QQQ In A Correction: Buy The Dip

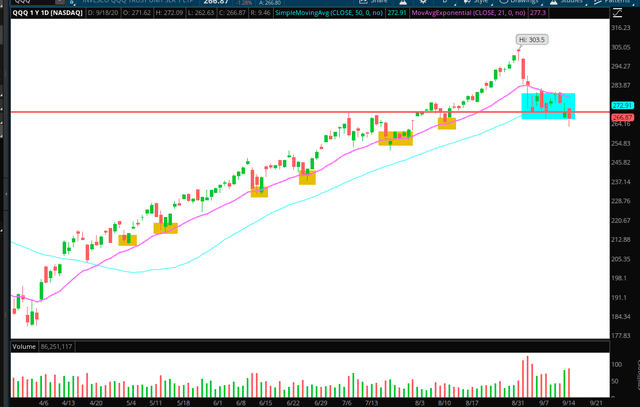

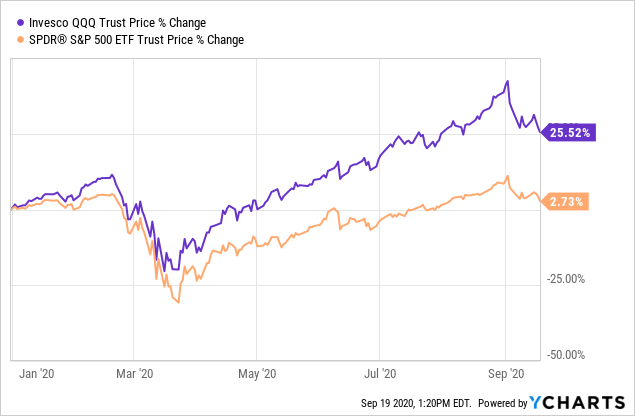

The Invesco QQQ ETF (QQQ) has crushed the market over the middle term, gaining over 25.52% on a year-to-date basis and widely outperforming the 2.73% produced by SPDR S&P 500 Trust ETF (SPY) in the same period.

(Click on image to enlarge)

Data by YCharts

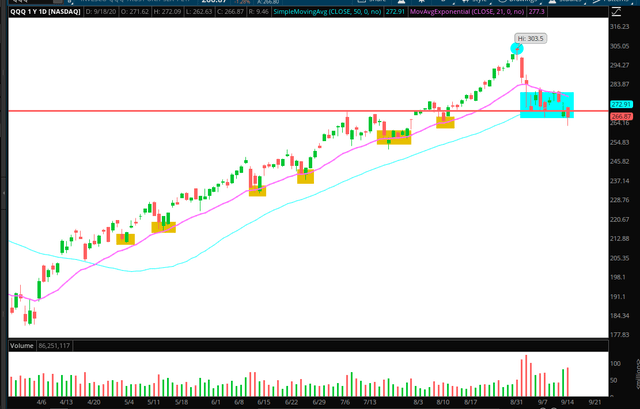

However, the growth-oriented QQQ has been under considerable pressure in recent days, declining by over 12% from its highs of September 2 and breaking below critical support levels in a short period of time.

As we can see in the chart below, the 21-day exponential moving average - in purple - has been acting as support through most of the recent rally since April, and this support is now broken.

Source: TOS

In this context, it makes sense for investors to wonder if this is just a short-term correction in QQQ or the beginning of a new bear market that is going to take the ETF down by 25%-30% or even more from its highs.

We can never know for sure, the future is always a matter of probabilities as opposed to certainties and there are no guarantees when investing. However, the evidence currently available is more indicative of a short-term correction than a full-blown bear market for QQQ. At these prices, remaining patient and even buying on weakness seems like a better idea than rushing to sell.

A Much Needed Reset

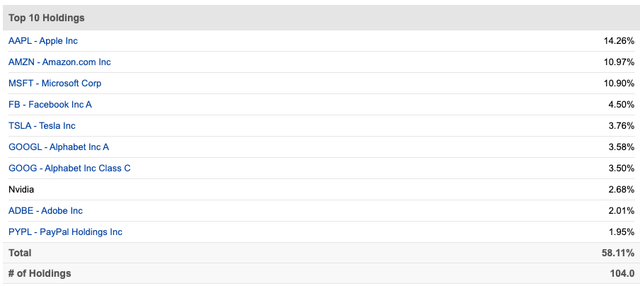

QQQ is oriented towards growth stocks, with a large participation of technology in the portfolio. If we take a look under the hood, it is easy to see the mega-cap names, such as Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Facebook (FB), and Alphabet (GOOG) (GOOGL), account for a large share of overall assets.

(Click on image to enlarge)

Source: Seeking Alpha

These tech titans have widely outperformed the market in the past decade, and even more during 2020, until the correction began in early September. This long-term outperformance was produced on the back of rock-solid financial performance from these companies, although valuations have also expanded over this period.

Big long-term rallies are generally driven by solid fundamental reasons, but investor behavior typically gets carried away from time to time, taking prices too high, too far. In August, in fact, the QQQ chart was getting rather parabolic, and speculation in the options market among both institutional investors and reckless retail traders accounted for a large share of this parabolic rise in price.

In the interest of full disclosure, I decided to raise some cash on September 2 because prices were getting extremely overextended by then. Even during a strong uptrend, prices tend to test the short-term moving averages from time to time. You never know when a correction is coming or how sharp it will be, but the probabilities for a sizeable correction are clearly bigger when prices get too carried away to the upside.

Markets work like a rubber band to some degree: When you get too overextended in one direction, this typically brings prices violently back in the opposite direction.

QQQ went too high and too rapidly in August, and then it came down sharply in September. There is nothing very extraordinary or surprising in this kind of behavior, although the speed of the correction has been notable.

(Click on image to enlarge)

Source: TOS

QQQ is nowhere near oversold levels at these prices, but the excess optimism that was reflected on the chart in August is now more in line with moderate sentiment levels. For this reason, I have been slowly re-allocating most of the cash that I raised a few weeks ago over recent days.

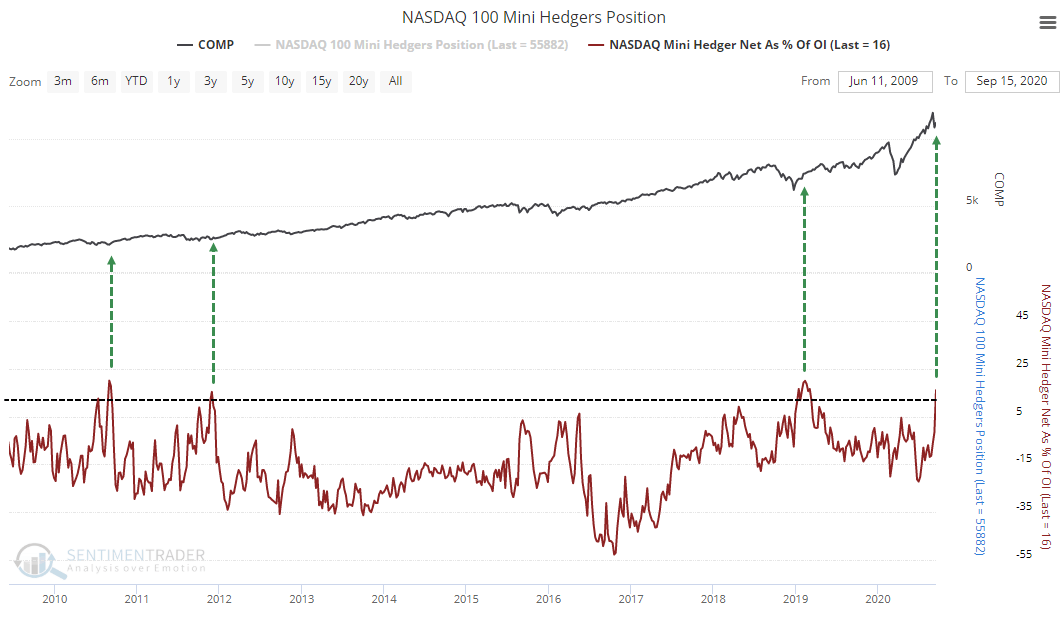

Interestingly, the chart from SentimenTrader is showing bullish exposure among smart money hedgers in the Nasdaq 100 ETF. Selling QQQ when the dumb money was aggressively driving prices higher with leveraged options trades turned out to be a good idea, so maybe now that the instrument is no longer overbought and the smart money is buying, it can make sense to consider some long exposure too.

Source: SentimentTrader

Quality, Performance, And Valuation

The bearish argument for QQQ in the long term is mostly based on the fact that valuations have gone too far and prices have nowhere to go but down from current levels. There could be some overvalued stocks in the portfolio, of course, but the whole QQQ portfolio itself doesn't seem overvalued when considering the quality of the companies it owns.

Looking at the portfolio as a whole, the forward PE ratio stands at 28.13, and it produces a remarkably attractive return on equity level of 32.25%. In times when interest rates all over the world are extremely low and a 10-year Treasury bond is paying less than 0.7%, you can buy a portfolio of highly profitable growth companies with a forward earnings yield of 3.6%.

Many of the companies in the portfolio are aggressively investing for further growth, so valuation is quite hard to assess in many cases. However, if we look at well-established names such as Apple, Microsoft, Alphabet, and Facebook, the numbers are not unreasonable at all.

These four companies are trading at forward PE ratios in the range of 25 to 27 and they have huge profitability on capital based on return on equity and return on investment. Their growth rates have been very attractive in recent years, and chances are that they will continue outperforming other big companies on other sectors in terms of growth potential in the years ahead.

| Company | Fwd PE | ROE | ROI |

| AAPL | 27.6 | 70.70% | 26.90% |

| MSFT | 27.3 | 39.50% | 23.10% |

| GOOGL | 25.6 | 15.60% | 14.10% |

| FB | 24.9 | 22.90% | 17.40% |

Data Source: FinViz

The QQQ portfolio includes some specific companies such as Tesla (TSLA), which carries valuation levels that are very hard to grasp. But you also have other names such as Intel (INTC), which is currently trading at an exceptionally low forward PE ratio of around 10.6.

The point is that you can always find particular extremes in valuations, but it is hard to say that the whole QQQ portfolio is overvalued when considering that many these companies have wide economic moats, above-average growth prospects, and healthy cash flow generation.

Yes, valuations have expanded in recent years, but we are also going through one of the sharpest recessions in history, with technology becoming crucially valuable across the board, technological adoption accelerating in many cases, and the big tech players delivering outstanding numbers while most other sectors of the economy are struggling to protect their revenues and earnings.

The pandemic has shown that technology is increasingly critical for society, I don't even want to imagine what this could have been without smartphones, cloud computing, e-commerce, and all kinds of online technologies like social media and streaming.

Besides, the global recession has also pushed the Federal Reserve to implement unprecedented stimulus measures. Monetary authorities have recently said that they will still keep rates low even if inflation temporarily increases, which is a whole new paradigm in terms of flexibility.

Investors can currently buy bonds with 0.7% yield and substantial downside risk if rates start moving higher in the future, or they can buy shares of rock-solid companies with pristine balance sheets, strong competitive strengths, and healthy long-term growth prospects with an earnings yield of 3.5%-4%.

Sure, investors can also buy cheaper stocks in other sectors, and money has been in fact rotating towards more cyclical sectors in the stock market lately. But it is hard to argue against the fact that many of the best high-quality companies in the world are currently part of the QQQ portfolio. You can find cheaper stocks in other sectors, but the best quality is in technology.

I am not saying that QQQ is necessarily cheap, but it is not overvalued either from a price and quality perspective, at least not in comparison to other alternatives in the equities and fixed income markets.

Prices could remain volatile and jittery in the short term, especially with all the political and economic uncertainty on the horizon. However, the probabilities are that QQQ is going through a short-term correction as opposed to a new bear market, and buying on dips looks like a smarter idea than running for the exits at these levels.

Disclosure: I am/we are long AAPL, GOOG, AMZN, FB, PYPL. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own ...

more