Keeping Hope Alive - Portfolio Strategy

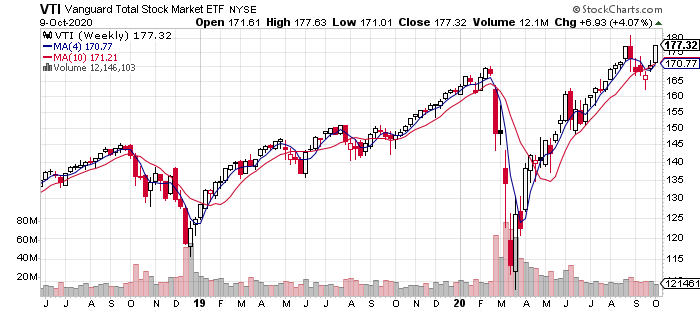

Keep (Stimulus) Hope Alive: The US stock market continued to rebound from September’s correction. Vanguard Total US Stock Market (VTI) posted its second straight weekly gain with a 4.1% surge at the close of last week’s trading (Oct. 9). The fund, at 177.32, is now within shouting distance of its record close (180.50) on Sep. 2. Once again, the lesson seems to be: ignore the downside because it never lasts.

How long can Mr. Market keep this game going? Perhaps as long as Washington keeps chattering about a new stimulus bill. There have been more twists and turns on the subject this week than a boa constrictor on prescription stimulants, with the latest variation focused on the White House’s offer on Friday afternoon for $1.8 trillion, or $400 billion shy of the Democrats’ offer — a relative thin wafer relative to the numbers thrown around lately.

Will it fly? No clue, but all the back-and-forth was enough to keep equities bubbling last week.

The bond market, on the other hand, had a mixed and mostly muted reaction to stimulus negotiations. Corporates via iShares iBoxx $ Investment Grade Corporate Bond (LQD) ticked up ever so slightly this week (+0.1%). Treasuries took a bit of hit, however: iShares 7-10 Year Treasury Bond (IEF) fell 0.6%, the second weekly slide, leaving the fund near its lowest price since June.

The big winner for the usual suspects in our broad global asset class portfolios: iShares Latin American 40 (ILF), which rocketed higher by 7.3%, the first weekly rise for the ETF in the last six. But don’t get too excited: the fund is still treading water after partially bouncing back in May and June from the coronavirus crash in March.

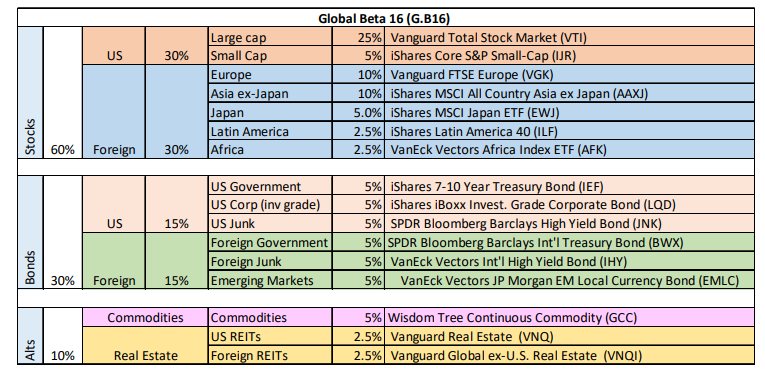

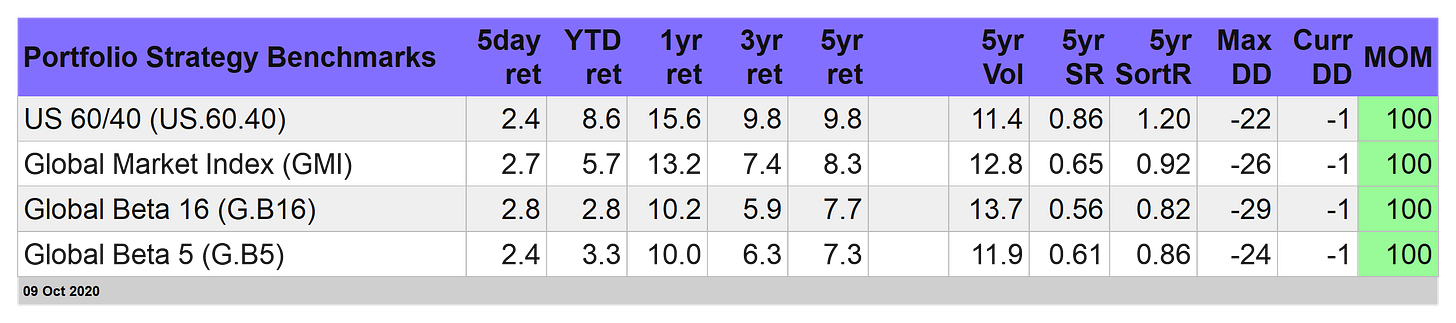

Overall, most of the global markets rose last week, providing a robust lift to our portfolio benchmarks. (As a refresher, our broadest benchmark is the passive Global Beta 16 (G.B16) portfolio that holds 16 funds and is diversified with quasi market-value weights across stocks, bonds, commodities and real estate on a global basis and rebalanced to the target weights every Dec. 31.)

G.B16 posted the strongest gain for our portfolio benchmarks this week, jumping 2.8%, although it was a solid run for most multi-asset-class portfolios. (For details on all the strategies and benchmarks, see this summary.)

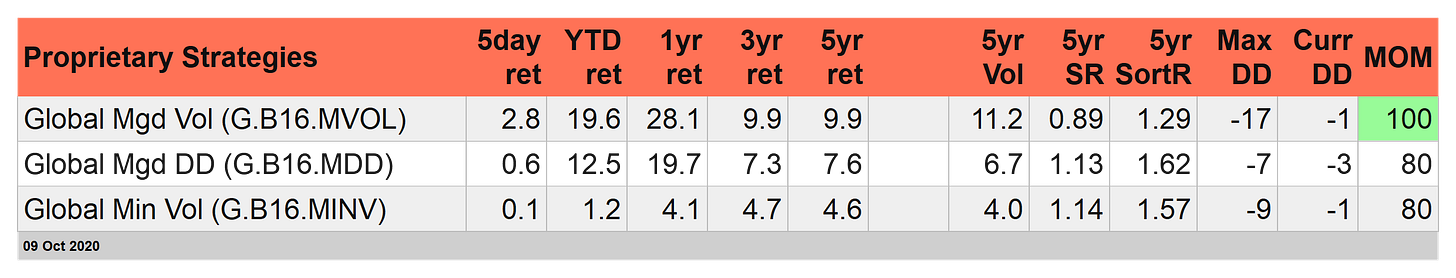

Results were far more varied this week for our three risk-managed strategies, which use the same 16 fund set as G.B16. Global Managed Volatility (G.B16.MVOL) kept up with the G.B16 benchmark and gained 2.8%. By contrast, Global Managed Drawdown (G.B16.MDD) and Global Minimum Volatility (G.B16.MINV) posted relatively weak advances.

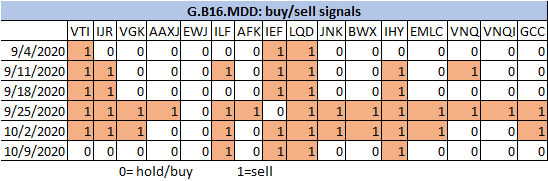

G.B16.MDD’s headwind of late has been its risk-off bias in recent weeks. But after this week’s broad-based rally, the strategy’s shifted back to a mostly risk-on posture at the close of today’s trading, as shown in the table below. The relevant trades are set to be executed at the open on Monday.

Global Managed Volatility (G.B16.MVOL) has fared better in the latest correction-rebound seesaw. Indeed, the strategy has remained risk-on for all 16 funds and that status prevails through today’s close. G.B16.MVOL’s model has had the good fortune to look through the recent market declines, effectively assuming that it was noise. G.B16.MDD, by contrast, has suffered a bit of whipsaw this time.

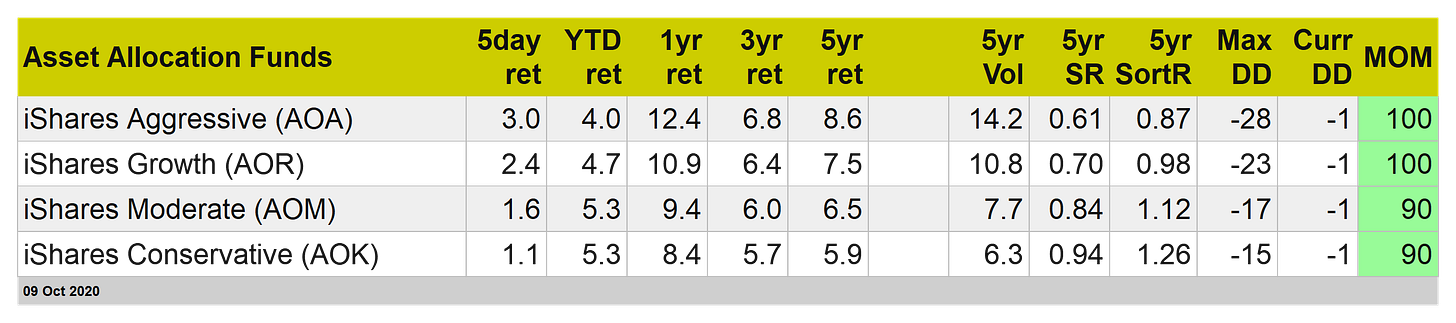

Let’s end on a high note, namely: BlackRock’s iShares Aggressive (AOA), which topped the week for our portfolio-monitoring field with a 3.0% return since last Friday. The fund is still up a relatively modest 4.0% year to date, but the ETF’s “aggressive” personality certainly paid off this week.

Disclosure: None.