Physical Versus Cash Settlement For Options

Most options, such as stock options and options on ETFs, are physically-settled at expiration. However, there are some options, such as index options, that are cash-settled instead. Let’s look at some examples to learn the difference between the two.

Physical Settlement Of Stock Options

Physical settlement means that you physically take ownership of the actual shares of stock if your option is in-the-money at expiration. Owning actual shares of a company means partial ownership (at least financially) of that company.

For example, options on stocks (such as IBM) are physically-settled. Suppose an investor buys one call option of IBM with a strike price of $120. And that contract expires 45 days in the future.

Buying one such option gives the investor the right to purchase 100 shares of IBM for $120 per share at any time prior to and at expiration. Should the investor decide to use this right, the investor may call the broker requesting to “exercise” the option, at which time the broker will give the investor 100 physical shares of IBM stock.

In the old days, the investor would have received stock certificates in the mail. But nowadays, it just shows up as owning 100 shares of IBM in your electronic brokerage software.

Simultaneously, the investor pays $12,000 for the purchase. It usually only makes financial sense to exercise if the price of IBM is above $120. Most investors will not exercise early unless the stock has dividends and taking physical ownership of the stock at a certain time gives the investor the right to the dividends.

If the price of IBM is above $120 at expiration, the option is said to be “in-the-money," in which case most brokers will automatically exercise the option for the investor, even if the investor did not explicitly tell the broker to do so. Since each brokerage firm is different, call your broker to find out if this is the case.

This is what is meant by physically-settled. The investor gets the physical stock at expiration if the option is in-the-money. If the price of IBM is below $120 at expiration, nothing happens. The option expires worthless and the investor does not get any stock.

Physical Settlement On ETF Options

Options on exchange-traded funds (ETFs) are also physically-settled. Suppose an investor sells 10 put options with a strike price of $175 on GLD. Selling 10 put options to another party means that the investor is obligated to purchase 1000 shares of GLD at a price of $175 per share in the event that the other party decides to exercise — which could be at any time prior to the expiration of the option.

If this happens, the investor is “assigned” the physical shares of the underlying. In this case, the investor would end up owning 1000 shares of GLD. And $175,000 is deducted from the account.

More Examples Of Physical Settlement Of Options

If an investor sells one call option of the physically-settled MSFT at a strike price of $210, the investor would end up selling 100 physical shares of MSFT. It is loosely said that the stock was “called away” from the investor.

What if the investor does not have 100 shares of MSFT in the brokerage account to sell? Then the investor’s account will show a “-100” shares of MSFT, which means that they owe the broker 100 shares of MSFT. The investor would then have to buy the shares at market price so that they can deliver those shares to the brokerage.

In this situation, the investor is at a financial loss. Now, suppose that an investor buys one put option on with a strike price of $350. If SPY is below $350 at expiration, the option will auto-exercise and the brokerage firm will sell 100 shares of SPY at $350/share. If the investor did not have 100 shares of SPY to sell, the account will show a negative “-100” shares. The investor would receive $35,000 from this sale.

The investor had the right to “put” SPY to the market at the strike price. And SPY was “put” to the market automatically at expiration when it was financially advantageous for that to happen.

This is a financial gain for the investor, as long as the investor quickly purchases the 100 shares at market price to give to the brokerage before the price of SPY changes in such a way to become a financial loss.

Cash Settlement Of Options

So far, we have seen that options on equities and ETFs are physically-settled. In what cases are options cash-settled? Options are cash-settled for options on indices.

For example, an investor can buy or sell options on SPX. Or on the VIX, RUT, and NDX. The reason why index option are cash-settled is because it is inconvenient or not possible to physically deliver the underlying asset. For example, an investor cannot own shares of the VIX. Therefore, he or she cannot be granted shares of the VIX at expiration.

Likewise, an investor cannot own the SPX index. Instead, the cash equivalent is transacted in the investor’s account. The ticker symbol SPX is for the Standard and Poor’s 500 index, which is a composite of 500 different companies. An investor cannot own physical shares of the SPX index. However, an investor can own physical shares of the exchange-traded fund SPY, which tracks the S&P 500 index.

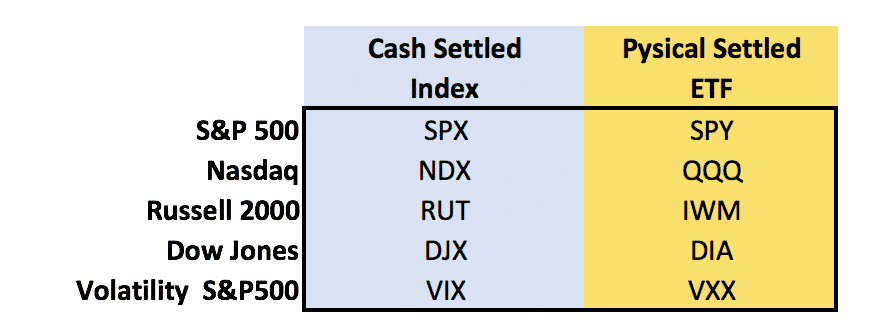

SPX is cash-settled. SPY is physically-settled. Similarly for the other major indices:

The above is only a partial list. Just to name a few more cash-settled options: OEX, XEO, RUI, RLG, RLV, UKXM, XSP, and others.

While most cash-settled options are also “European-style," meaning there is no early exercise or assignment; that is not always the case. Some cash-settled options are “American-style exercise," meaning that they can be exercised prior to expiration.

Both XEO and OEX are cash-settled. XEO is an S&P 100 index options with European-style exercise. OEX is an S&P 100 index options with American-style exercise. There are other advanced derivatives such as digital options, binary options, and cash-or-nothing options that are cash-settled.

Is Cash-Settled Or Physically-Settled Better?

It depends on what the investor’s intention is. If the investor’s intention is to obtain physical stock at a discount, then the investor may sell out-of-the-money put options on stocks that are physically-settled. This method of selling cash-secured puts is one that the famous investor Warren Buffet often employs.

If the investor’s intention is to obtain physical stock in order to collect dividends, the investor may buy call options on stocks that are physically-settled and have American-style exercise. If financially advantageous to the investor, they may exercise the call option early prior to the ex-dividend date such that they have the right to collect on the upcoming dividend payout.

If the investor’s intention is to not obtain any stock, but to generate income via non-directional option spread strategies such as iron condors and butterflies, the investor may choose to apply those strategies on cash-settled index options provided that the particular index has enough liquidity. There is assignment of stock for a cash-settled index.

The cash-settled SPX has a price of $3550 at the time of this writing. The physically-settled SPY has a price of $355, one-tenth of the size. A large investor who wants to reduce commission costs by trading fewer contracts may opt to use the SPX. A smaller investor that views this size as too intimidating may opt to use SPY instead.

So there you have it. Almost everything you need to know about physical versus cash settlement of options.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more