JNUG: A Weapon Of Wealth Destruction

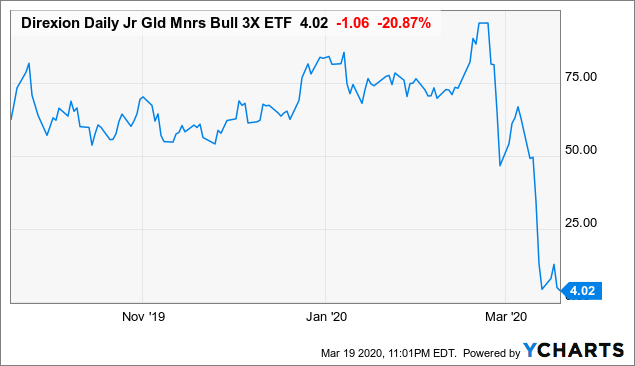

Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF (JNUG) is down by a staggering -95% on a year to date basis. Maybe you are thinking that the ETF could be a bargain at current prices, or perhaps that exposure to gold prices could provide a nice portfolio hedge in the current market environment. In that case, you may want to give these ideas a second thought.

Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF is a very troubling product for long-term investors and only short-term traders who fully understand the risks should consider it, perhaps as a trading vehicle for intraday positions.

(Click on image to enlarge)

Data by YCharts

Excessive Leverage On A Volatile Metal

Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF is the triple leveraged version of the MVIS Global Junior Gold Miners Index. In simple terms, the ETF provides three times the daily - and daily is the key word here - the return of the VanEck Vectors Junior Gold Miners ETF (GDXJ).

There's also an inverse version of this vehicle, the Direxion Daily Junior Gold Miners Index Bear 3x Shares ETF (JDST) provides triple the inverse of the daily returns of the junior gold miners ETF.

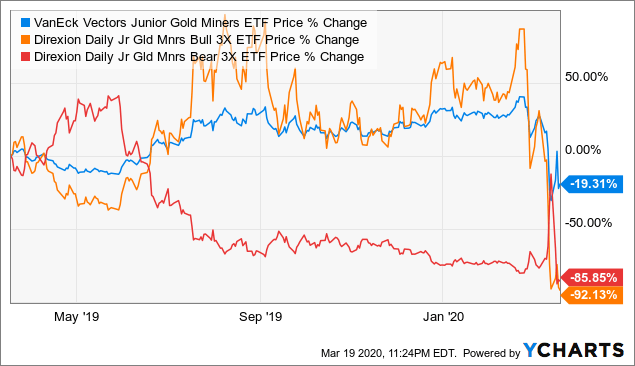

To illustrate the big dangers in these products, the chart below shows the returns of the three ETFs over the past year. The junior gold miners (GDXJ), the 3X junior gold miners (JNUG), and the -3X junior gold miners (JDST).

The numbers are just staggering. The junior gold miners ETF is down by almost 19%, but the 3X version and the -3X version have lost 92% and 86% of their value respectively in 12 months. Quite a display of wealth destruction over a relatively short period of time.

(Click on image to enlarge)

Data by YCharts

In simple terms, buying either the triple leveraged of the inverse triple leveraged junior gold miners ETF would have produced disastrous results. It takes quite a special product to produce such large damage both on the long and on the short side during the same period.

The Problem With Leveraged ETFs

Many investors assume that Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF is going to provide three times the return of the junior gold miners ETF over a specific holding period of time such as a month or a year. However, this is not the case. The ETF provides triple the return of the index over a specific day.

From a mathematical perspective, three times the returns of an index over a day and three times the return of an index over a year can be remarkably different things. Let's just look at the numbers in a hypothetical example.

- We have two ETFs tracking the same index, but one is a simple non-leveraged ETF and the other one is the daily 3X version.

- On the first day, the index falls by 10%, so the 3X version falls by 30%. The simple ETF goes from $100 to $90, and the leveraged one goes from $100 to $70. So far, there's no big problem in terms of performance.

- On the following day, however, the index rises by 11%, so the unleveraged ETF is again worth $100. On the other hand, the triple leveraged ETF will only be worth $93.

- The unleveraged ETF is back where it started, but the 3X ETF is losing money. The longer you hold on to the 3X leveraged ETF, the higher the chances that your returns will be disappointing.

This simple example can seem surprising to many investors, so it helps to play a little bit with the numbers in order to understand the different scenarios and their implications. But the main point is that an ETF such as Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF can generate returns that are very different from what you would expect by simply extrapolating triple the returns of the index over a month or a year.

The unpredictability of returns depends on the path trajectory of the underlying index and also on its volatility. The higher the volatility of the index itself, the more dangerous and unpredictable the triple leveraged ETFs in that space.

Much More Volatility Than You Need

Gold itself is quite a volatile metal, and gold miners are a leveraged play on gold prices. Mining companies have a relatively fixed cost structure, so when the price of gold fluctuates, the earnings of the gold mining companies fluctuate much more.

Granted, companies in the sector can hedge their price exposure to some degree, but they still face other uncertainty factors related to production levels, the impact of external factors, financial conditions and even legal and regulatory risk. Gold is volatile, and gold mining is a particularly risky business. Adding to the uncertainty, junior gold miners are relatively small companies in a very challenging sector.

Investing in a triple leveraged ETF always is risky in any case, and adding so much leverage in such a volatile sector makes the risk excessively high in my opinion.

Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF can only make sense for short-term traders taking intraday positions in the instrument to capitalize on its stratospheric volatility. For investors who hold positions over the middle and long term, there's just too much risk in this vehicle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more