QQQ: Outperforming In Bull And Bear Markets

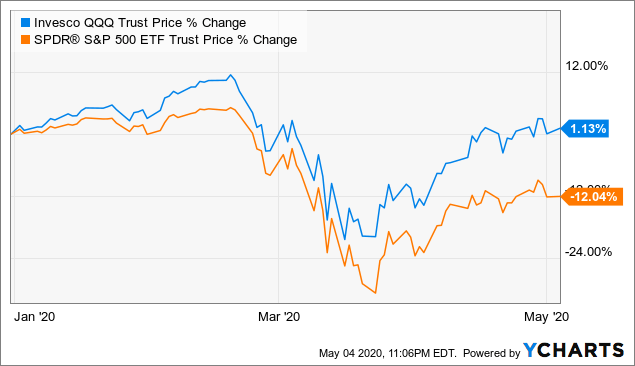

Invesco QQQ (QQQ) has downright obliterated the market over the past decade, and it has also outperformed during the recent bear market produced by the coronavirus pandemic. After such a long period of outperformance, it makes sense for investors to wonder if it still makes sense to consider a position on QQQ or if the best is already in the past for the tech-oriented ETF.

Some kind of reversion to the mean would be reasonable in the short term, and valuation is an important consideration to keep in mind. However, fundamental quality, superior profitability, and abundant potential for long-term growth mean that QQQ is well-positioned to continue outperforming versus the broad market over the years to come.

Outperforming In Good And Bad Times

QQQ has widely outperformed the broad market in the long term: the tech-oriented ETF is up by over 330% in the past decade versus a much smaller cumulative gain of 135% for SPDR S&P 500 (SPY) in the same period.

Data by YCharts

At first sight, this does not come as a surprise during a long-term bull market for stocks. High growth companies are generally considered more volatile than stable and mature businesses. When the economic landscape is favorable and risk appetite is strong among investors, it makes sense to expect superior gains for QQQ in comparison to other areas of the market.

However, QQQ is also outperforming SPY by a material spread in 2020 so far. Not only has QQQ produced bigger returns than SPY in a bullish environment for stocks, but also during the coronavirus pandemic and the ensuing bear market this year.

Data by YCharts

If the high growth stocks that make the portfolio of QQQ are generally riskier, it makes sense for these kinds of stocks to deliver superior returns in a bull market. However, you wouldn't expect to see these kinds of stocks outperforming in a bear market too.

QQQ also has a large exposure to the FANG group, and many analysts have been warning about how these stocks are overvalued and risky over the past several years.

When the recession came, however, the relatively more volatile and expensive stocks performed much better than the rest of the market. Some of this may be related to the specific nature of the pandemic-induced bear market, but there are also some important long-term fundamental drivers in place.

Macro Factors And Business Fundamentals

The table below shows the top 10 positions in the QQQ ETF. As we can see, the portfolio is far more concentrated in comparison to the typical index-tracking ETFs. The top 10 positions, Microsoft (Nasdaq: MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB), Alphabet (GOOG) (GOOGL), Intel (INTC), PepsiCo (PEP), Cisco (CSCO), and Netflix (NFLX) account for 54% of the total assets in the ETF portfolio.

(Click on image to enlarge)

Source: Seeking Alpha

This is not a typical recession, we are in a fairly unique environment, and it is easy to understand that companies such as Amazon and Netflix could temporarily benefit from the shelter at home policies in recent months.

However, cases such as Alphabet and Facebook are more nuanced. Advertising is a very cyclical industry, and most Wall Street analysts were quite negative on Alphabet and Facebook before these companies announced earnings last week. But the online advertising giants actually delivered better than feared numbers when the time came.

Even if advertising is a highly cyclical industry, online advertising keeps taking market share away from traditional media. The short-term macroeconomic trends are important when assessing an investment, but the long-term fundamental factors can be much more relevant.

It is also important to note that most of these companies have pristine balance sheets with more cash than debt, and they also generate wide profit margins and abundant cash flows. Even Warren Buffett himself has recently said that these companies are "just the opposite" of a bubble because they don't need any external capital.

The main positions in QQQ are typically companies with strong brand recognition and enormous scale. This can be a game-changer in terms of protecting the business from the competition and generating solid financial performance in all kinds of environments. Growth is also quite scarce and difficult to find nowadays, so companies with consistently superior growth rates become increasingly valuable to investors.

Valuation is an important risk factor to keep in mind, and this consideration is particularly relevant for the big growth stocks in the QQQ portfolio. However, proper valuation is about much more than comparing P/E ratios for different companies, you need to consider the quality of the business when making these kinds of assessments.

QQQ offers a collection of businesses with solid competitive strengths, attractive growth potential in all kinds of scenarios, strong balance sheets, and abundant cash flow generation. It is really no wonder why these companies are trading at a valuation premium versus the rest of the market and still delivering superior returns in bullish and bearish periods.

The Trend Is Your Friend

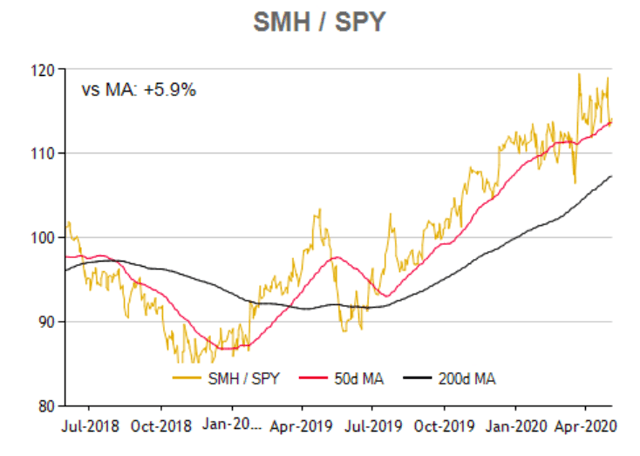

In order to assess the timing for a position in QQQ we can take a look at the semiconductor trend model. This is a quantitative strategy that watches the main trend in the semiconductor sector in order to buy or sell the technology-oriented QQQ.

Semiconductors are often the first step in the supply chain for the tech industry, and demand for different kinds of semiconductors says a lot about the prospects for the technology sector. When semiconductors are doing well, chances are that the tech industry is seeing strong demand and vice-versa.

The strategy uses a ratio that measures the relative performance of the VanEck Vectors Semiconductor ETF (SMH) versus the SPY. When this ratio is rising, it means that semiconductors are outperforming, which has bullish implications for QQQ.

The chart shows how the ratio has evolved in recent months, with the 50-day moving average in red and the 200-day moving average in black. When the 50-day moving average is above the 200-day moving average, we can say that the ratio is in an uptrend.

(Click on image to enlarge)

Source: ETF replay

When the ratio is in an uptrend the quantitative strategy is invested in QQQ, and when the ratio in a downtrend, the strategy goes for safety by investing in the iShares 20+ Year Treasury Bond ETF (TLT).

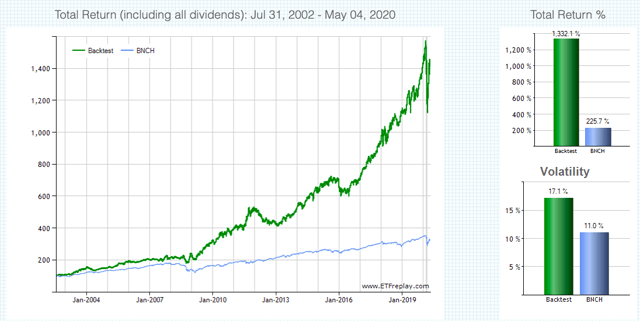

Since August 2002, the first month in which all of the ETFs are available for trading, the quantitative strategy gained 1,332% versus a cumulative gain of 225.7% for the benchmark in the same period. The benchmark is a portfolio of 60% global stocks and 40% bonds.

(Click on image to enlarge)

Source: ETF replay

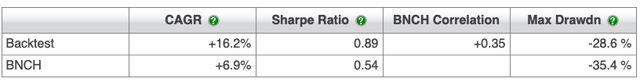

In annual terms, the quantitative strategy gained 16.2% versus 6.9% for the benchmark. The maximum drawdown - meaning maximum capital loss from the peak - was 22.6% for the trend following strategy versus a maximum drawdown of 35.4% for buy-and-hold investors in the benchmark.

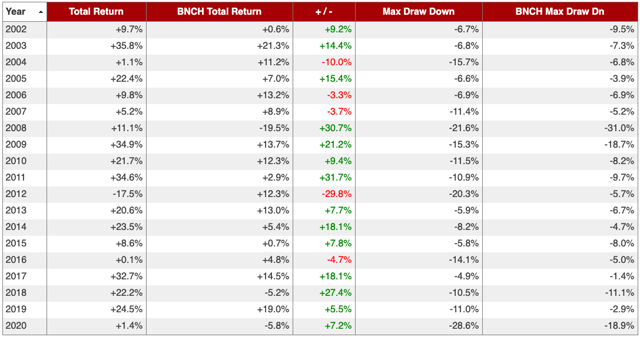

The table below shows the annual returns for the strategy versus the benchmark in each calendar year since inception.

(Click on image to enlarge)

Source: ETF replay

The strategy is based on trend following principles, so it generally does very well when the main trends in different assets are strong and well-defined. Conversely, when markets are moving sideways and trends are weak, the quantitative strategy can be expected to underperform.

During this particular cycle, the strategy has remained long in QQQ since March of 2019, and this has been the right choice so far. The strategy suffered considerable pain in February and March of this year, but that pain was more than compensated with vigorous gains in April.

The data could change in the near term, but it is what it is right now, and consistent resiliency in the semiconductor sector has bullish implications for QQQ going forward.

The Bottom Line

Prices never go up in a straight line, after such a long period of huge outperformance from QQQ in both bull and bear markets, nobody should be too surprised to see the ETF consolidating sideways or underperforming the market over short periods of time.

However, QQQ offers a collection of exceptionally strong companies with attractive growth prospects and solid fundamentals. In terms of timing, the trend is still favorable for QQQ as of the time of this writing.

For the same reasons that QQQ has outperformed the market in the past decade, the probabilities are that it will outperform the broad market going forward too.

Disclosure: I am/we are long AAPL, GOOG, AMZN, FB.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more