IVV Vs. RSP: How Do Cap-Weighted And Equal-Weighted Funds Compare?

Image Source: Pexels

Some people seem to think of ETFs as totally passive investing. But let’s take a closer look at that premise – using the iShares Core S&P 500 ETF (IVV) and the Invesco S&P 500 Equal Weight ETF (RSP) as examples, highlights Jim Van Meerten, analyst at Barchart.

I would agree that if you are investing in an equal-weight ETF, you are making a passive investment decision. But what if you choose to invest in a cap-weighted ETF?

Most active portfolio management algorithms aim for overweight positions in stocks that have rising prices and underweight positions in stocks with sinking prices. That’s exactly how a cap-weighted ETF works, by naturally “rebalancing” throughout each session as prices of each individual fund component rise and fall. And beyond that, most cap-weighted ETFs rebalance every quarter.

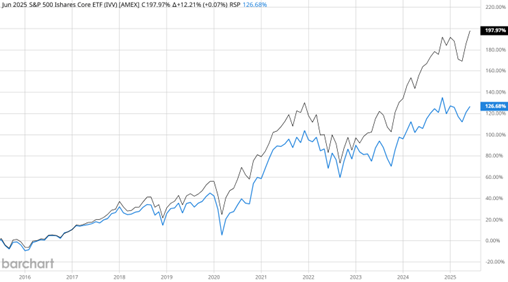

Let’s put that thinking to the test and look at a chart of the prices over a 10-year period for two funds: IVV and RSP.

You can see that over the 10-year period of this chart, IVV’s price rose 197.9% while the price of RSP only rose 126.6%. What if we also factored in the reinvestment of dividends for the total return?

iShares S&P 500 Cap Weighted ETF:

- 65.3% three-year total return

- 120.7% five-year total return

- 249.2% 10-year total return

Invesco S&P 500 Equal Weighted ETF:

- 37.8% three-year total return

- 99% five-year total return

- 164.9% 10-year total return

Using these comparisons, I think you’ll agree that the iShares cap-weighted S&P 500 ETF has a clear advantage over the totally passive, equal-weight ETF RSP.

About the Author

Jim Van Meerten earned a BS in Accounting and Business Administration from Berry College; a Juris Doctorate from the Woodrow Wilson School of Law; and attended post-baccalaureate and graduate courses in Business Administration, Quantitative Math, and Education at Florida Atlantic University, Georgia State University and University of North Carolina at Charlotte.

Previously he has been an accountant, attorney, adjunct professor in Business Law, Accounting and Internal Auditing, financial advisor, supervisory principal, and compliance officer. He also passed the Georgia CPA Exam, the Certified Internal Auditor Exam, and the FINRA Series 7, 24 and 9/10 exams.

He is presently an analyst at Barchart and writes "Chart of the Day," an article sent out daily that utilizes the tools available on Barchart.com, including screeners, Barchart technical indicators, and trading signals, to find stocks with compelling setups.

More By This Author:

KOID & HUMN: Two New ETFs To Profit From The Robotics RevolutionWhat The Fastest Bull Rally Means For Your Money Now

JPMorgan: Dimon Gets His Way, Shareholders Get The Benefits

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more