KOID & HUMN: Two New ETFs To Profit From The Robotics Revolution

Image Source: Unsplash

Humanoid robots are no longer just science fiction. Their arrival on Wall Street — via two new ETFs, KraneShares Global Humanoid and Embodied Intelligence Index ETF (KOID) and Roundhill Humanoid Robotics ETF (HUMN) — signals that serious money is starting to chase a once-fantastical theme, suggests Nicholas Vardy, editor of The Global Guru.

This ETF showdown is a tale of two tech frontiersmen: one measured and methodical, the other a gunslinger. For investors hungry for 10x upside, these two ETFs offer very different ways to play robotics-revolution breakthroughs.

Elon Musk says Tesla Inc.’s (TSLA) Optimus bot could be bigger than its car business. Goldman Sachs Group Inc. (GS) pegs the humanoid market at $150 billion by 2035. Ark Invest sees a trillion-dollar annual GDP boost from robotic labor in the coming decades. That might still be conservative.

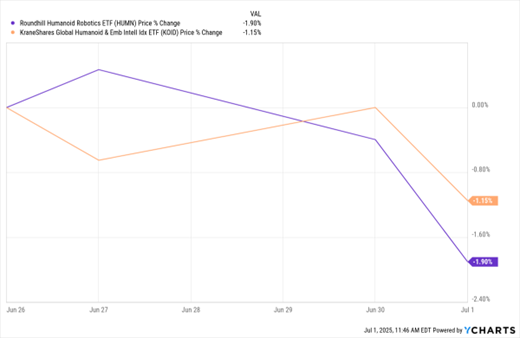

HUMN, KOID (One-Week Percentage Change) Chart

Data by YCharts

The global economy faces structural labor shortages. Humanoids promise to be the “steel-collar workers” that step into the breach. US manufacturing will be short 2 million workers by 2030. Aging societies like Japan and South Korea are desperate for scalable care solutions. Global industrial automation already attracts over $250 billion in annual investment.

Humanoids aren’t just sci-fi anymore. They’re the next productivity boom — with arms and legs.

KOID is a passive, rules-based ETF that tracks 51 equally weighted global names. It mixes big players like Nvidia Corp. (NVDA) and Tesla with niche enablers like MP Materials Corp. (MP), and has a geographic spread across the US, China, and Japan.

HUMN is actively managed, with 30 high-conviction positions. It targets core builders of humanoids and enabling tech (sensors, AI, materials) – and has concentrated exposure to Tesla, Nvidia, plus Asia/Europe niche leaders.

In tech investing, the 80/20 rule becomes the 95/5 rule: a few names drive nearly all the gains. HUMN leans into that math. KOID spreads the risk — and the reward. Want smoother volatility? Consider KOID. Want a shot at the next Nvidia? Consider HUMN.

About the Author

Based in London, Nicholas Vardy is a widely recognized expert on global investing, financial history, and trading psychology. A former global emerging markets portfolio manager for Janus Henderson, Mr. Vardy is currently portfolio manager at VFO asset management, a family office. He has been a regular commentator on CNN International and Fox Business Network.

Mr. Vardy has been an invited speaker to Cambridge University's Judge Business School, the University of Chicago's Booth Graduate School of Business, NYU Stern Business School, and the Corvinus Business School in Budapest, Hungary. He is currently completing a forthcoming book: This Time It's Different': A History of Financial Manias.

More By This Author:

What The Fastest Bull Rally Means For Your Money NowJPMorgan: Dimon Gets His Way, Shareholders Get The Benefits

Waste Management: An All-Weather Stock For This Resilient Market

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more