Is Bitcoin Set To Rebound? Ways To Play A BTC Cryptocurrency Turnaround

Summit Art Creations via Shutterstock

Bitcoin (BTC), the predominant cryptocurrency, may be set for a rebound, as it has rebounded from a recent trough. What are the best ways to play this if you don't want to shell out over $112,700 for 1 Bitcoin? This article will show some alternative plays, including options strategies for exposure to Bitcoin.

BTC is at $112,722 in midday trading on Monday, Sept. 8. That is up from a recent low of $107,920 as of Aug. 29 and a recent peak of $122,860 on Aug. 13.

(Click on image to enlarge)

Bitcoin - last 3 months - Barchart - Sept. 8, 2025

This could present an opportunity for value buyers in the crypto space. For one, if the Fed starts to lower interest rates, that might spark a financial rally, which could benefit BTC.

So, what are some of the ways that an investor can play Bitcoin without having to shell out a large amount of cash?

Alternative Plays in BTC

Some stocks already own large amounts of Bitcoin and consider themselves as a Bitcoin reserve treasury asset. For example, Strategy, Inc. (MSTR) has at least 628,791 BTC on its balance sheet.

That means it's worth over $70.878 billion. The stock's market capitalization is $93.418 billion as of today, according to Yahoo! Finance, at a price per share of $329.68.

Strategy also has an underlying software security business, but it's unclear whether that narrows the gap, along with its associated $8.1 billion in debt.

I discussed this in a recent Barchart article discussing MSTR options ("Strategy, Inc. Shows Huge, Unusual Call Options Activity - Speculators Abound in this Bitcoin Play")

But at least an investor only has to pay $329 or so to gain exposure to Bitcoin.

Grayscale BTC Mini Trust ETF and Related Options Plays

Another alternative play is the Grayscale BTC Mini Trust ETF (BTC). This stock trades for $49.90 per share and probably more directly benefits from the upside and downside of Bitcoin.

Moreover, investors can buy options and sell out-of-the-money puts and calls in BTC.

(Click on image to enlarge)

Grayscale Bitcoin Mini Trust ETF - last 3 months - Barchart - Sept. 8, 2025

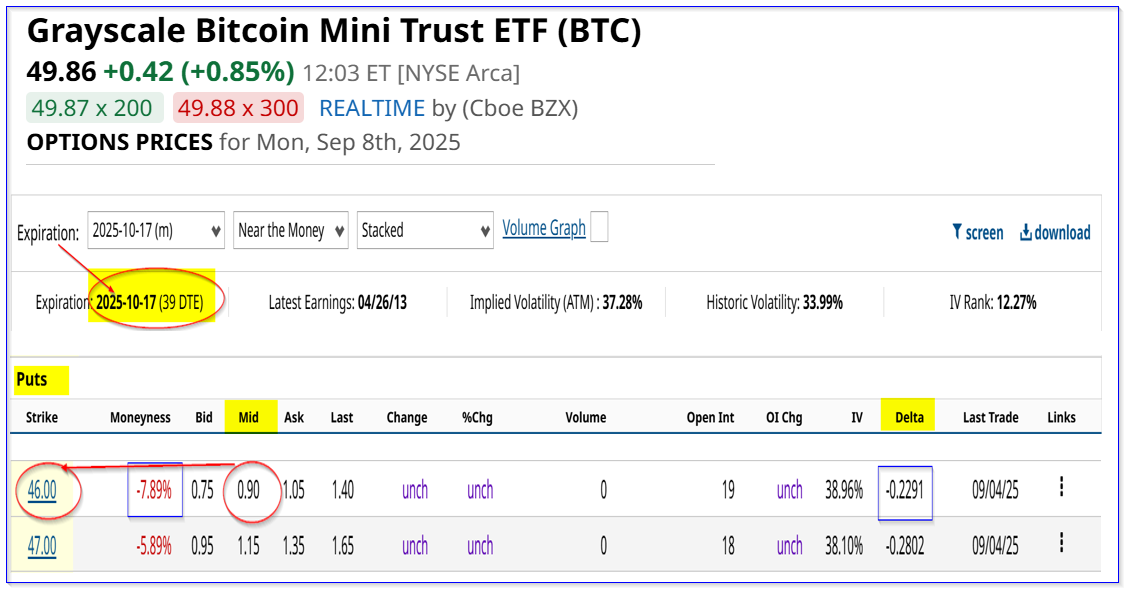

For example, look at the Oct. 17, 2025, expiration period for BTC stock. It shows that the out-of-the-money put option at the $46.00 strike price has a very attractive premium of 90 cents at the midpoint.

This strike price is over 7% below today's BTC stock price, but has an effective yield of almost 2.0% to the stock seller of these puts (i.e., $0.90/$46.00 =0.019565 = 1.9565%).

(Click on image to enlarge)

BTC puts expiring Oct. 17 - Barchart - As of Sept. 8, 2025

The point is that an investor who secures $4,600 as collateral with their brokerage firm can make an immediate one-month income of $90 by entering an order to “Sell to Open” this put contract.

Note that even if BTC falls to $46.00 (i.e., Bitcoin drops over 7%), the investor has a breakeven point of $45.10, or over 9.5% from today's price of $49.86. Moreover, there is a low chance this will occur as its delta ratio is only 22.9%.

However, some investors may want to have some upside in BTC as well. One way to do this is to buy in-the-money (ITM) calls and use the short OTM puts to pay for this.

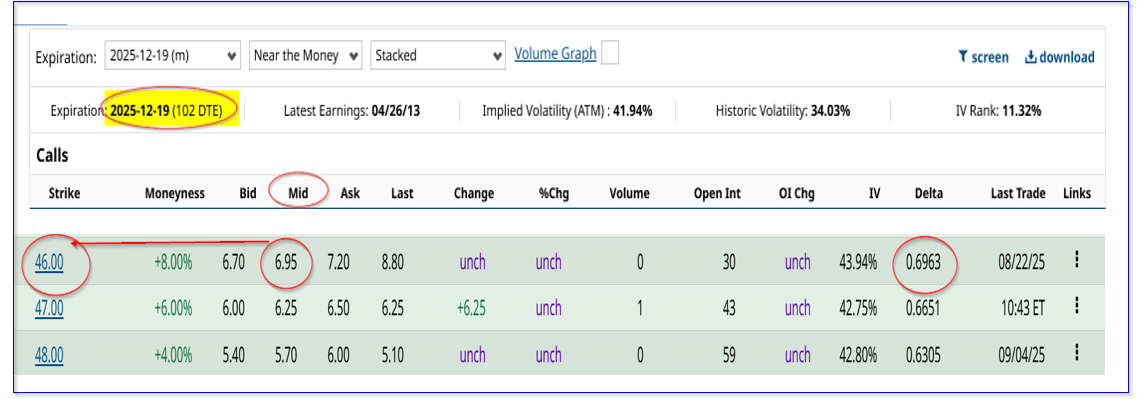

For example, the Dec. 19, 2025 expiration period shows that the $46.00 call options trade for $6.95 at the midpoint. That expiration period is 102 days from now, over three months.

(Click on image to enlarge)

BTC calls expiring Dec. 19 - Barchart - As of Sept. 8, 2025

The intrinsic value of these calls is almost $4.00, so the extra amount (extrinsic value) paid for these calls is $2.95 or so. But, if an investor can make 90 cents for three months by shorting OTM puts (i.e., $2.70), most of that extrinsic value can be covered.

This shows that there are ways to play Bitcoin using stock options in ways that make it easier to invest in Bitcoin than just buying BTC crypto.

Downside Risks

Investors should study Barchart's Option Education Center tabs to study risks associated with options investing.

For example, in shorting out-of-the-money puts, an investor could end up with an unrealized loss if their short puts are exercised and BTC stock falls below the breakeven price.

Moreover, there is no guarantee that an investor can make a 2% yield each month shorting these OTM puts. In addition, if Bitcoin falls, the investor's investment in ITM calls could result in a 100% loss if it falls below the entry price by the expiration of the call options.

Nevertheless, the investor can manage these positions and roll them over to later periods.

The bottom line is that by using these options strategies, an investor can gain all the upside in a Bitcoin turnaround for less money than it costs to buy one Bitcoin.

More By This Author:

Analysts Keep Raising Shopify's Targets - Make A 3.0% Yield In One-Month SHOP OTM PutsStrategy, Inc. Shows Huge, Unusual Call Options Activity - Speculators Abound In This Bitcoin Play

Broadcom's Free Cash Flow Surges With Higher FCF Margins, Implying A 25% Higher Value For AVGO Stock

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more