Investing In The Disruptors: Profitability In The Age Of Monopolies

- The market has entered into a period of relative uncertainty, as measured by the VIX.

- Industry consolidation increases profitability at the expense of efficiency.

- Monopolies negatively impact economic growth.

- The disruptors are the most important tools in breaking up the current monopoly problem.

- There are several ETFs that can be used to invest across the disruption industry.

The History of Monopolies

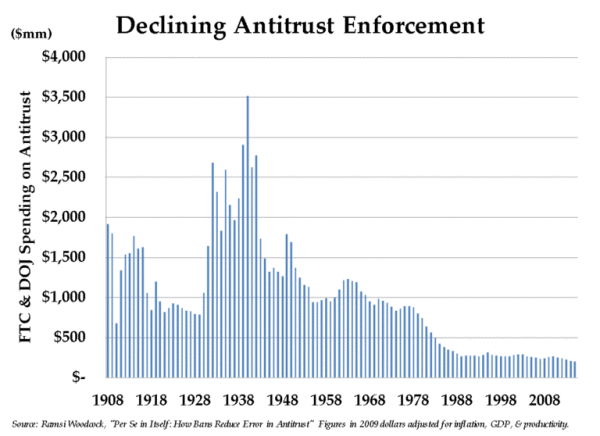

On October 27th of 1981, the publication of market concentration data was ended by President Reagan’s FTC Chair. Antitrust has appeared to become very low priority for every single administration over the past 35 years. But if products are still being delivered and the economy is still functioning, does it really make a difference if some industries are dominated by two or three key players?

Source: Pekinsinger

The Obama administration loosened the Herfindahl-Hirschman Index guidelines back in the years following the Recession to allow for more business activity. In response to scrutiny, the FTC said that “when success and failure are driven by relative degrees of innovation and efficiency, markets also become more concentrated“. Basically, the FTC stated that innovation spurs consolidation. However, it also spurs disruptors.

Disruptors will be the key to economic growth in the coming years, and will become necessary in breaking up existing monopolies. There are several ways to invest in disruption, through the companies in the 2019 IPO market, as well as through the Renaissance IPO ETF.

The Growth of Industry Concentration: Monopoly Power

There prevalence of monopolies in the market has grown over time. Google owns 90% of the search engine market. 4 Airlines control 76% of the overall industry. 3 companies control 75% of the beer market. 4 companies control 97% of the dry cat food market. 2 companies control 76% of the coffin and casket industry.

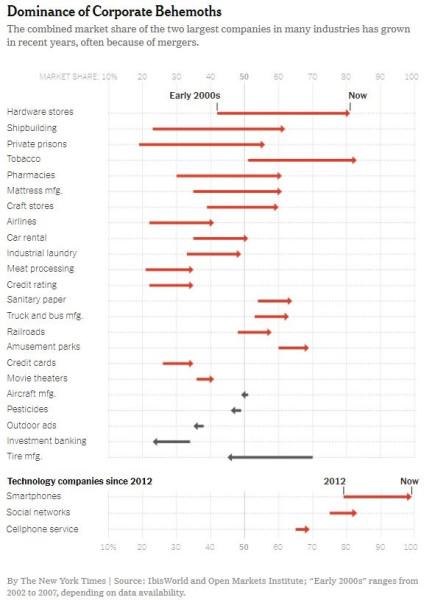

This consolidation process has only accelerated over time. More than 75% of US industries have become increasingly concentrated over the past twenty years, with the “average increase in concentration levels reaching 90%” as measured by the Herfindahl-Hirschman index (HHI) according to research from Grullon, Larkin, and Roni.

Source: David Leonhart

The above graphic details the growth in market power of the two largest companies in a variety of industries over time. Smartphone companies, tobacco companies, and hardware stores have experience the largest increase in concentration, but across the board, industries have become more consolidated.

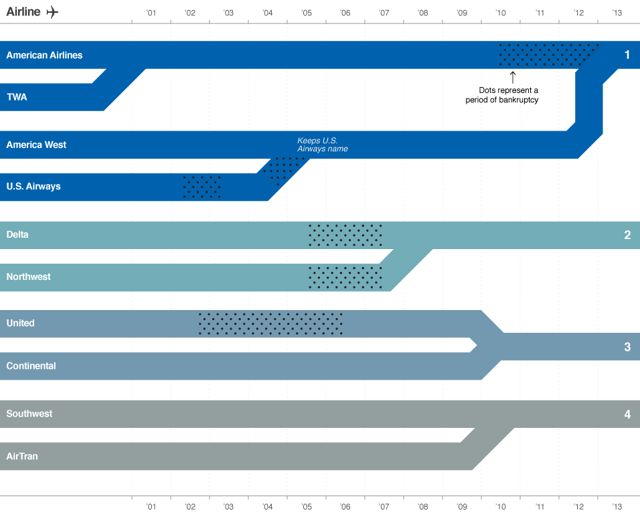

The airline industry is a great example of an increase in market concentration. Delta, American, United Continental, and Southwest all dominate the domestic airline industry. Those 4 firms control 76% of the $150B market. In 2005, those same 4 firms only controlled 38% of the market. Their market concentration has doubled over the past 15 years.

Source: Barry Ritholtz

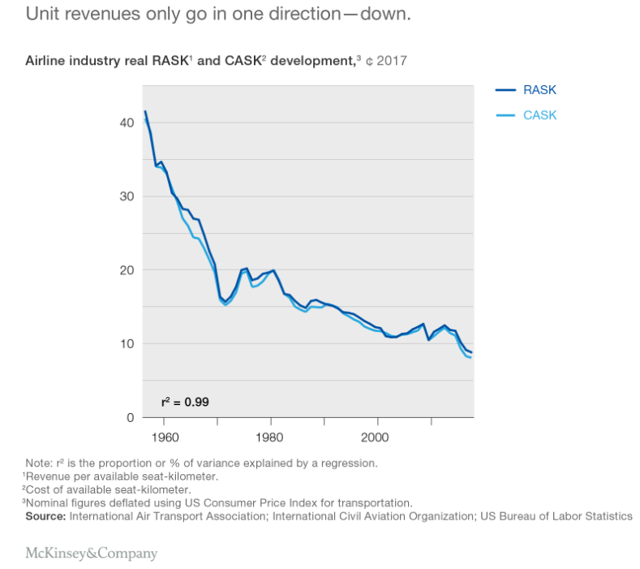

The airline industry is not known for being efficient. Bankruptcies and mergers have reduced 10 players to 4 in less than 20 years. Despite $2T of GDP cultivated from the aviation industry around the world, airlines still lose money. Despite the increase in consolidation, or perhaps because of it, airlines still cannot consistently improve revenue.

Source: McKinsey and Company

This makes sense. As industries become more concentrated, and the number of firms decline, they are much less efficient. Most industries do become more profitable too, unlike the airline industry. The pharmaceutical industry, health insurers, and spirits, among many others, have all seen their profits increase due to an increase in industry concentration.

When the HHI of an industry increases from the 25th percentile to the 75th percentile, the Lerner Index, which is a proxy for profitability, increases “about 182% relative to its median”. The Asset Utilization Ratio, which is a proxy for efficiency, only experiences an increase of “about 6% relative to its median” following a similar change in the concentration index, according to research from Grullon, Larkin, and Roni.

A change in industry concentration impacts profit margin much more than it impacts efficiency. There is a positive association between increased concentration and profitability. This is due to an overall lack of competition across industry members, as well as the ability to hike prices to capture more profits. Firms are getting more profitable, but not more improving their methods of operations. That can be problematic down the road.

Why an Increase in Profitability is Not a Good Thing

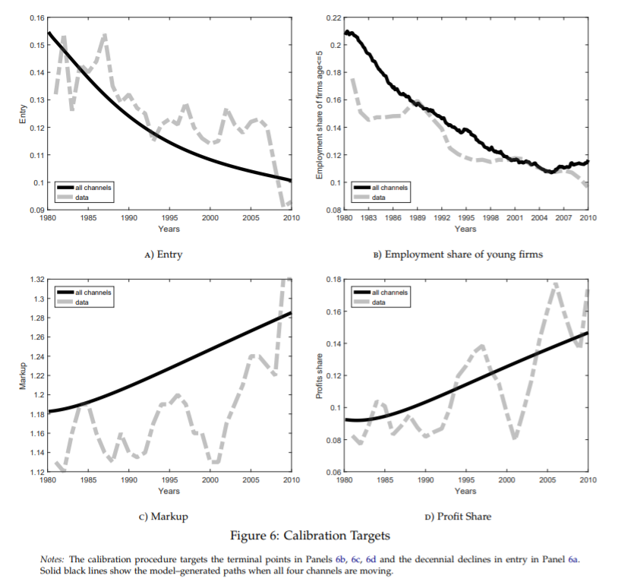

Across the board, new market entrants have declined, due to an increase in barriers to entry as the market consolidates among the top players. It becomes more expensive to try and break through. As industry concentration increases, markup and profit share both increase across the industry. Firms are able to increase their prices and improve their profits, primarily from the reduction in competition. This can have detrimental side effects.

Source: Akcigit and Ates

When there is increased concentration in an industry, there also tends to be more political power. 69 businesses are in the top 100 economic entities worldwide, with more money than several small countries combined. Money can influence political power, and political power, in turn, creates further opportunity for corporate wealth creation. The differences between corporation and government are growing thin as some companies have a larger annual revenues than the governments of Switzerland, Norway, and Russia.

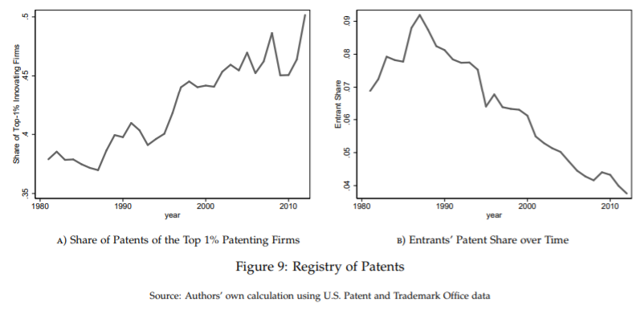

The firms with the political power can have sway over technology, bids on projects, and other key profit-making opportunities. This power has potentially led to a decline in knowledge diffusion, or the spread of technology and ideas, across the economy. The share of patents across the industry can be used as a proxy for knowledge diffusion. A decline in knowledge diffusion makes it tougher for younger firms to get access to the same technology in their attempt to break into new markets.

Source: Akcigit and Ates

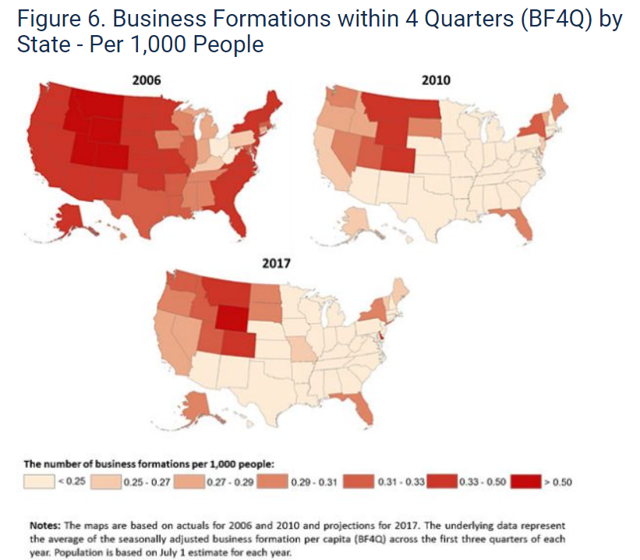

That potentially stifles innovation and business creation, as well as enables the continued increase of monopoly power across the top players. That’s partially why there has been a decline in business formations over time, with almost all 50 states declining in new business growth since 2006.

Source: Census

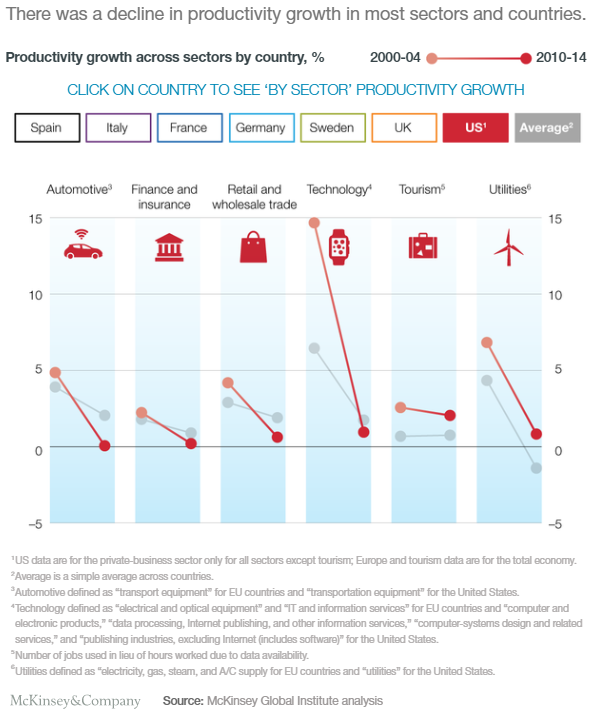

Even beyond new businesses forming, there has been stagnant productivity growth among existing businesses. This is another example of the discrepancy between profitability and efficiency, as corporate profits increase and productivity growth remains neutral. New players aren’t entering the market, and existing players aren’t improving efficiencies.

Source: Bureau of Labor Statistics

This productivity decline occurred across all sectors in the US. The financial crisis didn’t help matters much, and our economy and the markets are still recovering from some of that impact. Digital disruption has actually made things tougher for productivty too, with companies stating that “17% of their market share from core products or services was cannibalized by their own digital products or services.”

Source: McKinsey&Company

The Age of Disruptors: Breaking Up Monopolies

Disruptors are driving innovative growth in the current market environment. Airbnb shook up the hotel industry. Uber broke up the taxi industry, and the disruptor is currently being disrupted by Didi Chuxing in China. GoodRx increased prescription drug price transparency. Casper created the mattress in the box. Coursera is working towards improving the education industry.

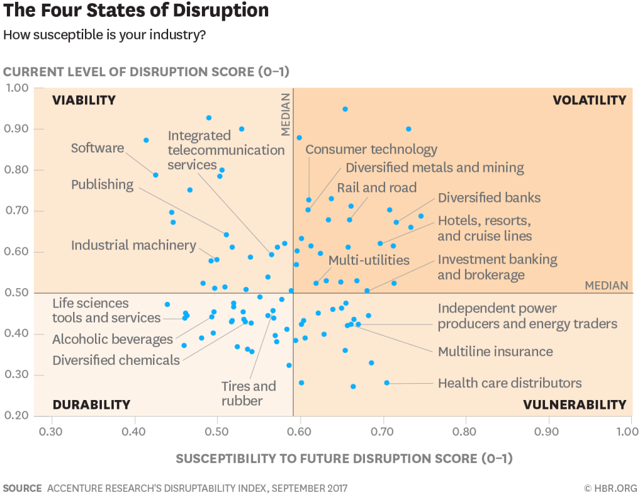

Source: Harvard Business Review

These disruptors are extremely important to economic growth. In the 2019 IPO class, 226 companies are expected to go public at a total value of $697B, and over $100B in total offerings. 119 of the 226 companies are unicorns, with valuations over $1B, with over 80% of the companies not turning a profit. The fundamentals are concerning, but the companies carry growth stories, and offer services that we need, and that we want, most of the time.

Source: UPFINA

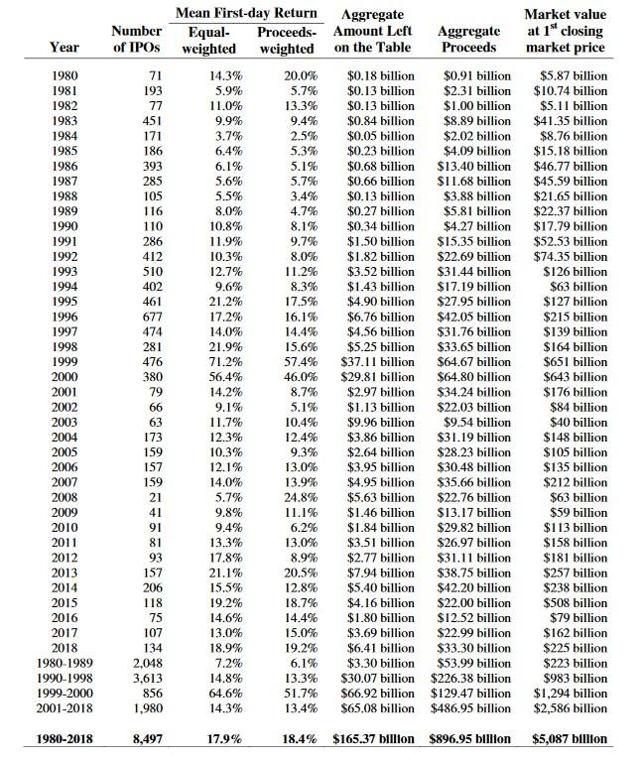

The 134 firms that went public in 2018 returned 18.9% on their first day, which is 1% above average. Comparing that to the 476 firms that went public in 1999, with a first day return of 71.2%, this current IPO market doesn’t look like a bubble.

These companies are the ones that can break up monopolies, and keep big corporations on their edge of their seats. But the only issue is, that companies are going public in smaller and smaller numbers. Fewer and fewer firms are choosing the IPO route, primarily because of the prevalence of private equity and other financing alternatives.

The Reduction in Publicly Traded Firms and the 2019 IPO Class

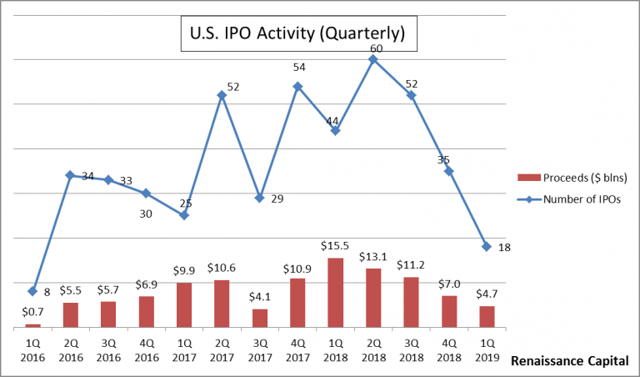

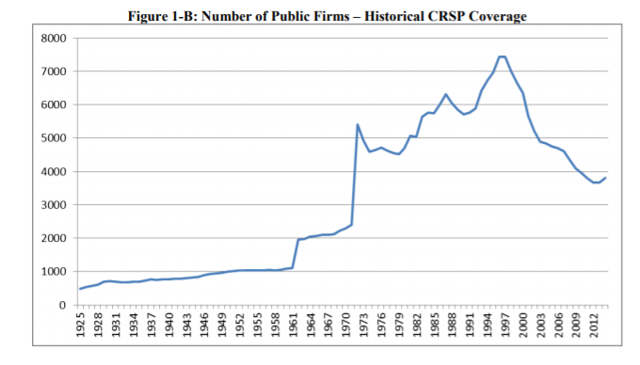

The number of public firms has declined substantially since the early 2000s, essentially cutting in half. There was an uptick in IPO activity at the end of 2018, but the end of year government shutdown has compressed 2019 numbers thus far. The remainder of 2019 is expected to be a strong year for IPO candidates, notably those in the healthcare and tech sectors.

Source: Integrity Research

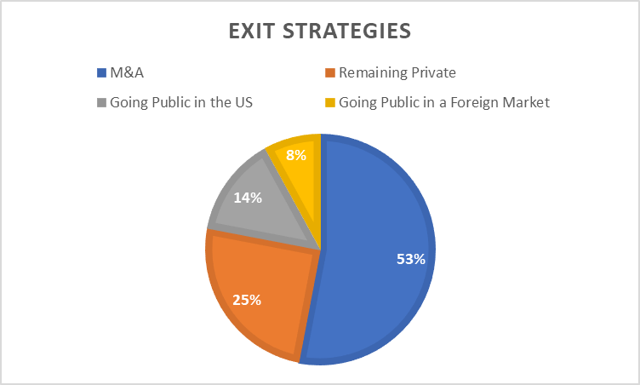

However, firms overwhelmingly prefer not to go public, if possible. M&A is by far the most popular ‘exit strategy’ for firms, with 53% of 100 tech CFOs surveyed by BDO’s Technology Outlook Survey. They prefer that strategy over remaining private, having an IPO in the US, or having and IPO in a foreign market. Only 24% of respondents preferred going public, and only 14% preferred going public in the US.

Source: CNBC, Author

Public markets have lost 50% of their traded firms over time. In fact, researchers found that:

“This decline has been so dramatic that the number of firms these days is lower than it was in the early 1970s, when the real gross domestic product in the US was just one third of what it is today. “

Source: GLM

Conclusion: Diversified Investments are King

It appears that at every turn, there is a road block. Monopolies increase profitability, but not efficiency. The number of publicly traded companies has declined. The companies that are going public don’t turn a profit, but are entirely necessary for continued economic growth and for breaking up the monopolies.

The overall macro narrative has been negative recently due to the prospect of a trade war between the US and China, issues in Italy and abroad, and a potential global slowdown on the horizon. But considering the low return on fixed income investments, coupled with a low annualized inflation rate, equities are the best choice for investors seeking positive returns.

It’s impossible to avoid market consolidation when investing. Companies will merge and acquire, sometimes for the better, and sometimes for the worse. But as investors, it’s important that we pay attention to the late market cycle warnings, as well as the impact that a concentration of industry power can have on returns.

So basically, keep all sensors on. The economic weakness of a late cycle, plus a trade war, plus general investor uncertainty might make for a tough trading environment in the coming months.

However, the 2019 IPO class is strong, and a lot of the companies are making big strides against industry players. It’s tough to break up monopolies, and it is an expensive task, but the disruptors are doing a good job thus far. Efficiencies should improve, especially as companies adjust to the digital world.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

moreComments

No Thumbs up yet!

No Thumbs up yet!