Large-Caps Continue To See Gains

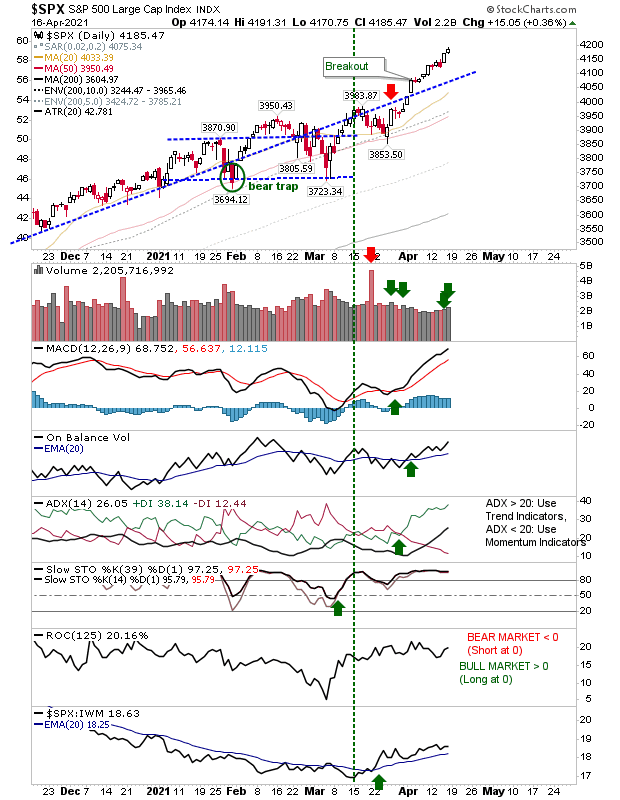

Friday saw the S&P 500 and Dow Jones Industrials continue to post gains while other indices drifted along in a narrow trading period.

The S&P 500 is on a ribbon rally of small, steady gains that brings its relationship with the 200-day MA to 16.1%, which is between the 99% to 95% range of historic price extremes; this is a rally which is running hot.

There is no slowdown in technical strength or bearish divergences to worry about, and relative performance remains positive after an extended period of underperformance - so there is no reason not to see this rally continue despite its extended nature.

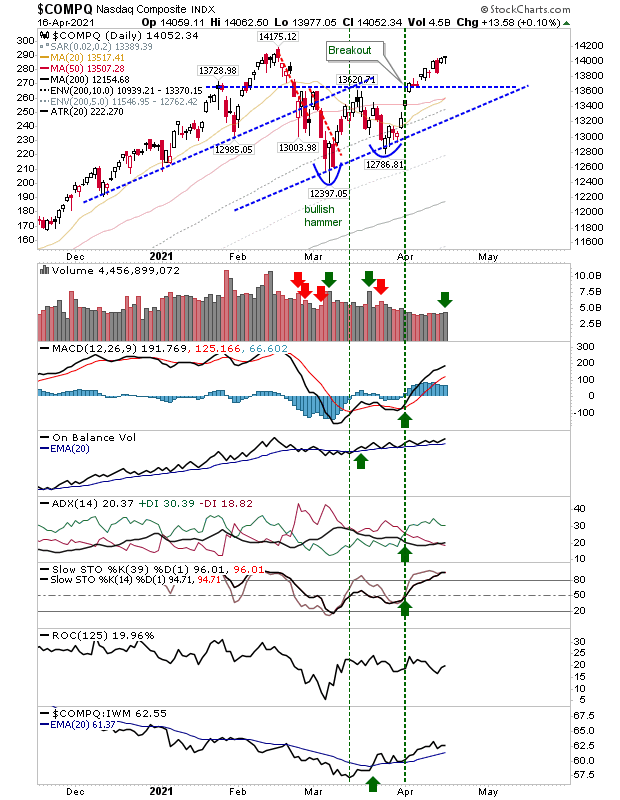

The Nasdaq and Russell 2000 had similar days, with little net change and both rallies remaining below prior swing highs. The Nasdaq still enjoyed good technical strength, so Friday's quiet action was of little concern to the larger picture.

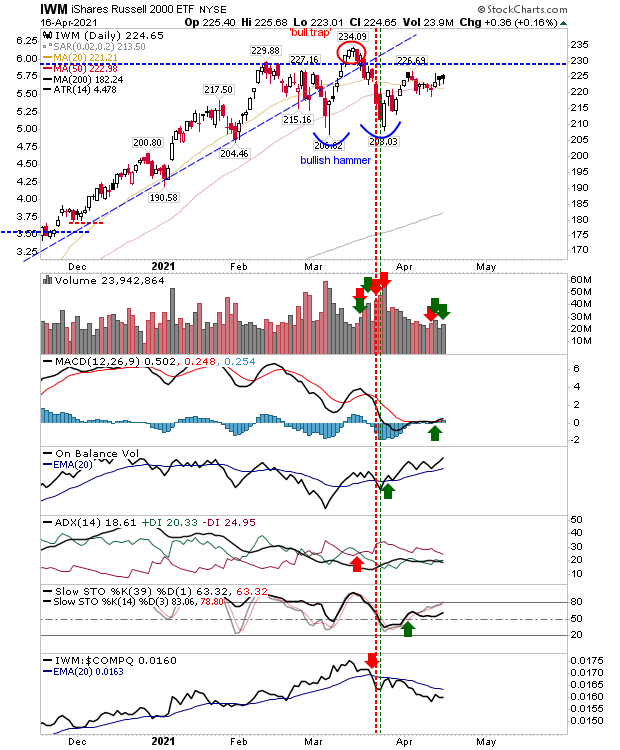

The Russell 2000 remains contained by its handle, but primed for a breakout. Keep a watchful eye.

In the coming week we will want to see the Russell 2000 push on and join in the gains of Large-Caps (and the Nasdaq, if it follows suit).

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more