QQQ Is Good For Entering This Kind Of Market

The Invesco QQQ exchange-traded fund appears to be an excellent way to enter into the coronavirus-roiled market with a solid, diversified foundation. As compared to other broad market-oriented indices and funds the QQQ ETF is geared towards large technology companies and communications services while avoiding heavy weightings to sectors such as financials and energy which may suffer particularly amid a coronavirus-spurred economic drought.

Furthermore, the QQQ ETF, as it aims to mimic the NASDAQ-100 index, consists of large-cap companies of the above-described sectors. Many small and medium cap companies may have a greater weighting in some other broad market funds but these are the smaller companies that may, as the coronavirus financial crunch hits, find themselves in the most serious liquidity crises.

As the QQQ ETF describes on its legal prospectus, the ETF holds all NASDAQ-100 stocks and attempts to market-capitalization balance them to represent the NASDAQ-100 index with quarterly rebalancing and annual reconstitution. The structure of the ETF itself is strong with only a 0.20% gross expense ratio consisting of a 0.09% NASDAQ-listing fee, 0.05% trustee fee, and 0.06% marketing fee. The fund is one of the oldest ETFs, having begun on March 10, 1999 in the tech bubble, and as of Wednesday's close had a sturdy $82.928 billion in assets under management.

The benefit of QQQ's tracking of the NASDAQ-100 index in this market environment, as compared to other broad index funds, is that it has sector diversification that is better prepared to cushion against the coronavirus impact and is moderately weighted towards large and medium-cap companies.

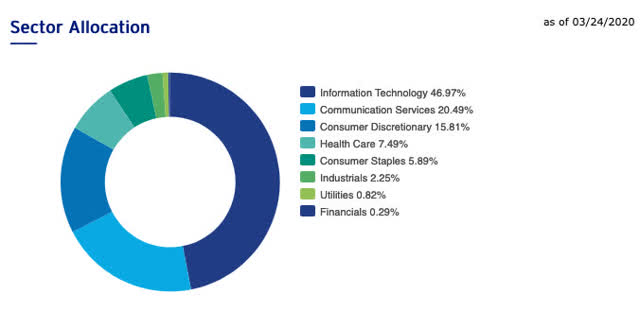

(Source: Invesco QQQ Fund Page)

The coronavirus pandemic is causing severe business disruption to many section of the economy with some of the hardest-hit industries being travel, leisure, retail, restaurants, and other companies that are fueled by people engaging in community and in-person joy. The NASDAQ-100 index, and thus QQQ, has almost half of its holdings in information technology companies that will be hit by a coronavirus, largely through decreases in online ad sales and the few components that have retail lines, but nonetheless will see less of a devastating decline in business and may even seem boosts in some online activity and purchases.

These companies will be better cushioned against coronavirus and therefore so will an index fund weighted towards them as QQQ is and that excludes sectors particularly at risk of complete devastation. The rest of the QQQ holdings are almost entirely in communications services, similarly a relative safe haven amid this month's sell-off due to high Internet usage from people working from or locked in-home, and consumer discretionary which at first seems worrying but then not so much so when you see it's mostly due to the 9.89% holding of Amazon being classified as such.

The other major benefit of QQQ in this market environment is that it is moderately weighted towards large-cap companies but not overly so. The NASDAQ-100 index is market-capitalization weighted which means the roughly 100 companies of the index are balanced towards behemoths like Apple, Microsoft, Amazon, Google, and so on but not completely and totally.

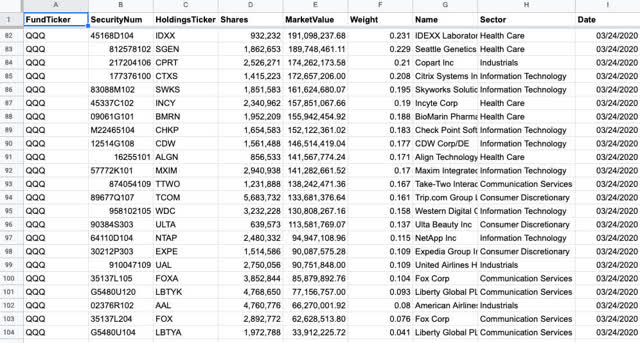

(Source: Invesco QQQ Fund Page "All Holdings" CSV)

As shown above, the top 10 companies in QQQ constitute 56.099% of the fund, a substantial amount. However the bottom 50 companies, constituting a variety of medium-cap and small-cap companies, beginning with MercadoLibre at a $24 billion market cap and going all the way down to Liberty Global at a $10.22 billion market cap, still constitute a moderate 10.726% percent of the index and give some exposure to moderately-sized companies but not overly so.

(Source: Invesco QQQ Fund Page "All Holdings" CSV)

This weighting towards large-caps with a dash, but not too much, of medium and small caps is good because it seems precisely the smaller companies that are facing the greatest liquidity concerns amid the coronavirus disruption and may have the toughest time getting access to debt and capital amid it. We see this in the significantly greater drops for the Russell 1000 and Russell 2000 as compared to the large-cap heavy indexes amid the sell-off of the past month.

Data by YCharts

As shown in the chart above as well the NASDAQ-100, and therefore QQQ, have already been much more cushioned to the sell-off than the broader markets. I believe this will continue to be the case and largely due to the exclusion of sectors from the QQQ ETF that are most at risk in this coronavirus crisis.

With markets already down in largely bear market territory, even with this week's grand rallies so far, it seems an appropriate time for some averaging-in for the risk-reward at this level of equities. As described above I believe the QQQ index fund ETF, due to its weighting towards technology and its large-cap orientation, is a particularly good index fund foundation to take on to weather these rocky market seas.

Disclaimer: These are only my opinions and do not constitute investment advice.