Leveraged ETFs: When And How To Use Them

The primary goal of this article is not to encourage an investor to use leveraged ETFs but educate those that would like to use them. I also will explain how the ETF sponsor intends for you to use their products and my recommendations for using their products. Many ETF managers offer leveraged ETF products, but for this study, I will focus only on three managers. Direxion, ProShares, and VelocityShares are the three ETF managers that I often use, and just for this reason, I selected them. There are many good ETF managers in the market, but if I researched all of them, I feel that the point of this research would get polluted by repetitive information.

Leveraged ETF's Applications:

DAY TRADE: In my opinion, leveraged ETFs were designed for day trading. Before investing in any financial product like an ETF, bond, fund or a company that just completed an IPO, I read the prospectus. When I visited the website of the three ETF managers that I mentioned above, I noticed that they all used the same word in their leveraged ETFs' product overview and is even in the actual name of the ETF. DAILY. For example, the Direxion Daily MSCI Brazil Bull 3X Shares ETF (TICKER: BRZU). The overview statement for BRZU states that: "This leveraged ETF seeks a return that is 300% of the return of its benchmark index for a single day. The fund should not be expected to provide three times the return of the benchmark’s cumulative return for periods greater than a day." By only reading this phrase, it is possible to conclude that this ETF should be used as a very short-term investment. This conclusion assumes that your goal is to track the underlying index with a minimal tracking error of which in the long-term BRZU will not have.

OVERLAY: If the investor knows they will receive money from a long lost relative who just recently died, they might want to overlay these funds to match the current portfolio allocations. If for some reason the investor doesn't have access to the derivatives necessary to execute an overlay or the cost of the derivatives is too high, then he can use a Leveraged ETF. Imagine that the investor's relative left them with $50,000 that will be deposited in their account in one month and the investor has 10% of his portfolio invested in EWZ. The investor could use $5,000 from their margin account to invest in EWZ, or they could use $1,666.67 to invest into BRZU. By investing in BRZU, the investor borrows less money, which means they pay less and have more funds available in their margin account to perform other overlays.

NO LEVERAGE: Not all investors are approved to trade on margin, or their accounts may not allow it. I know that some IRA accounts do not allow trading on margin or they have minimal margin available. If this is the case, then the investor can use leveraged ETFs to trade on margin

As you can see, there are several reasons that an investor would want to use a leveraged ETF even though it is not as efficient as other methods. These reasons could be considered satisficing if the investor does not thoroughly research is alternatives. In the next section, I will compare a portfolio invested 100% in EWZ against a portfolio with 33.33% invested in BRZU and the rest in cash.

EWZ Vs. BRZU

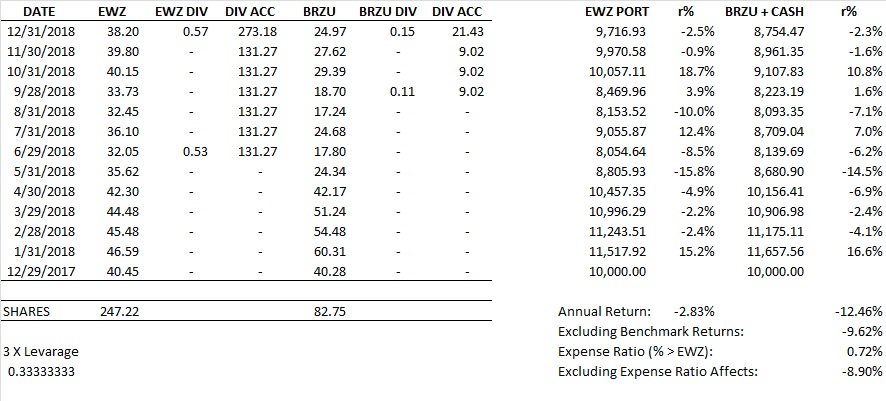

In the table below I replicated two different portfolios where one is invested 100% in EWZ, and the other is invested 33.33% in BRZU and the rest in cash. The information in the below table is available at any public data site, and I did the calculations. Neither of the portfolios was rebalanced or reconstituted, the cash position made 0% interest, and the dividends went into the cash investment. I will refer to the portfolio that is invested in EWZ as the benchmark portfolio and the portfolio invested in BRZU as the contrast portfolio.

For the year of 2018, the benchmark portfolio had a return of -2.83% while the contrast portfolio returned -12.46%. After excluding the benchmark return, the contrast portfolio underperformed the benchmark by 9.62%. The expense ratio of 0.72% is the result of adding back EWZ's expense ratio and subtracting BRZU's expense ratio. When the expense ratio effects are excluded, the contrast portfolio underperformed the benchmark portfolio by 8.90%.

There are many reasons why the contrast portfolio underperformed, but I will only cover those that I feel have the most significant effect. The first reason is high volatility. Volatility is not your friend when you rebalance your portfolio daily like the administrators of the ETF BRZU do. Emerging market Indices are commonly more volatile than developed market indices, but in either situation, volatility increases the cost to rebalance the portfolio. For foreign market ETFs like BRZU, volatility is amplified by the volatility of the FX rate.

The next reason that the contrast portfolio underperformed the benchmark portfolio is due to the cost of swaps. For those investors that have never used a swap, I will simplify how this derivative works. A swap does just what it is called; it swaps one thing for another. In the case of BRZU, it holds several swaps which receive a variable rate (EWZ return) and payout a rate. I could not find this information in the BRZU prospectus, but I imagine that they pay out a fixed rate. An example: The month of September of 2018, EWZ returned 3.9% and imagine that the fixed rate for the swap is 1%, monthly. The total return on the swap is 2.9%, and this means that the swap underperformed its benchmark.

Cash drag is the last reason that I will cover in this research. You might be asking yourself, don't all ETFs have cash drag? Yes, they all have cash drag as they because of liquidity needs. But leveraged ETFs must keep enough cash on hand for liquidity purposes and to cover the swap and trading expenses. Due to the frequent rebalancing mentioned earlier, leveraged ETFs must pay both direct and indirect trading costs daily.

Conclusion

Though leveraged ETFs like BRZU are unable to match the performance of their benchmark, they can still be useful for investors. That being said, I would not advise investors to use these ETFs for long periods and for any other purpose that is not mentioned in this text. Also, it is important to take into consideration the tax consequences of each investment and how they can affect (negative) your portfolio. I hope you found this information useful and if you did please follow me via TalkMarkets.

Disclaimer:

By accessing http://bsr-simplified.blogspot.com.br (referred to as the website in the following sections) or social financial platform used to promote our research, you have read, ...

more