My Only Prediction For 2020: Gurus Will Fail Again

With the new year 2020 just getting started, the financial media tends to provide massive amounts of coverage regarding market predictions from so-called "market gurus". These forecasts attract a lot of attention from investors, after all, we humans have a natural tendency to try to forecast what the future will bring.

Unfortunately, the statistical evidence is quite clear and conclusive, those forecasts from market gurus have no predictive value in the aggregate. Especially when it comes to grandiloquent gurus making all kinds of extreme forecasts about the distant future, the best thing an investor can do is completely ignoring these predictions.

Don't get me wrong. The best strategists use evidence-based models and hard data, as opposed to opinions, to assess the risk and reward trade-off in the market at a particular point in time. These approaches can be enormously valuable when it comes to analyzing market conditions and making investment decisions accordingly. However, for the most part, market forecasters and stock market gurus provide no value whatsoever.

The issue of forecast accuracy is particularly important in times of market distress. A 15% rally is different from a 10% rally in stocks, but the most important thing for investors is trying to avoid big drawdowns.

The mathematics of the stock market returns can be unforgiving when there are big losses, so avoiding devastating bear markets should be priority number one.

As a quick reminder:

- If you lose 30% of your capital, you need a 43% gain to recover that money.

- If you lose 50%, you need to gain 100% to recover the capital.

- If you lose 80%, then you need to gain 400%

During the terrifying financial crisis in 2008, the S&P 500 ended the year with a decline of 38.5%, and it was down by 53.6% at some point in the year. Notably, the median Wall Street forecast was expecting a positive 11.1% return for 2008, so the consensus was wrong by a staggering 49.6%.

Not only are market forecasts consistently wrong, but these forecasts also tend to be mistaken by a particularly large margin when they are most needed: In times of deep and ugly market declines.

The Benefits Of Diversification

Making market predictions based on subjective opinions and speculation about the future has proven to be an expensive mistake time and again. As opposed to following those kinds of predictions, investors should rather focus on strategies with a time-tested ability to optimize the risk and reward trade-off in a portfolio over the long term.

Diversification can be crucial in that respect, and nowadays investors can easily access widely diversified portfolios of index funds for conveniently low costs.

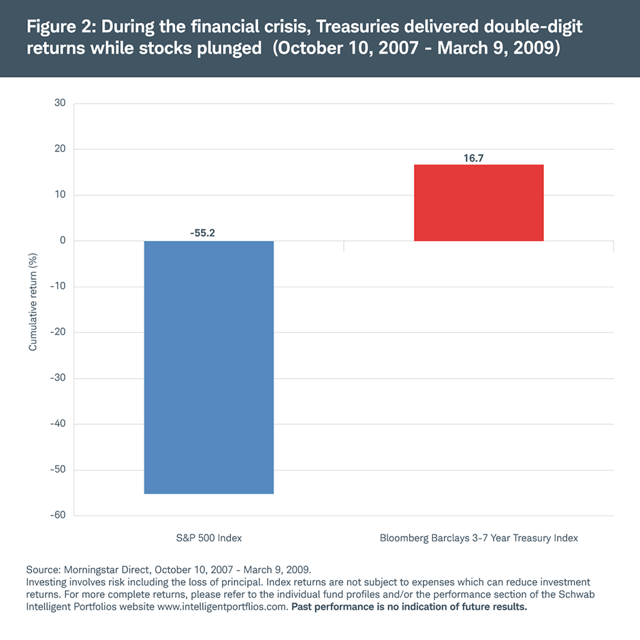

The chart below shows the performance of stocks versus Treasuries during the worst period of the financial crisis, from October 10 of 2007 to March 9 of 2009. While stocks collapsed by over 55%, Treasury bonds surged by almost 17% over this period. This means that adding Treasuries to a portfolio of stocks would have made a big difference in terms of controlling for downside risk.

Source: Schwab

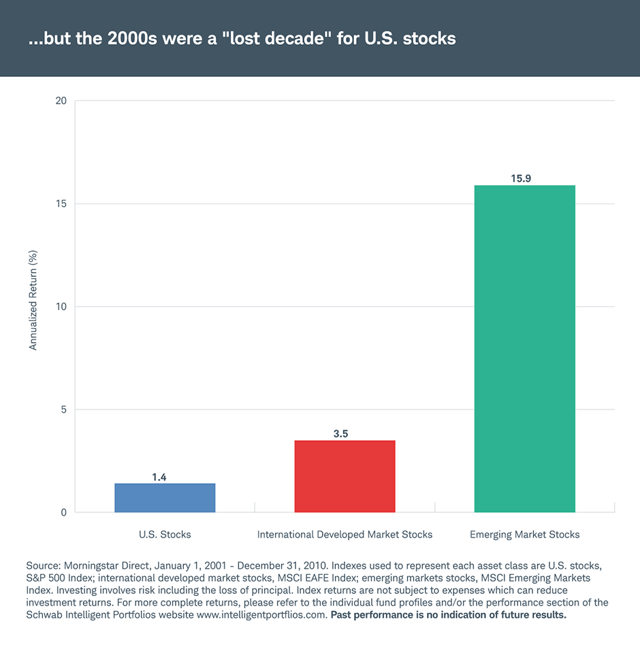

Even when it comes to stocks as an asset class, investors need to keep diversification in mind. U.S. stocks have produced big returns while also outperforming international stocks by a wide margin in the past decade. However, this is not always the case throughout history.

U.S. stocks produced anemic returns and lots of volatility during the 2000s while emerging markets stocks gained an impressive 15.9% per year over this period. In this context, adding international stocks to a portfolio of U.S. would have made all the difference in the world.

Source: Schwab

Trend Following To Reduce Downside Risk

Another possibility is implementing trend following strategies to control downside risk and optimize risk-adjusted returns. There is plenty of data proving that trend-following strategies can be effective in terms of reducing the risk of big drawdowns over the long term.

From a research paper by AQR entitled A Century of Evidence on Trend-Following Investing:

We study the performance of trend-following investing across global markets since 1880, extending the existing evidence by more than 100 years. We find that trend following has delivered strong positive returns and realized a low correlation to traditional asset classes for more than a century. We analyze trend-following returns through various economic environments and highlight the diversification benefits the strategy has historically provided in equity bear markets.

The Asset Class Rotation Strategy is a quantitative strategy that rotates between 9 ETFs that represent some major asset classes.

- SPDR S&P 500 (SPY) for big stocks in the U.S.

- iShares Russell 2000 ETF (IWM) for small U.S. stocks

- iShares MSCI EAFE (EFA) for international stocks in developed markets

- iShares MSCI Emerging Markets (EEM) for international stocks in emerging markets

- Invesco DB Commodity (DBC) for a basket of commodities

- SPDR Gold Trust (GLD) for gold

- Vanguard Real Estate (VNQ) for REITs

- iShares 20+ Year Treasury Bond ETF (TLT) for long-term Treasury bonds

- iShares 1-3 Year Treasury Bond ETF (SHY) for short-term Treasury bonds

In order to be included in the portfolio, an ETF has to be in an uptrend, meaning that the current market price is above the 10-month moving average. Among the ETFs that are in an uptrend, the strategy buys the top 3 with the highest relative strength as measured by a ranking system that measures risk-adjusted returns over 3 and 6 months. The ETF portfolio is rebalanced every month and the benchmark is a globally diversified portfolio that is allocated 60% to stocks and 40% to fixed income.

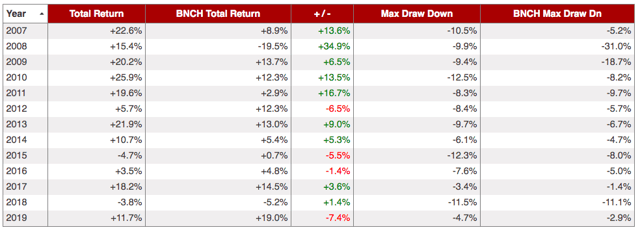

Since January of 2007, the Asset Class Rotation strategy has produced a cumulative return of 356.9% versus 110.3% for the benchmark in the same period. In annual terms, the strategy gained 12.4% per year, more than double the 5.9% produced by the benchmark.

The maximum drawdown, meaning maximum capital loss from the peak, is less than half, at -14.4% for the Asset Class Rotation strategy versus -35.4% for the benchmark.

Source: ETFreplay

Source: ETFreplay

We can gain a deeper understanding of how the strategy works by looking at the annual return numbers for different periods.

Source: ETFreplay

Its worst year was 2015, and the annual loss in that year was a very manageable -4.7%. The strategy tends to produce positive returns most of the time, and losses are relatively small when they happen. This is arguably the main advantage in these kinds of strategies since capital protection is of utmost importance. In 2008, when the benchmark declined -19.5%, the strategy gained 15.4% by investing in safe-haven assets such as Treasuries and gold.

On the other hand, in years such as 2015 and 2018, when the main trends in different asset classes were weak and short-lived, the strategy produced mediocre returns in comparison to the benchmark.

The strategy buys strong assets and sells weak assets. When price trends are strong and well-defined, the strategy captures these trends and it makes solid returns. On the other hand, when market trends are weak and short-lived, the strategy will tend to get hurt by false signals. This is an unavoidable drawback, no strategy can outperform all the time and in all kinds of market environments.

A trend-following strategy such as Asset Class Rotation is based on price trends and relative strength, so it can be expected to outperform during big bear and bull markets such as 2008 and 2017. On the other hand, it will probably generate disappointing returns in sideways years such as 2015 and 2018.

But the main point to consider is that this is not an all-or-nothing decision between trend-following and buy and hold. Such as we diversify among different stocks, we can also diversify among strategies, and incorporating trend-following into a buy and hold portfolio can make a lot of sense in order to reduce downside risk.

Besides, a strategy such as this one is not only useful as a trading vehicle, but also as a source of information to evaluate the market environment. Information is power, and analyzing market conditions based on hard data and time-proven factors is a much sounder approach than listening to the so-called market gurus and their consistently inaccurate forecasts.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more