Invesco QQQ: Being Greedy When Others Are Fearful

The stock market is suffering from massive volatility and rampant uncertainty due to the COVID-19 panic in combination with the collapse in oil prices over the past several weeks. In this context, it makes sense to be looking for opportunities to buy. Like Warren Buffett said, being greedy when others are fearful can produce outstanding returns over the long term.

However, investors also need to keep risk under control by focusing on companies with strong fundamentals, solid balance sheets, and attractive growth prospects through good and bad times.

If you are going to buy stocks in a declining market and while the economy is facing a potential recession, then you need to make sure that you are buying companies that can come out of a recession in a good shape.

In other words, you want to buy businesses that are strong enough to continue growing and generating healthy cash flows even under the most challenging conditions.

With these factors in mind, Invesco QQQ (QQQ) could be a good alternative to consider. The ETF offers exposure to many of the strongest companies in the world, with solid potential for long-term growth and no exposure whatsoever to the energy sector.

The ETF has been outperforming the market both to the upside and to the downside lately, and it looks well-positioned to continue outperforming in the middle term.

Solid Fundamentals

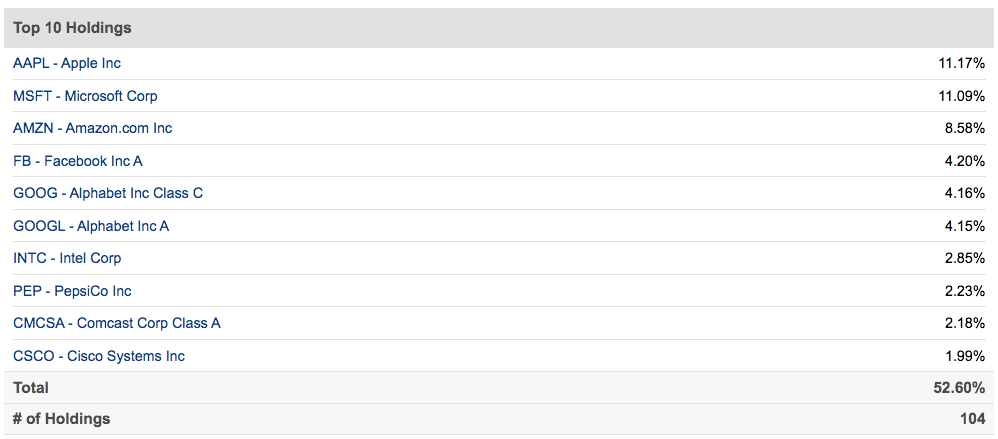

Invesco QQQ is relatively more concentrated than other ETFs, with the top 10 positions representing 52.6% of the portfolio. Even more, Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Facebook (FB) account for nearly 43% of the portfolio when considered together.

(Click on image to enlarge)

Source: Seeking Alpha

These top five positions are among the biggest and strongest companies in the world, with healthy balance sheets and plenty of access to financial resources. These tech titans generate abundant cash flows year after year, so they don't need any outside capital. This is a particularly relevant advantage in case we see financial conditions deteriorating further in the near term.

The table below shows the sector exposure for QQQ versus VTI. It is important to note that QQQ has no exposure whatsoever to the energy sector and only marginal exposure to financial services. With the energy sector facing colossal challenges due to collapsing all prices lately, avoiding this sector makes a lot of sense if you are trying to keep risk under control.

(Click on image to enlarge)

Source: Morningstar

When analyzing which companies are strong enough to survive in the worst-case scenario, competitive strengths, or moats, are of utmost importance. Competitive strengths are factors such as brand differentiation, scale advantages, or superior technologies. These factors allow a company to protect its cash flows from the competition and to sustain profitability over time.

Looking at moats as characterized by Morningstar, QQQ has a larger presence of "Wide Moat" and "Narrow Moat" stocks than the broad market as represented by VTI.

(Click on image to enlarge)

Source: Morningstar

In a nutshell, QQQ is focused on high-quality companies with solid balance sheets and consistent cash flow generation. Even if the economy enters a recession in the coming weeks, the companies in the QQQ portfolio, as a group, should be able to able to successfully sail through any storm.

Outperforming In Bull And Bear Markets

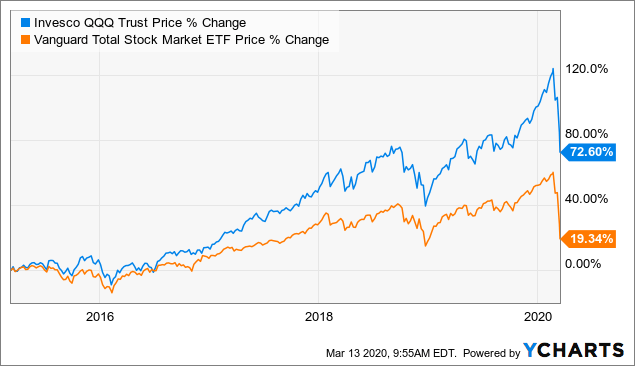

Invesco QQQ has materially outperformed the Vanguard Total Market ETF during the strong bull market in the past five years. This is not particularly surprising when considering that growth stocks tend to do better than the market averages when optimism is rising and risk appetite is bullish across the board.

(Click on image to enlarge)

Data by YCharts

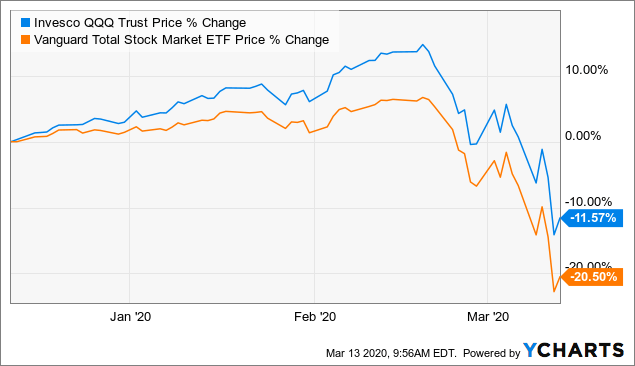

But more interestingly, QQQ is also outperforming VTI on the way down. This could be subject to change in such a fluid market environment, but it is not easy to find instruments that can outperform the market both on the way up and then again on the way down.

(Click on image to enlarge)

Data by YCharts

Relative strength begets more relative strength and assets that are outperforming tend to attract more money over time, this bodes well for QQQ in comparison to other alternatives in the market right now.

In order to analyze the timing for different ETFs in the market, we can take a look at the different alternatives through the ETF Timing Algorithm. This is a quantitative algorithm that ranks more than 2,200 ETFs based on returns over different periods. The table below shows the different factors considered in the algorithm and their respective weights.

(Click on image to enlarge)

The algorithm looks for ETFs that are delivering consistently high momentum metrics across different time frames. However, we don't want the ETF to be too overextended in the short term, so the algorithm gives a -20% weight to the one-month return.

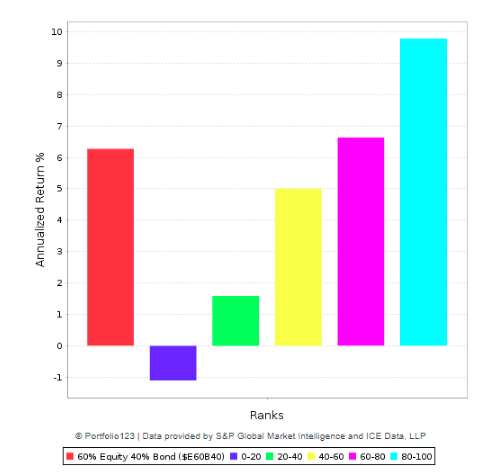

The chart below shows the historical returns for ETFs in different ranking segments versus the 60/40 benchmark. ETFs with a high ranking tend to significantly outperform the benchmark, and there is a direct relationship between the ETF Timing ranking and performance.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

It is important to keep in mind that momentum can be a double-edged sword. Assets that are outperforming tend to continue outperforming more often than not, however, when markets are going through major dislocations, you can have big changes in relative performance trends. Winners tend to keep on winning, but when they start losing, they can lose in a big way.

That being acknowledged, QQQ has a timing ranking of 99 as of the time of this writing. If you are looking for an ETF that is consistently outperforming the market while also pulling back in the short term, then QQQ is an interesting alternative to consider.

Risk And Reward Going Forward

It is still too early to tell what the social and economic impact of COVID-19 will be over the middle term. History shows that buying in times of panic tends to produce superior returns over the long term, but we need to acknowledge the fact that things could keep getting worse before they get any better. This is not a prediction, of course, only an important risk factor to keep in mind.

It is impossible to buy a full position at the exact market lows, so it makes sense to start slowly buying as markets are on the way down. But you never know how low prices will go, so you need to keep some cash at hand in case the markets go much lower and for a much longer time than you were expecting.

Nobody ever got rich betting against the United States, and nobody is going to get rich by betting against the best companies in the world over the long term. Nevertheless, risk management is always priority number one, and cash is king during challenging times.

The main idea is that buying slowly is the way to go during times of crisis. Perhaps buying half of the position on the way down and the other half when things are starting to improve.

In terms of specific risk factors, several of the big tech players in the QQQ portfolio have been criticized for their data privacy policies and dominant market positions in some niches. Regulatory risk is particularly relevant for the top five positions in the QQQ portfolio.

Personally, I own big positions in several of the stocks in QQQ, so it doesn't make much sense for me to buy the ETF too. However, for investors who are looking to buy high-quality businesses during times of market panic, QQQ offers diversified exposure to a collection of exceptional businesses.

Volatility and uncertainty are substantial in the short term, but chances are that prices will be higher 12 months for today. Even better, in a time horizon of three to five years, investors should be well rewarded for following Warren Buffett's advice and being greedy when others are fearful.

Disclosure: I am/we are long AAPL, AMZN, FB, GOOG.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

moreComments

No Thumbs up yet!

No Thumbs up yet!