Odds In Favor Of Bulls

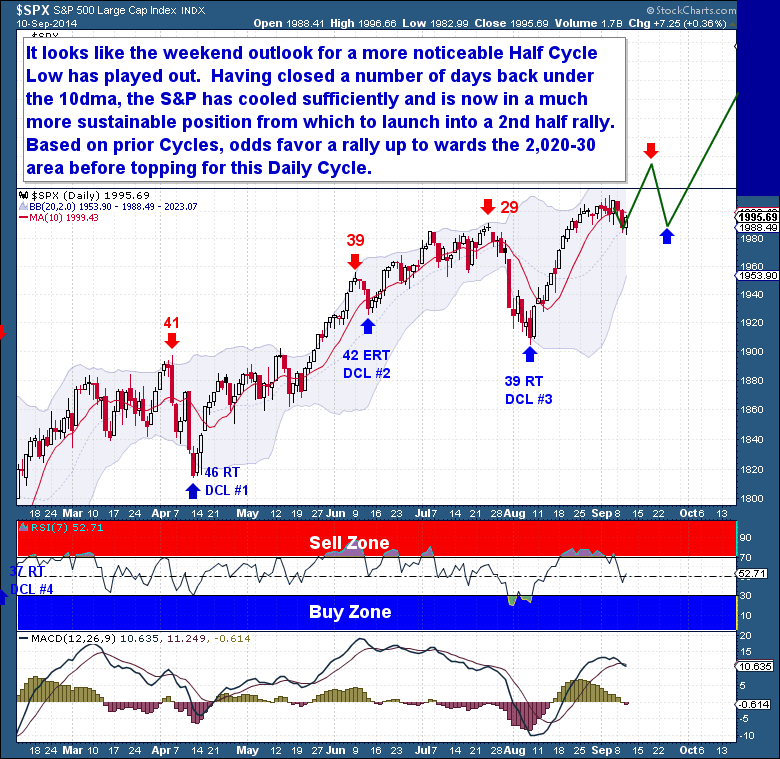

This looks to me like a very controlled and deliberate move in the equity markets. We had a 100 point move in the first 15 days of this Daily and Investor Cycle, so obviously it has taken some time to consolidate those gains. Coming into this past weekend, I was not satisfied in taking a long position on the daily chart because I was concerned that a real Half Cycle Low was not evident.

But it now looks like the weekend outlook for a further drop and Half Cycle Low has played out. On a shorter timeframe, sentiment has cooled slightly, while technically the S&P is now back to a position that has in the past spawned many a Cycle rally. With such a dominant long term trend behind this market, and being the 1st Daily Cycle, this 35 point retracement in the timing band for a HCL is certainly a great candidate for yet another “buy the dip” trade.

This is a special report from this week's premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Promo code ZEN saves you 10%.