Rally Time In The Gold Stocks

Image Source: Pixabay

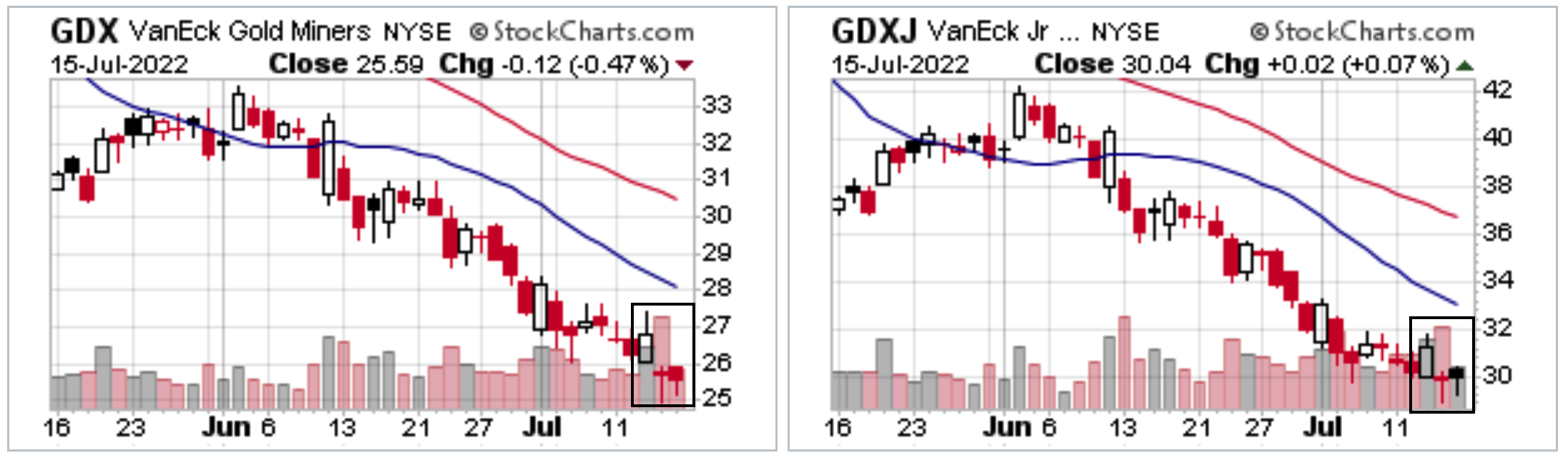

The gold stocks are extremely oversold. That’s obvious. However, selling pressure has waned since the end of June. The daily candles have been mild, suggesting less and less distribution. The last few days mark three consecutive days of accumulation candles for the first time in months.

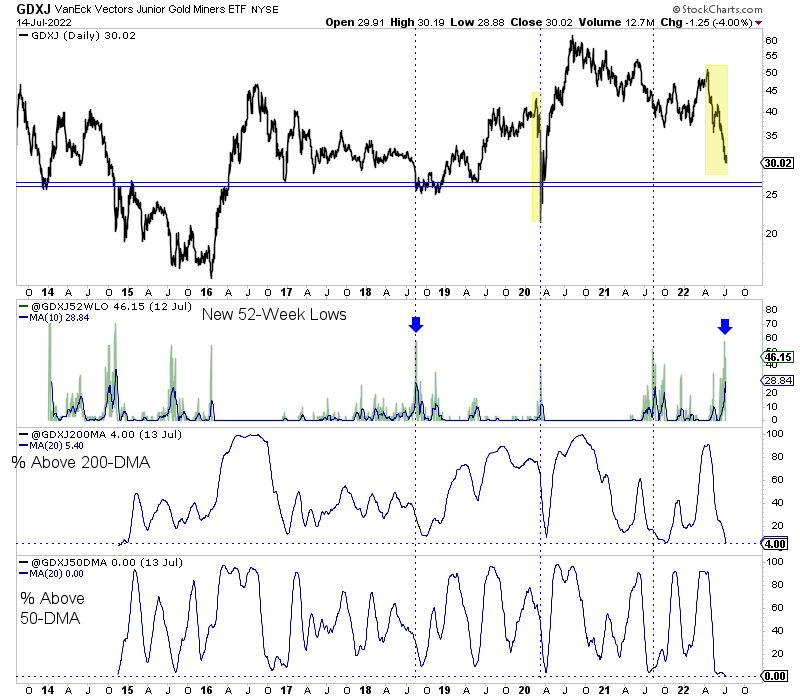

These candles come amidst an extreme oversold condition. On the charts below, we plotted GDXJ along with our custom indicators. Each of the three indicators have hit the most extreme levels in over seven years. GDXJ is the most oversold it has been since the end of 2014.

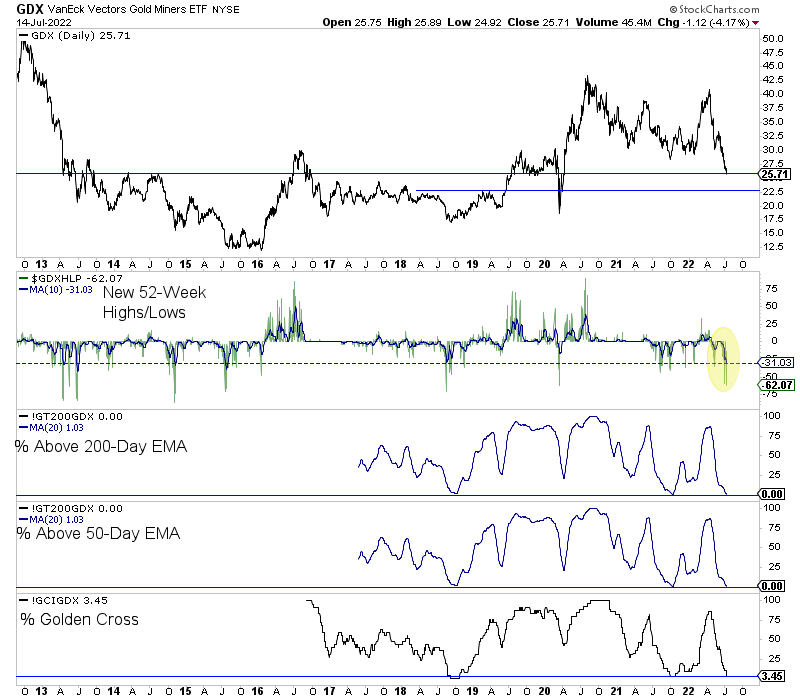

The large-cap miners are not quite as oversold as GDXJ, but they are close.

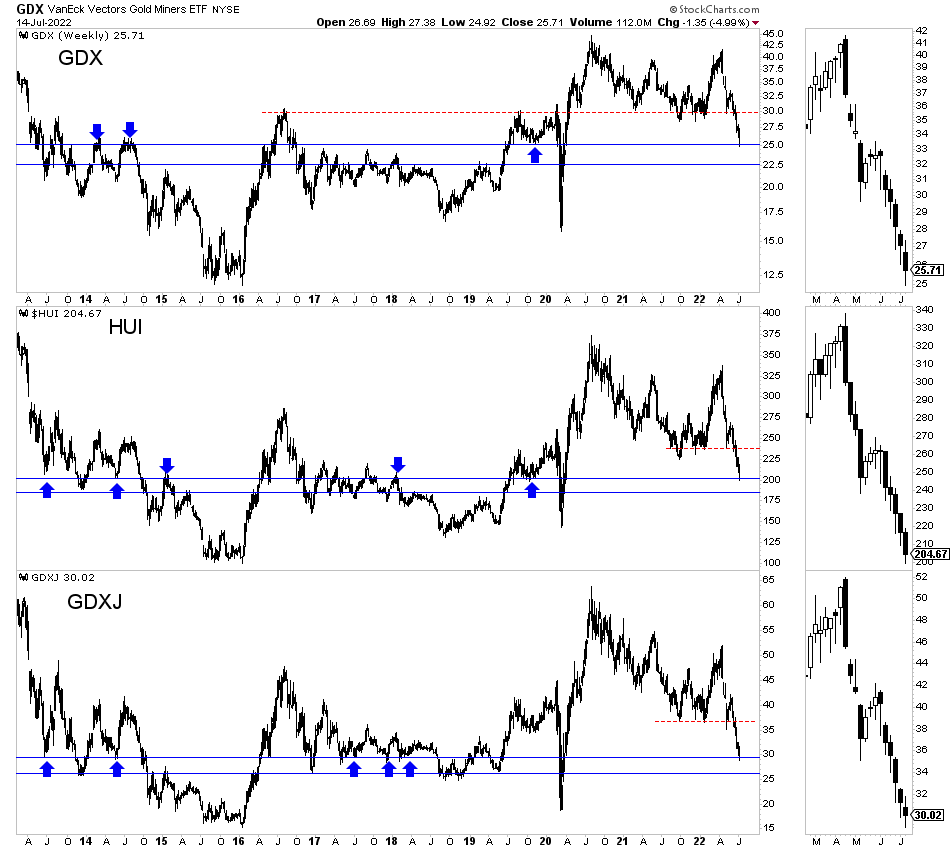

In reassessing support levels in the gold stocks (after last week), I came up with the following (in the image below). GDX, GDXJ, and the HUI all have begun to stabilize at their respective first support levels.

The path of least resistance for the gold stocks in the short-term is higher. Even when they were extremely oversold in 2008, 2013, and 2014, they enjoyed a relief rally before more selling.

Whether this rebound will be sustainable will depend on the market’s view of Fed policy. If the market anticipates the Fed hiking past September several weeks from now, then this rally will be sold. However, if there is a growing belief that July or September is the last hike, this rally could be the start of something big.

More By This Author:

Pinpointing The Bottom In Gold & Gold Stocks

Gold's Struggling But Here's When & How It Changes

Is Gold About To Crash Like In 2013?

I continue to focus on finding high-quality juniors with at least 5- to 7-bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside ...

more