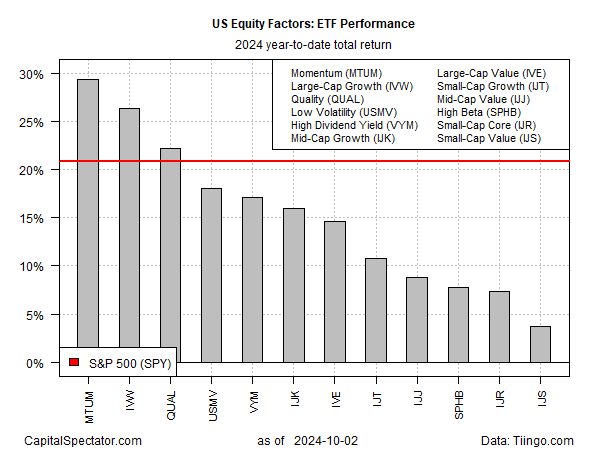

Momentum, Large-Cap Growth Factors Still Leading This Year

Betting against momentum and large-cap growth continues to be a losing proposition, at least in relative terms, for positioning US equity portfolios in 2024, based on a set of factor ETFs. These risk premia have dominated for much of the year and it’s not obvious that the trend is set to change, based on trading through Oct. 2.

The iShares MSCI USA Momentum Factor ETF (MTUM) still holds the lead year to date, posting a strong 29.4% total return. That’s ahead of the rest of the field, in most cases dramatically so. The gain is also well ahead of the broad market’s 20.8% advance, based on SPDR S&P 500 (SPY).

Although all the major equity factors are posting year-to-date gains, the results vary widely. The weakest performer: small-cap value (IJS), which is up a relatively weak 3.7% in 2024.

Trends don’t last forever and so investors are watching for clues that may shift the dynamics of the horse race. On the short list for possible catalysts are two events that could roil the economy and the financial markets in the weeks ahead: a port strike and an escalation of fighting in the Middle East.

For now, the US stock market has largely been unaffected. The S&P 500 Index is only slightly below the record high the benchmark reached last week. The potential for reaction, however, is significant, depending on how each event unfolds in the days and weeks ahead. Perceptions about winners and losers in the upcoming US election could also alter market expectations.

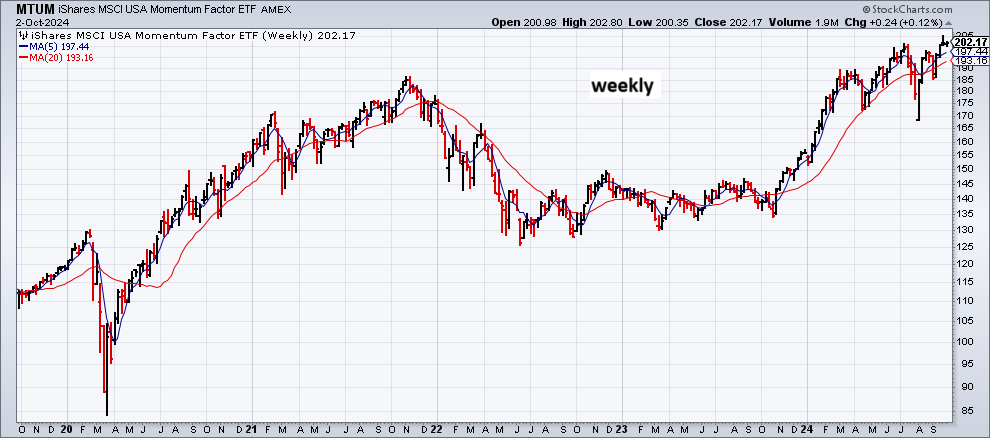

Meantime, the technical profile for the factor leader (MTUM) still looks strong. The summer sell-off took a toll, but MTUM rebounded quickly and is close to a record high.

(Click on image to enlarge)

“While the stock market is grappling with a variety of worries — including escalating tensions in the Middle East, a port strike and election uncertainty — liquidity is key and there is plenty of it now that the Fed has started to cut interest rates … that means that markets can continue to grind higher,” says Mary Ann Bartels, chief investment strategist at Sanctuary Wealth. “Embrace October’s volatility, as there is still plenty of fuel left in this bull market,” she predicts.

More By This Author:

Total Return Forecasts: Major Asset Classes - Wednesday, Oct. 2

Major Asset Classes - September 2024

Recent Data Still Point To Solid U.S. Growth For Q3

Disclosure: None.