Looking For Market Signals With Extreme Price Changes

Predicting is hard, especially about the future, but sometimes it’s a bit easier for financial markets when prices are at extremes. The challenge is defining “extreme.”

The possibilities are slightly higher than the number of grains of sand in the Sahara, but there are some obvious places to start. One of the analytical tools on my short list is comparing the current price to some moving average and then transforming the result into z-scores, which statistically determines if a value is typical or atypical, based on standard deviations above/below the mean.

The choice of moving average is linked with your time horizon. Traders will look at relatively shorter averages, investors at longer time windows. In all cases, the goal is the same: deciding if the current price is extreme. The logic here is that prices that move too far, one way or the other, are more likely to normalize, at least temporarily. In turn, that offers a basis for deciding if the market’s near-term bias is positively or negatively skewed to a degree that’s higher than usual.

The caveat, of course, is that extreme market events can remain extreme. So it goes with forecasting. Everything is flawed on this front, but some flaws appear to be less flawed than others.

Ideally, you’ll review several metrics for a higher level of confidence in developing expectations. I ignore that rule here in the interest of brevity and illustrating a concept.

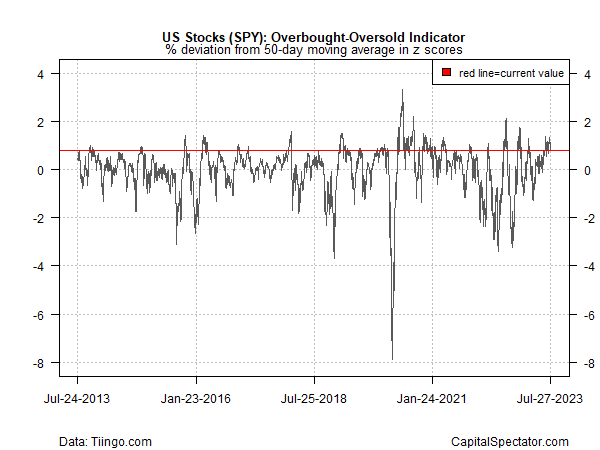

Let’s start with the US stock market, defined here as the SPDR S&P 500 ETF (SPY). Using a 50-day average via z scores shows that there have been several cases of spikes below -2 over the past decade. Not surprisingly, those periods have generally aligned with relatively strong positive expected returns for the near term.

SPY’s last big spike down maxed out at -3.2 on September 30. As it turns out, that was a couple of weeks ahead of the fund’s bottom (Oct. 12, 2022). Since then, SPY has rallied 28% through yesterday’s close (July 27, 2023).

Coincidence? Maybe, but a careful study of extreme price moves tends to imply that the expected return is relatively high following these events. It’s hardly assured and it’s never obvious in real time if an extreme move marks a bottom at that point or if the bottom has recently passed or has yet to arrive. What this technique does offer, however, is a relatively objective way to cut through some of the noise in search of a signal.

But as the chart above shows, using a 50-day average is still fairly noisy. Investors with a longer-term perspective may be more comfortable with a longer-term average. The chart below shows SPY with a 200-day average. Here, too, the results show that relatively extreme downside moves at the maximum were flagged in 2022, albeit on two separate dates: June 22 and September 30.

Confusing? Perhaps, but looking at both metrics in real-time in last year’s second half would have offered some context for thinking that the market was close to bottoming. Using this data in combination with a macro view – early hints in Q4:2022 that the US economic slowdown was stabilizing, for instance – provided a basis for the view that a more aggressive risk posture was warranted.

Hindsight is easy, of course. What about the here and now? All the usual caveats apply, but one thing is clear: SPY’s current profile suggests that its price isn’t extreme, at least in terms of the 50-day chart. As such, that makes estimating the future a bit tougher vs. last fall.

But the 200-day chart is starting to look a bit lofty, which may be an early clue that SPY’s price is starting to flirt with an extreme level. If and when the 50-day data confirms that view, the case for a bit of de-risking will look even more compelling.

More By This Author:

Tech Stocks Still Lead Market By Wide Margin This YearModerate US Growth Expected To Persist In Q2 GDP Report

Gold Still Looks Pricey Based On A Fair Value Model

Disclosure: None.