IXC: A Fund To Profit From A Resurgence In Energy Prices

Photo by Timothy Newman on Unsplash

It doesn’t surprise me that we’ve seen market prices pull back lately. Even though earnings estimates for the S&P 500 Index (SPX) are rising, most sectors look pricey as heck. But there is one investment that looks very attractive, and it has the potential to make you Texas-sized money. I’m talking about the iShares Global Energy ETF (IXC), advises Sean Brodrick, editor at Weiss Ratings Daily.

That might surprise you because energy is the sector everyone loves to hate. And that’s because energy stocks haven’t gone anywhere in three years. I believe that’s about to change in a big way.

One reason would be sheer value. Energy has the second-lowest forward price-to-earnings ratio among the S&P 500 sectors, and the best dividend yield. In fact, its dividend yield is four times that of the S&P 500, which recently stood at 1.17%.

What’s more, large integrated energy companies are generating record free cash flow due to disciplined capital spending, high operational leverage, and resilient oil and gas prices. This has enabled aggressive dividend growth, buyback programs, and enhanced returns to shareholders. These factors historically support further upside in stock prices.

This gets really interesting because forces are seemingly lining up to push oil prices higher. Oil prices have been hovering near the bottom of the range they’ve traded in all year. I don’t believe they will stay this low.

The best strategy is to buy individual oil companies that are growing supply while keeping a lid on costs and paying fat dividends. But if you want just to buy an ETF, you can pick up something like the IXC fund. It gets a “C+” from Weiss Ratings, has a dividend yield of 3.7%, an expense ratio of just 0.4%, and is stuffed with big global oil companies.

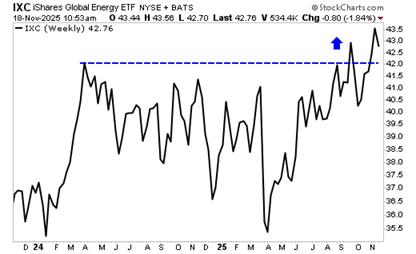

You can see the IXC ETF broke out through overhead resistance and seems to be zigzagging higher. It should go to at least $61, and maybe even higher. You can already find value in oil companies. Now you can target them for profitable investments, too.

My recommended action would be to consider buying the iShares Global Energy ETF.

About the Author

Sean Brodrick brings true boots-on-the-ground experience to the resource markets. He’s toured gold and silver mines from the far north in Nunavut to Nevada, to Mexico, to far southern Argentina, and all points in between.

Mr. Brodrick is always on the hunt for the next big discovery and tracks the fast-rising world of critical minerals reshaping global supply chains. His fieldwork and sharp market insight give his Weiss Ratings readers an edge — spotting opportunities long before Wall Street catches on.

More By This Author:

AI Stocks: Does Burry's Hyperscaler Depreciation Thesis Hold Water?XLE: This Is No Replay Of 2015 In The Oil Patch

Buffett: Yes, Luck Plays A Big Role In Investing, Too