Is The Holy Grail Of VIX Investing Finally Here?

Today, May 3, 2016 two new volatility ETFs will start trading on the BATS electronic exchange – the REX VolMAXX Long VIX Weekly Futures Strategy ETF (VMAX) and the REX VolMAXX Inverse VIX Weekly Futures Strategy ETF (VMIN). Both will start with an NAV of $25 per share. These ETFs are the first products on the market that will provide exposure to the VIX Weekly Futures market which started trading on July 23 of 2015, roughly a year ago. I had a chance to sit down with the team that created these ETFs and discuss their goals and aspirations for these new products.

The issuer of these two new volatility ETFs is REX Shares, a new start-up ETF outfit headed by Greg King. Greg King, largely unknown to the retail volatility investor, has an impressive track record in the ETF industry. He headed the iPath ETN platform at Barclays where he came up with the concept of the Exchange Traded Note (ETN) and created the first volatility ETN in 2009 – the iPath S&P 500 VIX Short Term Futures ETN (VXX). Subsequently, he founded the ETF company VelocityShares, which was eventually acquired by Credit Suisse and which gave us the second and most popular volatility ETN in 2011 – the VelocityShares Daily Inverse VIX Short Term ETN (XIV). Today VXX and XIV are the 2 oldest and most popular volatility products and command a combined AUM of more than $2 billion on any given day. Greg King is a true visionary in the ETF world and we owe much of what we see on the ETF scene today to him. You can think of him as the Elon Musk of ETFs.

Like a good movie producer, Mr. King wasn’t satisfied with his original VIX ETF creations and wanted to go bigger and better. The result of these efforts are these new VMAX and VMIN ETFs that are going to start trading today.

How Do VXX and XIV Fall Short?

Before we delve into VMIN and VMAX, let’s look first at the issues the REX Shares team is trying to fix in the current leaders in the volatility ETF world – XIV and VXX.

Beta and Correlation

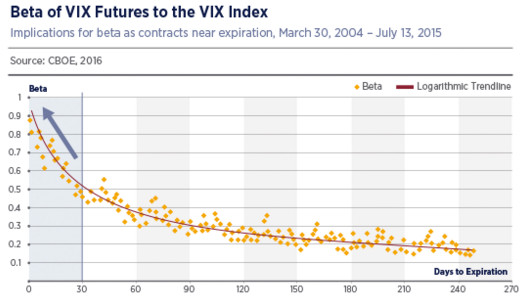

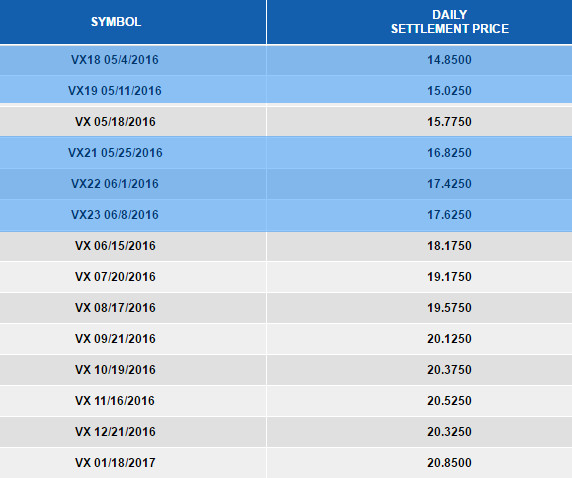

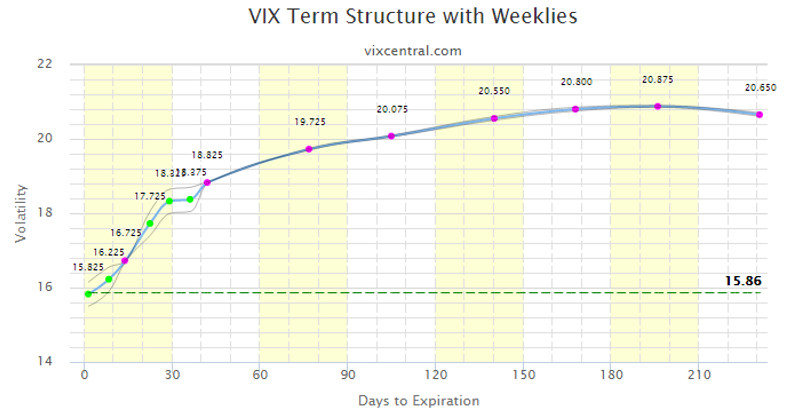

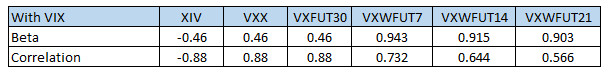

A common criticism of VXX and XIV are that while they provide exposure to the VIX, they do so only in a half-baked manner. As I discussed in the SA article But Why? VXX and XIV Are Already Just Perfect, these ETNs are constrained by the products in which they invest. Since these ETNs are composed of monthly VIX Futures and monthly VIX Futures represent what investors think the VIX will be further out in time, they do not provide a perfect VIX exposure. The VXX and XIV essentially give you exposure to a synthetic VIX future with an average time to expiration (TTE) of 30 days (I will call this VIXFUT30 for the remainder of this article). The farther the average time to expiration, the more disconnected the ETF or the synthetic future will be from the VIX itself.

Source: volmaxx.com

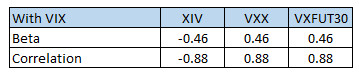

As you can see in this graph, the 30 day TTE VIX Future would result in Beta of roughly 0.5. This is confirmed by my own observations. I calculated the Beta of XIV, VXX and the VIXFU30 against the VIX for the entire history of these products (starting in 2009 for VXX, 2011 for XIV and 2004 for the VIXFUT30) and those values came out to be -0.46, 0.46 and 0.46 respectively (the XIV being the inverse of the VIXFUT30 obviously).

What do these numbers mean?

A correlation means how often that does one product move with the other. How often does the VXX go up when the VIX goes up? Well, it turns out that is 88%. This is very good but not perfect. As VXX investors are well aware, there are many days when the VIX goes up but the VXX doesn’t.

A beta means how much of the move is captured. How much does the VXX go up when the VIX goes up? Well, it turns out the VXX goes 46 cents for every $1 that the VIX moves. So if the VIX moves 10%, on average the VXX goes up 4.6%. As most of volatility investors have observed, that has roughly been the case.

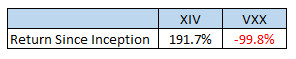

The Contango Effect

Another concern is that the XIV and VXX are heavily influenced by the Contango present in the front month VIX futures. The VX1-VX2 contango of which these ETFs are composed, has averaged 5.4% since 2004 and that has resulted in steady but consistent decline especially in the VXX. Most, even sophisticated, investors don’t understand the inner workings of the ETFs and are often surprised at how much money they lose in them since they think they are an exact VIX replacement. The VXX is -99.8% since its inception in 2009 while the XIV is +191.7%.

However, the issue of daily roll is not limited to the ETFs. If an investor was to manage his own VIX futures position, the fact that futures do expire every month would force him to be engaged in the same kind of rollover the ETFs do. The advantage of the ETF rollover is that it is done on a preset schedule, it is cost efficient, it is done when liquidity is present and bid-ask spread minimized. It is doubtful that the average investor would handle this rollover as well as the ETFs. But even if done well, the rollover is present and it would affect long term returns just like with the ETF.

Legal Structure

Yet another concern is the legal structure of these products, which is the Exchange Traded Note, which is essentially a debt with a maturity date. For example, the XIV maturity date is December 4th, 2030. This is far out enough not to concern most people today, but some investors are concerned nonetheless.

Bankruptcy Risk

Yet another concern is the bankruptcy risk. Technically, the XIV can go bankrupt if a sufficiently large move in the VIX transpires. We need the VIXFUT30 to move 100% up for the XIV to go bankrupt. A 100% move in the VIXFUT30, given the 0.46 beta is equivalent to a 217% move in the VIX. Historically, the largest move in the VIX came on February 27th, 2007 and that move was 64.2% when the VIX moved from 11.15 on 2/26 to 18.31 on 2/27. This is not a date that anybody associates with any particular event, yet that is when the biggest VIX percentage move happened. Well, a 67% move is only 30% of the 217% move required to bankrupt the XIV (if it existed then). So historically, the XIV hasn’t come within 30% of bankruptcy. Some people fear the effects of a nuclear attack on US soil. Well, we had a similar catastrophic event on 9/11 when the World Trade Center was attacked and most of the downtown New York exchanges went out of operation. The exchanges were closed for a week and when they did open, the volatility shorts actually made money on the open before the VIX was allowed to spike. The point is regulators simply will not allow a catastrophic event to bankrupt majority of market participants. In fact, the VIX jump on 9/17/2011 when the VIX started trading again was only 31% or only the 21st largest move in the history of the VIX (at the time the 8th largest).

VIX Weekly Futures Primer

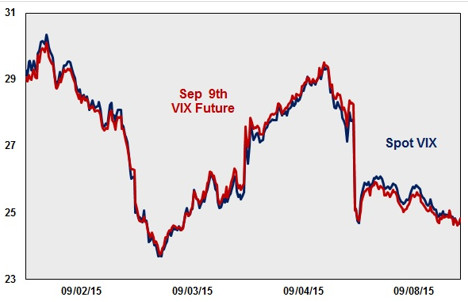

The VIX Weekly Futures started trading last year on 7/23/2015. The first contract VX1Q15 expired on 8/5/2015. After a few weeks in operation, volatility investors got very excited about the weeklies because finally there was product out there that closely followed the spot VIX.

Source: CBOE

So let’s delve into the weeklies a little more. The VIX Weekly Futures always expire on a Wednesday. The weekly future contract notation follows one of 2 conventions – either VX{consecutive Wednesday number in the year}] or VX{Wednesday number in the month}{month code}{year}. So for example, the first weekly future contract is represented by either VX31 or VX1Q15. VX31 means that the contract expired on the 31st Wednesday that year. VX1Q15 means that the contact expires on the 1st Wednesday of August of 2015 (Q15). Both of these amount to the same Wednesday 8/15/2015.

There is no VIX Weekly Future for the Wednesday when the monthly future expires. As such you will see gaps in the weekly notations. For example, in 2015, there was VX31, VX32 and VX34. VX33 was skipped because the expiration date would’ve coincided with the August monthly contract VXQ15. So the proper sequence of contracts is VX31, VX32, VXQ15, VX34 or VX1Q15, VX2Q15, VXQ15, VX4Q15 in the alternate notation.

There are usually 5 weekly contracts active at any given time. You can view the active weekly contracts on the vixcentral.com website on the “VIX Term All” tab.

Source: vixcentral.com

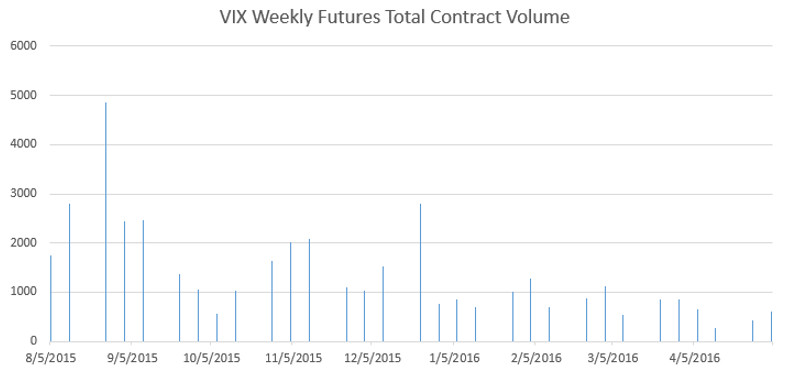

Since the VIX Weekly Futures are relatively new (they have been around for less than a year), liquidity is not abundant. However, they have been a relative success compared to other CBOE products targeted at other asset classes such as Oil and Gold. In the past, Oil (OV) and Gold (GV) VIX futures were discontinued due to lack of interest (volume). Initially, VIX Weekly Futures were doing better than the OV and GV, but as of late not much better. Average daily volume is 44 contracts with a big decline lately probably because the market just won’t go down. Compare this with the 22,408 daily contract average for the monthly futures.

Source: CBOE (data) and vixcontango.com (graph)

How Are VMIN and VMAX better than XIV and VXX?

VMIN and VMAX intend to provide investors with a cleaner access to the VIX. Let’s count the ways

Beta and Correlation

The first notable difference between VMIN/VMAX and XIV/VXX is that the new ETFs will invest in VIX Weekly Futures as well as the monthly VIX Futures (for the week when a VIX weekly future is not available). The stated goal for the ETFs in the fact sheet is:

“The funds seek to invest in VIX futures contracts that are near to expiration, subject to overall liquidity and roll cost considerations, and intend to maintain a weighted average time to expiration of less than one month at all times”

So VMIN/VMAX intend to better the XIV/VXX by holding contracts that are closer than 30 days to expiration. Unlike the XIV/VXX, the VMIN/VMAX are “actively managed” ETFs. In other words, there is no clear cut formula that is made available in the prospectus. However, the obvious goal would be to reduce the time to expiration as much as possible and do so in a systematic matter. Given the liquidity constraints in the VIX weekly futures, a simple formula probably couldn’t be achieved at this time so that is why they opted to “actively manage” the ETF, although I suspect computers will be doing most of the work.

In order to find out what the time to expiration of the ETFs are, I calculated based on VIX Weekly Futures historical data 3 synthetic VIX weekly futures – VXWFUT7 with 7 days to expiration (holding VXWK1 and VXWK2), VXWFUT14 with 14 days to expiration (holding VXWK2 and VXWK3) and VXWFUT21 with 21 days to expiration (holding VXWK3 and VXWK4). Based on these synthetic futures, if they achieve Beta of 0.95for VMAX, then the VMAX is most likely to be rolling over VXWK1 and VXWK2 contracts on a weekly basis (just like VXX rolls over VX1 and VX2 monthly contracts).

The actual Beta achieved remains to be seen due to the present liquidity issues in the weekly futures. If they are not able to find liquidity in the weeklies, I assume they will have to find liquidity in the nearest monthly VIX future which is a very liquid contract, but depending on the time to expiration that may hurt the beta and correlation a little bit.

Now whether, they are able to achieve their goal remains to be seen due to the present liquidity issues in the weekly futures. If they are not able to find liquidity in the weeklies, I assume they will have to find liquidity in the nearest monthly VIX future which is a very liquid contract, but depending on the time to expiration that may hurt the beta and correlation a little bit.

In any case, regardless of the initial implementation difficulties, the VMIN and VMAX should be able to provide a cleaner access to the VIX than the VXX and XIV, but whether their ultimate objectives will be achieved remains to be seen.

REX Shares will be publishing the daily holdings of both VMIN and VMAX on the product website volmaxx.com as well as the correlation and the beta. You can monitor that website to see what actually is transpiring in these ETFs.

The Contango Effect

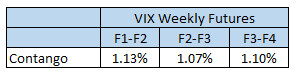

There is contango present in the weekly contracts but not nearly as pronounced as in the monthly contracts. The monthly average contango is north of 5% as we discussed. The average contango in the weekly is roughly 1% per week which over an entire month would be roughly what the monthly contango is.

If you are short term holder of the VMIN/VMAX, the contango effect should be somewhat less pronounced than the monthlies, but if you do hold VMIN/VMAX over a longer period of time, the decay from roll yield would roughly be similar to VXX and XIV.

Legal Structure

VMIN/VMAX are not Exchange Traded Notes, they are proper Exchange Traded Funds. However, they are not organized as investment partnerships and as such will not issue a K-1 the way SVXY does. So from a legal perspective VMIN and VMAX are unicorns. They have everything a volatility investor could possibly want.

I found a 30% leveraged facility in the prospectus, which is going to be used for cash management purposes. I am very sensitive to utilizing leverage in the ETFs due to the daily rebalancing decay effect and the “actively managed” part concerned me whether the leveraged facility would be used to improve the beta (for example UVXY achieves better beta than VXX by using leverage). But it appears, that the leverage facility would be used for cash management purposes only to facilitate investor redemptions and not for the actual holdings of the fund.

Bankruptcy Risk

Given that the time to expiration is dramatically reduced, it was a bit of concern whether we could have a bankruptcy situation with VMIN. Since VMIN aims to achieve -0.945 beta, that means that the VIX would have to jump 105% for the VMIN to go bankrupt. As I discussed above, we have never had a bigger than 65% move in the VIX so in this case we haven’t even gotten 62% of the way to a bankruptcy on a historical basis. While the actuarial probabilities are higher so to speak, given that it has never happened before even during catastrophic events such 9/11, it makes it very unlikely that it will happen in the future. In any case, a VIX move that could bankrupt the VMIN can only happen during times of extreme complacency when the VIX is down to 10 or 11 and at those times you shouldn’t be long VMIN anyways.Why pick up pennies in front of steamroller when you can collect dollar bills raining from the sky after the storm.

Summary

The two new REX Shares ETFs VMIN/VMAX are sure to be a welcome addition to the toolset of any volatility investor especially those with a shorter term trading horizon. They are well designed and well implemented and they will allow day traders to capture most of the daily fluctuations of the VIX without the use of leverage. Professional and institutional investors are likely to use these to hedge their S&P500 exposure more effectively. Hedging directly in the futures market is a headache due to the constant roll over work that has to be done, so even large professional investors like George Soros and other hedge funds would gladly utilize a more efficient way via an ETF. These ETFs will be the closest trading vehicle to the VIX that is out there. At the end of the day, I think these ETFs will be well accepted by the market place unlike some of the bombs of the recent past (VXUP/VXDN). For those who want to jump right in, you have to be aware of the low liquidity in the VIX Weekly Futures market today. The effectiveness of these ETFs is currently limited by the available liquidity in the VIX Weekly Futures market. Eventually, I think VMIN and VMAX will dramatically increase the liquidity of the VIX Weekly Futures market just like VXX and XIV did for the monthly VIX Futures market back in 2010 and 2011. As it stands right now, proceed with caution.

Good stuff. Will we see more by you?

Frankly find the whole world of volatility ETFs somewhat confusing. In layman's terms how do these compare to regular stocks or Index funds? Do you have a link to send me that provides an broad overview of these types of investments? Thanks

https://vixcontango.com/site/introduction You might want to watch the video as well.