Looking For Outsized Dividends From The Promising AI Sector

Business news is full of discussions about the growing impact of artificial intelligence (AI). Companies are spending billions on developing AI software, on building the massive data centers required for AI to operate, and on creating energy infrastructure to provide the substantial amounts of power needed by the data centers.

Investors are wondering when AI will bring about significant changes and what those changes will look like. For many industries, the use of AI is already having a powerful effect. Recently, I saw this in an email from The Daily Upside:

Artificial intelligence is transforming enterprises across every sector.

- Machine learning optimizes supply chains.

- Natural language processing handles customer service.

- Computer vision ensures manufacturing quality.

These aren’t future-tense “flying car” promises. They’re current profit drivers that already generate measurable returns.

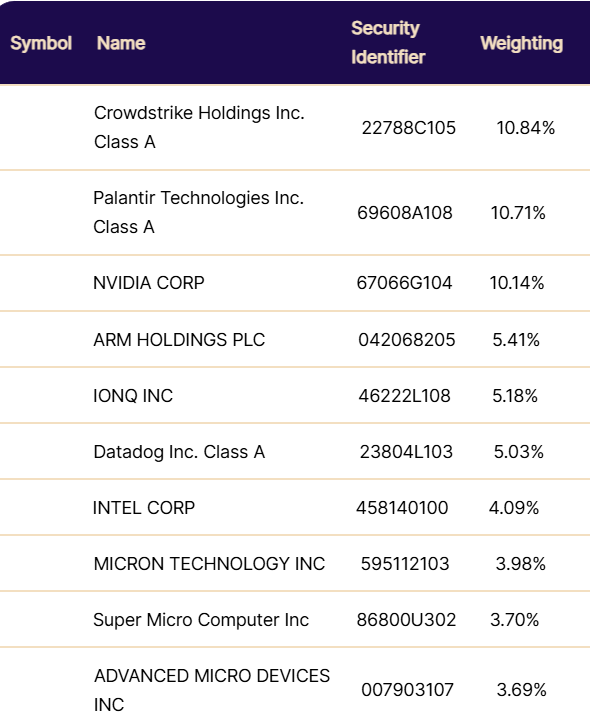

For an AI investment, I recommend the REX AI Equity Premium Income ETF (AIPI) to the subscribers of my high-yield ETF newsletter services. AIPI holds a portfolio of AI-related stocks. The fund employs a covered call option strategy to generate cash flow, which is used to pay monthly dividends. Here are the top AIPI holdings:

AIPI has a current distribution yield of 34.8%. Total returns from the fund were 7.56% and 42.75% for the last three and six months, respectively. turns to investors. We currently have 14 outstanding ETFs in our recommended portfolio.

More By This Author:

New Silver ETF Offers Appreciation Plus Income

Take Advantage Of Energy Midstream On Sale

Collect Dividends Twice Per Week With This New High-Yield Fund