MSCI Emerging Markets Index: Getting Exposure To Emerging Markets

The world is battling the COVID-19 pandemic. The coronavirus has affected economic activities across the globe. But emerging market economies are expected to grow faster than developed nations in the foreseeable future. They give investors a lucrative opportunity to benefit from their growth stories. If you want to invest a portion of your portfolio in emerging markets, one of the simplest ways is to invest in funds tracking the MSCI Emerging Markets Index. Let’s find out what this index is all about and which funds/ETFs track its performance.

What is it?

The Morgan Stanley Capital International (MSCI) Emerging Markets Index was introduced in 1988. Initially, it captured large-cap and mid-cap stocks in only ten emerging economies, representing only 1% of the global market capitalization.

However, the index has added several countries over the years. It now captures large-cap and mid-cap stocks across 26 emerging market countries, representing 13% of global equity market capitalization. As of April 2020, the index covered about 85% of free float-adjusted market capitalization in each of the 26 countries. It includes 1,404 stocks.

The MSCI Emerging Markets Index is a free float-adjusted market cap index. It is widely used to measure the stock market performance in emerging economies. It includes highly liquid and easily traded stocks. A number of mutual funds, index funds, and ETFs use it as a benchmark.

The MSCI reviews the index four times a year - February, May, August, and November. However, the index is rebalanced only twice a year in May and November.

MSCI Emerging Markets Index constituents

Here's the list of 26 developing countries the index represents:

- Argentina

- Brazil

- Chile

- China

- Colombia

- Czech Republic

- Egypt

- Greece

- Hungary

- India

- Indonesia

- South Korea

- Malaysia

- Mexico

- Pakistan

- Peru

- Philippines

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Taiwan

- Thailand

- Turkey

- United Arab Emirates

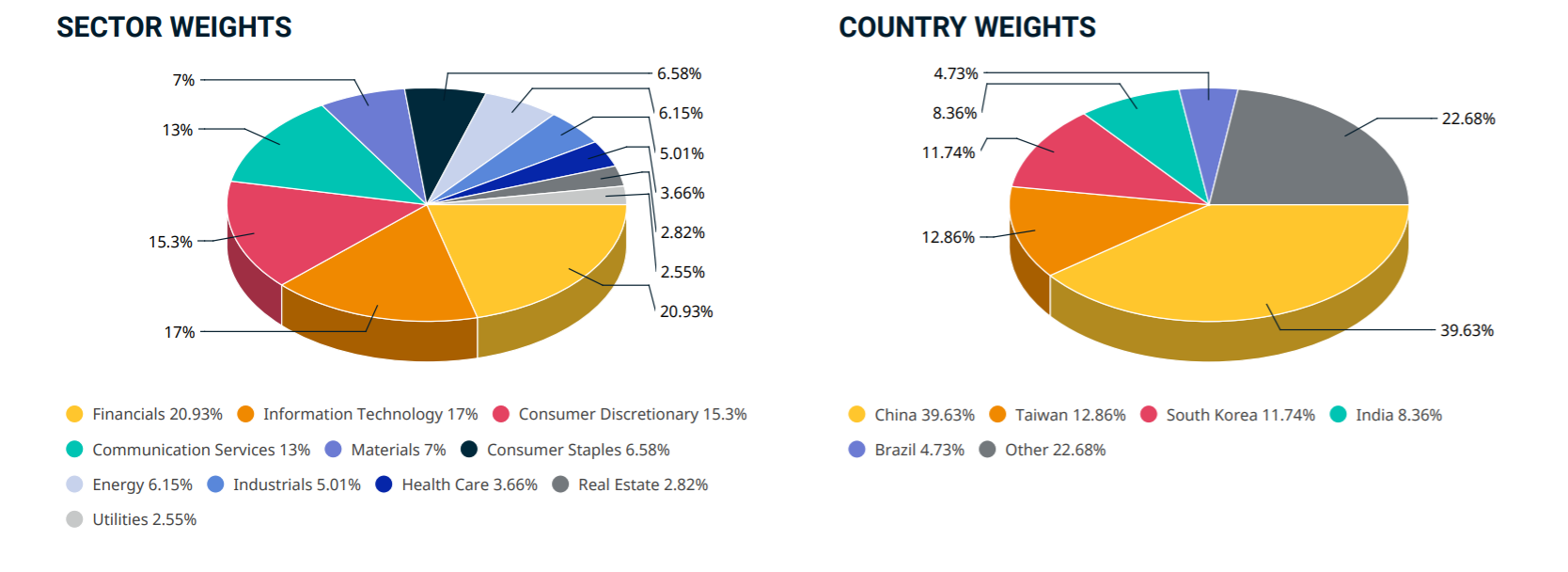

Since it's a free float-adjusted market cap index, the countries don't have equal weight in the index. China constitutes nearly 40% of the index, followed by Taiwan (13%) and South Korea (12%).

(Click on image to enlarge)

Image source: MSCI Fact Sheet

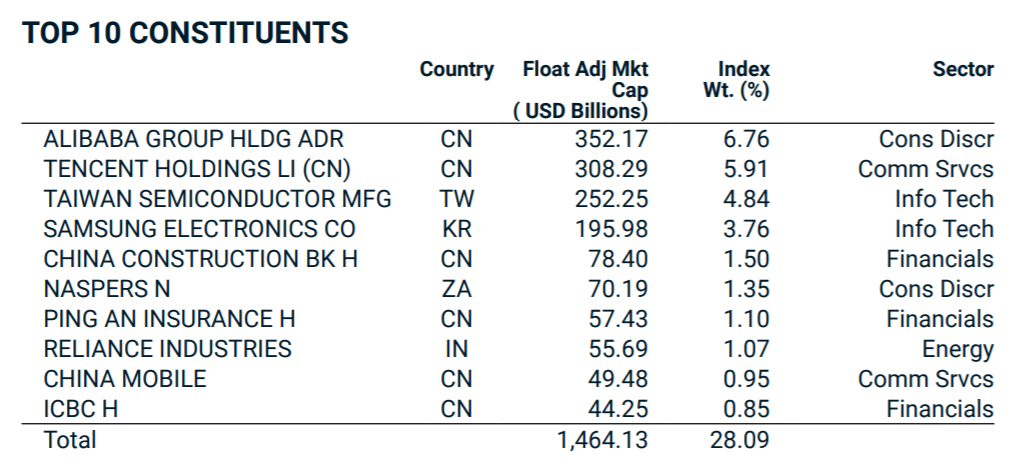

If you look at individual companies, Chinese Internet giants Alibaba and Tencent dominate the index. They are followed by Taiwan Semiconductor Manufacturing, Samsung Electronics, and China Construction Bank. Six out of top ten largest constituents are Chinese. The other four are from Taiwan, India, South Africa, and South Korea.

(Click on image to enlarge)

Image source: MSCI Fact Sheet

How to invest

Remember that equity markets in emerging economies tend to be more volatile than their counterparts in developed nations. So, emerging market equities are only suitable for investors who can stomach extreme volatility. For those interesting in gaining exposure to the MSCI Emerging Markets Index, the simplest way is to buy the iShares MSCI Emerging Markets ETF (EEM).

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 ...

more

Is that good for EEM or for MSCI?