Major Asset Classes January 2026 Performance Review

Image Source: Pixabay

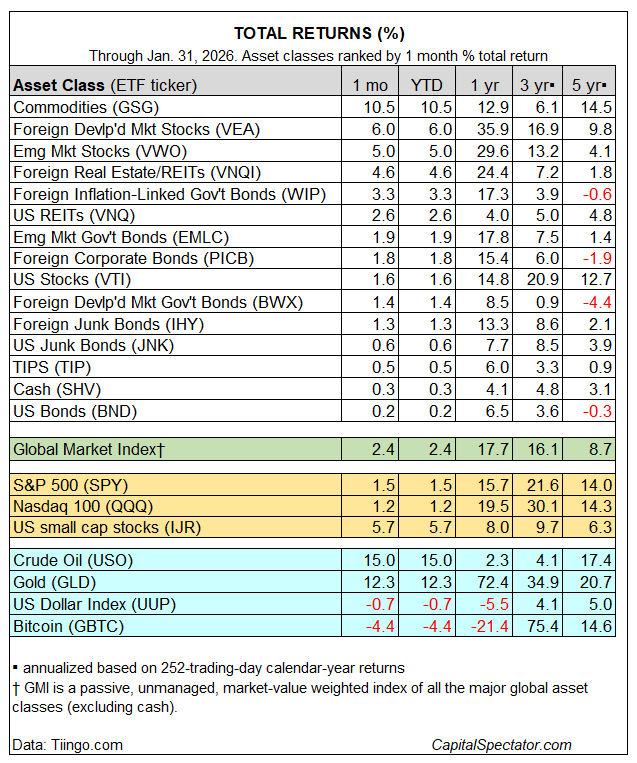

Commodities and foreign stocks led the performance race in January for the major asset classes, based on a set of ETF proxies. Meanwhile, offshore assets, supported by a weak dollar, outperformed their US counterparts by a wide margin.

A broad measure of commodities led the way higher in January. The iShares S&P GSCI Commodity Indexed Trust (GSG) soared 10.5% last month, marking the fund’s strongest monthly performance in 2-1/2 years.

Foreign stocks were in second and third place in January’s horse race. Developed-market shares ex-US (VEA) rose 6.0%, with stocks in emerging markets (VWO) in close competition via a 5.0% increase.

US stocks (VTI) trailed by a wide margin, rising 1.6% in January. US bonds (BND) only managed to post a thin 0.2% advance. US small-cap stocks, by contrast, delivered strong results, blowing past other slices of US markets with a sizzling 5.7% rise, based on iShares Core S&P Small-Cap ETF (IJR).

Despite a wide array of performances in 2026’s kickoff, January was notable for across-the-board gains for the major asset classes. In 2025, there were three months of rallies in all corners.

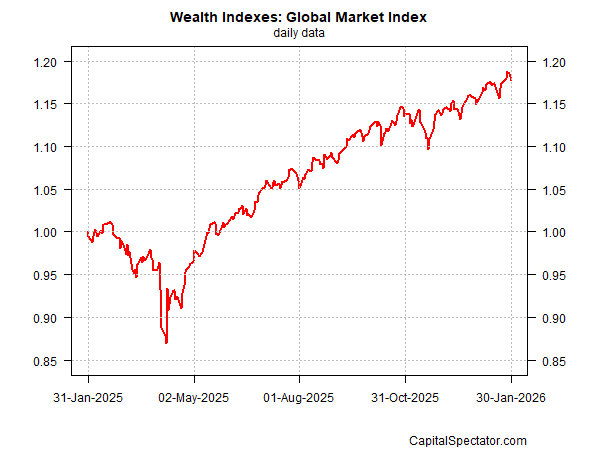

The Global Market Index (GMI) kicked off the year with a strong start, jumping 2.4% — its best monthly gain since September. With the latest rise, GMI extended its string of monthly gains to ten in a row, the longest run of wins in eight years. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

More By This Author:

Foreign Bonds Lead US Fixed Income In 2026

The Fed’s Job Isn’t Getting Any Easier

Is Weak Consumer Sentiment Flashing A Economic Warning?