Private Infrastructure As An Asset Class

Private infrastructure refers to physical assets that provide and/or support essential services such as energy grids and data centers. Typically operating under long-term contracted or regulated business models, infrastructure assets can offer stable cash flows with relatively low sensitivity to the economic cycle, due to factors such as steady demand growth and potentially predictable cash flows, as well as providing diversification benefits. This paper provides an introductory overview of infrastructure investing, exploring its characteristics, benefits, challenges, and potential role in a diversified portfolio.

What is Infrastructure?

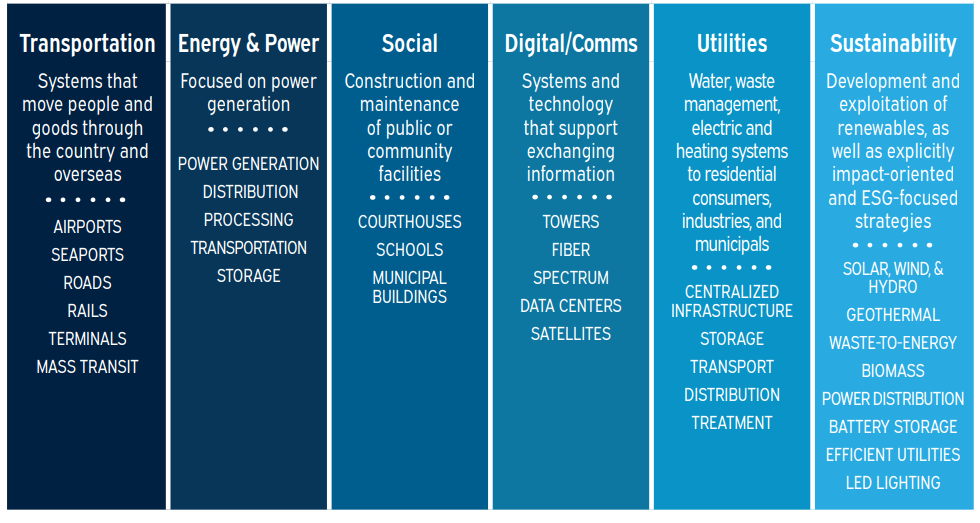

Infrastructure encompasses the fundamental physical systems that support modern society and economy. These table below shows the various broad categories that make up the infrastructure investment universe.

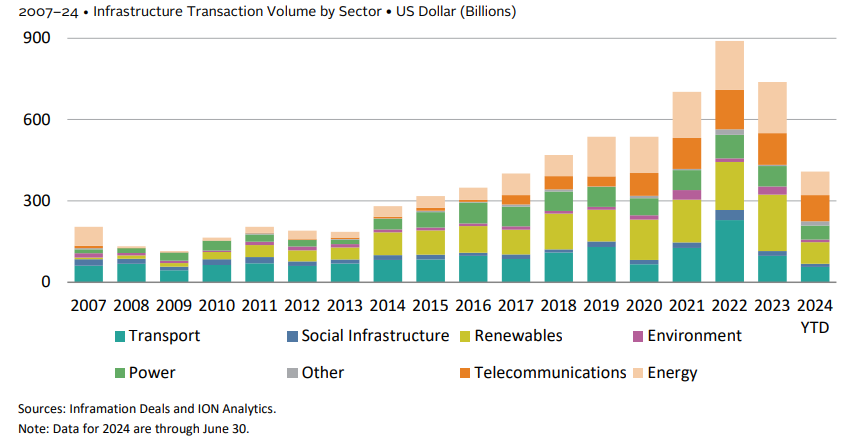

The table below shows how the opportunity set has been expanding.

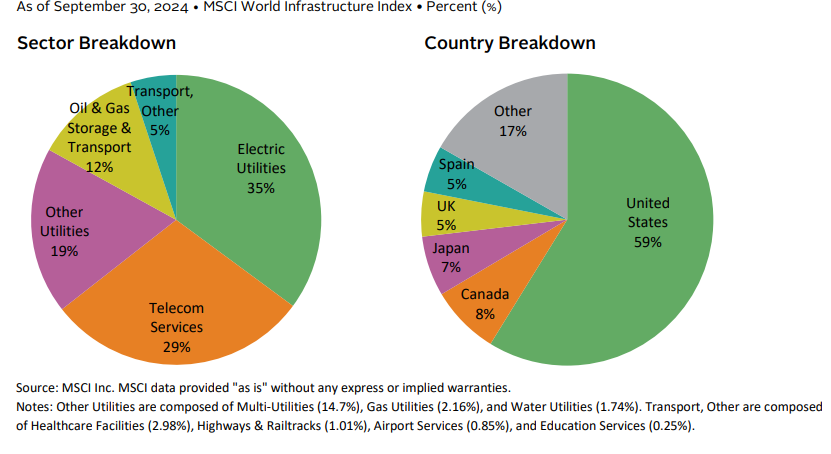

The table below shows the sector and country breakdown of infrastructure investment as of September 2024.

Common Characteristics

- Essential services have inelastic demand and thus are resilient to the economic cycle.

- Long-term cash flow predictability.

- Contracted, regulated revenue.

- Long useful life assets with relatively inelastic demand.

- Potential for inflation protection.

- Limited competitive pressure due to high barriers to entry (asset heavy industries).

Why Invest in Infrastructure?

Infrastructure investments are made to physical assets that provide and/or support essential services critical to the economy that offer several attractive characteristics:

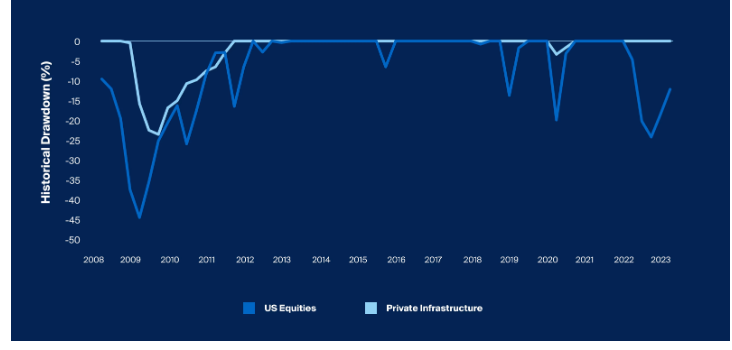

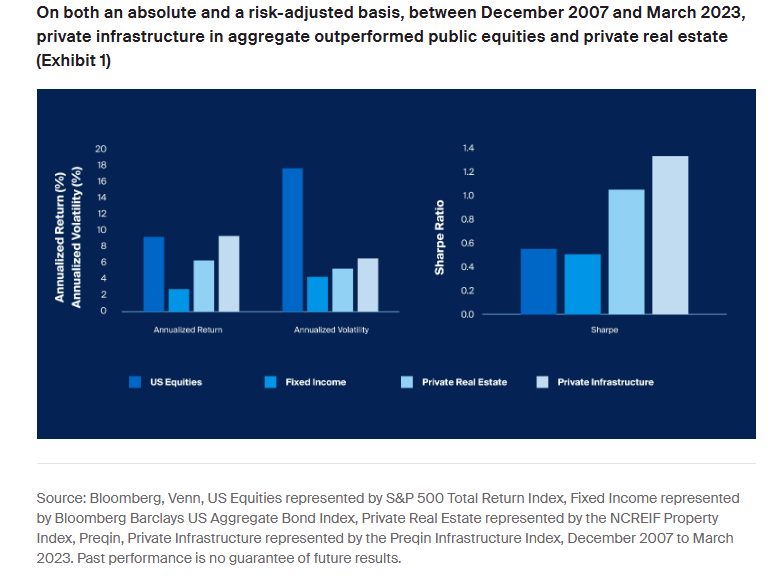

- Essential services provide downside risk protection: Infrastructure assets typically provide essential services with consistent demand, often regulated or underpinned by long-term contracts, with limited competitive pressure due to monopoly positions and/or significant barriers to entry (given the time-to-build, life cycle, and heavy capital requirements), leading to stable and predictable cash flows that results in lower volatility (see chart below).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

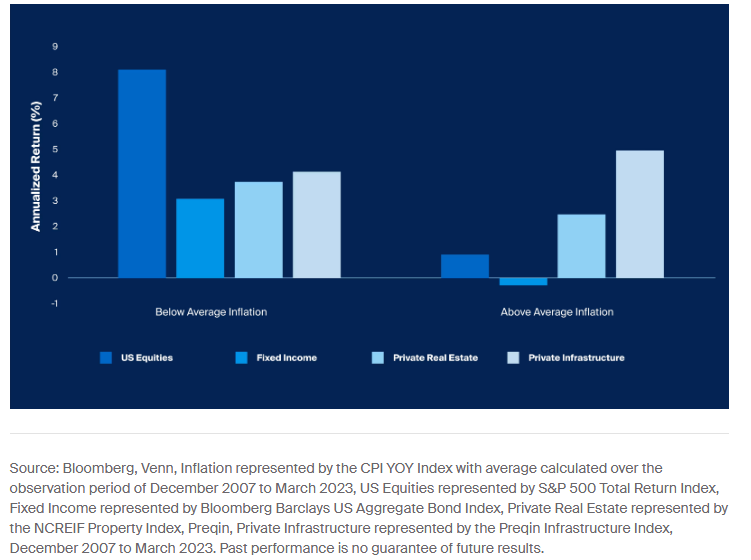

- Inflation Hedge: Many infrastructure assets have revenues linked to inflation, providing a natural hedge against rising prices. This is particularly true for regulated utilities and toll roads. A Prequin study found that infrastructure tended to outperform in periods of higher inflation.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- Diversification: Given their ability to post steady returns across various economic environments, infrastructure assets can stabilize overall portfolio performance. Demand for services like toll roads and power tends to be recession resistant and providers (often protected by long-term contracts) can pass inflationary pressures to end-users, supporting returns on capital.

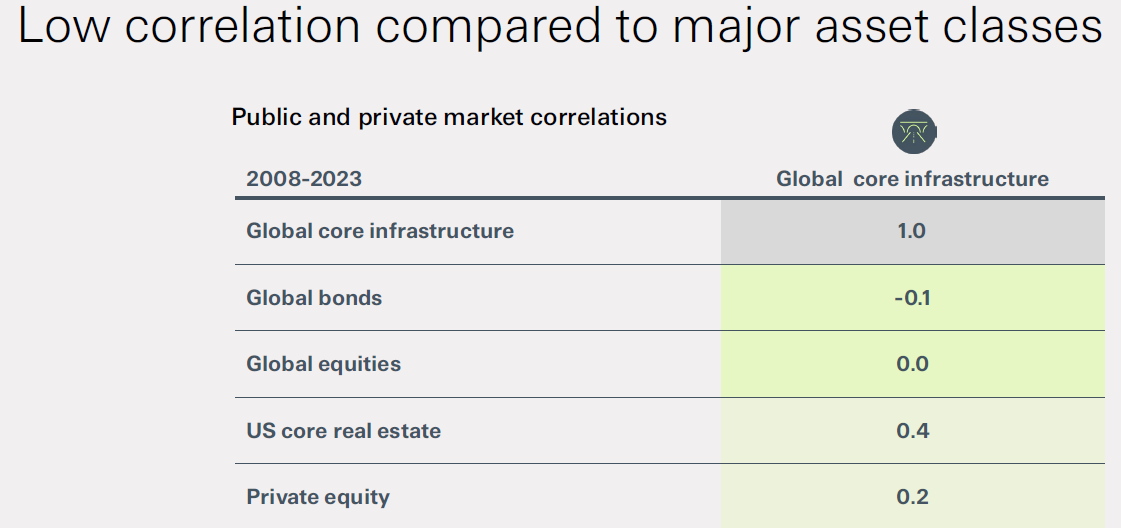

- Infrastructure assets exhibit low correlation with traditional asset classes like stocks and bonds, offering valuable diversification benefits to a portfolio.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Long-Term Investment: Infrastructure projects typically have long lifespans, aligning with the long-term horizons of many institutional investors like pension funds and sovereign wealth funds.

- Potential for Real Returns: Well-managed infrastructure assets can generate attractive risk-adjusted returns, including income from operations and potential capital appreciation.

- ESG Considerations: Increasingly, investors are focusing on the Environmental, Social, and Governance (ESG) aspects of infrastructure investments. This includes investments in renewable energy, sustainable transportation, and projects that benefit local communities.

- Government Support: Governments worldwide are recognizing the need for infrastructure investment and are often providing support through public-private partnerships (PPPs), tax incentives, and streamlined regulatory processes.

- Tax efficiency due to ability to pass through depreciation of underlying assets, which may result in tax-advantaged income.

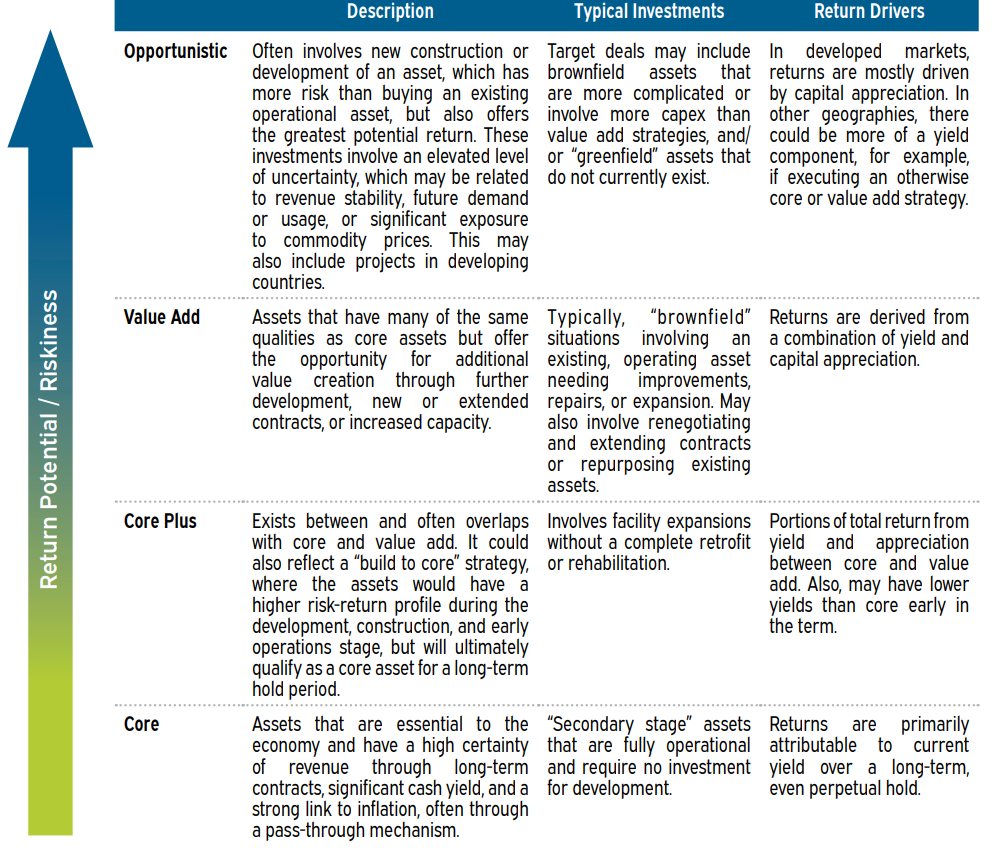

Investment Strategies

Infrastructure strategies can be differentiated by their risk and return profiles. Both equity and debt strategies are available in infrastructure. Equity strategies may be broadly characterized as core, core plus, value add, and opportunistic, on a continuum from lower risk and return to higher risk and return. The strategies are not mutually exclusive and the risk/return profile of any individual asset may purposefully change over an owner’s hold period, as managers may enter an investment at a relatively higher risk-return profile, work to de-risk or otherwise improve the asset, and exit by selling it to investors with a relatively lower risk/return target.

Historical Returns

CAIS, a financial technology platform, focused on alternative investments used the Preqin Infrastructure Index, which shows the quarterly change in the returns on invested capital for all private market infrastructure funds that Preqin tracks and compared its return to that of the S&P 500 Index. Their analysis focused only on quarterly returns, helping to “normalizing” the data and potentially alleviating the issue of “artificially” lower volatility of a less frequently updated index. Their data sample covered the period December 2007-March 2023. CAIS found that the Preqin Infrastructure Index delivered a 9.3% annualized return, narrowly outperforming the S&P 500 Index which returned 9.1% per annum, and it did so while experiencing only about one-third of the volatility (5.3% versus 17.6%). The result was a much higher risk-adjusted return as reflected in the Sharpe ratio (see chart below).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Challenges and Risks:

While infrastructure investing offers numerous benefits, it also presents certain challenges and risks:

- High Capital Costs: Infrastructure projects often require significant upfront investment.

- Regulatory and Political Risks: Changes in regulations, permitting processes, or government policies can impact project timelines and profitability.

- Construction and Operational Risks: Construction delays, cost overruns, and operational challenges can affect project returns.

- Interest Rate Risk: Changes in interest rates can impact the financing costs of infrastructure projects.

- Liquidity Risk: Direct investments in infrastructure can be illiquid, making it difficult to sell assets quickly.

- Valuation Complexity: Valuing infrastructure assets can be complex, requiring specialized expertise.

Evergreen Funds Offer Advantages Over Traditional Drawdown Funds

Evergreen funds allow investors to achieve their private equity allocations faster and manage capital more efficiently than traditional drawdown funds which typically take many years to fully invest. With traditional drawdown funds fees are charged on the committed capital, regardless of whether capital has been called. This results in the J-curve effect, depressing returns in the early years. In addition, until all the capital has been called investors need to keep liquid assets to meet the unscheduled capital calls. On the other hand, evergreen funds allow investors to immediately deploy their capital into a diversified private equity portfolio, achieving their desired asset allocation in a faster and more efficient manner.

An evergreen private fund typically invests about 85%-90% in existing private equity portfolios with the remainder in a “liquidity sleeve” (typically treasury bills or other liquid assets). Thus, the capital allocated to private equity can generate returns from day one, while the vehicle also has the capacity to manage upcoming acquisitions and liquidity requests. Further, when a portfolio company is sold to a strategic or financial buyer, or taken public, with the shares sold down over time, the resulting capital is automatically recycled into new deals, limiting reinvestment risk that can leave investors out of the market for a period after a realization in a traditional drawdown fund.

Evergreen Infrastructure Funds

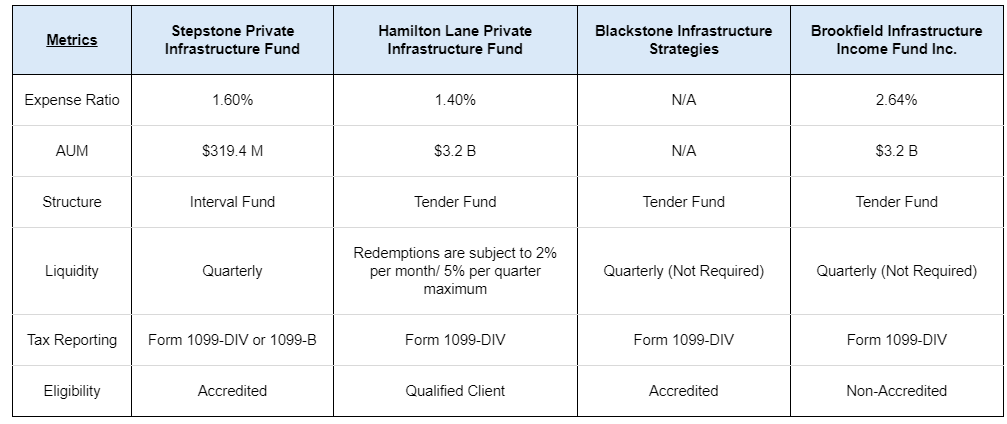

The following table provides the basic facts on four evergreen infrastructure funds: Stepstone’s Private Infrastructure Fund (STRUX), Hamilton Lane Private Infrastructure Fund (HLPIF), Blackstone’s Infrastructures Strategies (BXINFRA) and Brookfield Infrastructure Income Fund Inc. (BRININD)

When reviewing a fund’s expenses, it is important to note that a fund can have expenses beyond the management fee (such as a carry as a percentage of the returns) and other fees. In addition, a fund may offer an expense fee waiver for a period (which it has the right to not renew). Therefore, careful due diligence is required. Finally, it is important to note the major differences between interval funds and tender offer funds. The three main ones are:

- Interval funds are public funds traded on stock exchanges (operating under Rule 23c-3 of the Investment Company Act of 1940), while tender offer funds are private vehicles (operating under Rule 13e-4 of the Exchange Act).

- Interval funds have daily pricing while tender offer funds typically price monthly.

- Interval funds have minimum redemption requirements while tender offer funds have the right to suspend redemptions.

Investor Takeaways

Infrastructure possesses unique characteristics that justify considering it as a separate asset class in a portfolio, offering investors the potential for stable returns, inflation hedging, diversification, and positive societal impact. However, it is essential to understand the specific characteristics, risks, complexities associated with infrastructure investments, as well as the total expenses of a fund. A thorough due diligence process, along with a well-defined investment strategy, is crucial for successful infrastructure investing.

One other takeaway relates to the diversification benefits of infrastructure. While infrastructure has had almost no correlation to equities and fixed income investments, its relatively higher correlation to real estate (0.4 to US Core Real Estate, see table above) should be accounted for when designing a portfolio. Investors who already have allocations to real estate should take that allocation into account when deciding on how much to allocate to infrastructure.

More By This Author:

What the Index Effect’s Disappearance means for Market Efficiency

Exploring Bond Tax Efficiency: Futures or Bond ETFs?

The Negative Impact Of Crowding On Active Fund Performance