce costs.

AMC Entertainment, which saw extreme volatility during the COVID-19 pandemic, ranked 52nd on the list for retail investors with $90 million in net flows. The stock has generated a 27% return YTD (as of Feb. 15). The cinema operator’s revenues have been recovering since the pandemic, but they’ve yet to reach pre-2020 levels.

More By This Author:

Consumer Price Inflation, By Type Of Good Or Service (2000-2022)

How China Became Saudi Arabia’s Largest Trading Partner

Which Countries Pollute The Most Ocean Plastic Waste?

Disclosure: None.