Inflation And The Equity Market

The recent release of Federal Reserve minutes gave investors a reason to reevaluate the pace of future Fed tightening. The minutes led investors to believe the Fed might raise rates in the first half of this year and maybe even as soon as March. The Jan. 25-26 Fed meeting will likely shed more light on future rate hikes.

Quantitative Tightening (QT), or the reduction in the Fed's balance sheet, may occur soon after rates move higher as well. This earlier increase in rates comes on the back of higher inflationary pressures and what seems like a tight labor market.

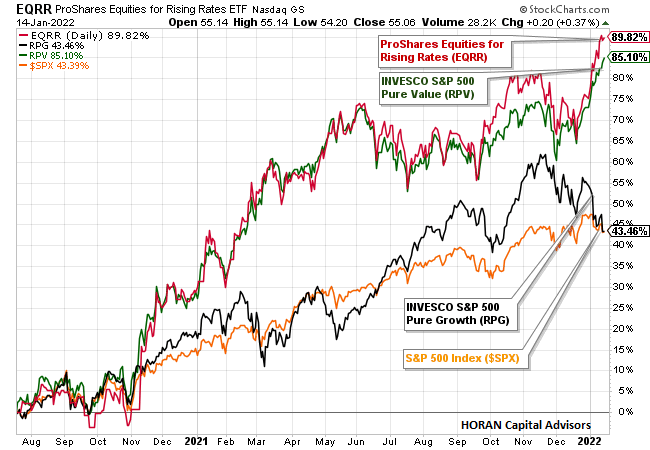

This move higher in inflation has led to better performance in certain stocks that benefit from higher inflation. The ProShares Equities for Rising Rates ETF (EQRR) has performed as expected in this higher interest environment. Investors should know, though, this ETF is concentrated in mostly five sectors. As of the end of November, 2021, the three largest sectors, Financials, Energy, and Materials, account for almost 80% of the weighting in the ETF.

As the chart below shows, since mid-July of 2020 the EQRR index has outperformed the S&P 500 Index, approximately 89.82% versus 43.39%. Has the performance of this index already discounted those equities benefits from an inflationary spike? Also evident on the chart is Pure Value's outperformance relative to Pure Growth's, 85.10% versus 43.46%.

The favorable performance for stocks that benefit from higher interest rates has taken place at about the same time that market interest rates have actually moved higher. Over this same time period, the yield on the 10-Year U.S. Treasury has increased from about .50% to 1.78%, as seen below. The higher move in market interest rates has pressured bond or fixed income returns.

Higher prices, pressure on "real" wages, and already satisfied pent up demand may be indicators of a lessening of inflationary pressure. As Nancy Lazar of Cornerstone Macro recently noted:

"Real retail sales -- units -- have been declining for almost a year, as pulled-forward demand dissipates. Basically, consumers bought 3-years worth of stuff in a year (e.g., computers, TVs, household appliances, sports equipment, etc.), and with the pandemic transitioning to an endemic, consumers are shifting from spending on stuff to spending on services, just as income slows sharply, back to trend. Indeed, investors are anticipating this, as reflected in hotel stocks recently outperforming."

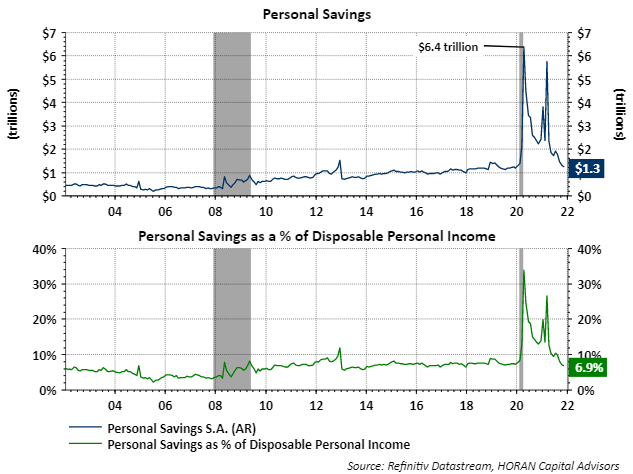

This pull forward in demand/elevated spending can be seen in the decline in the build up in savings. Personal savings rose to $6.4 trillion at the peak of the pandemic and is now back to a more normal $1.3 trillion.

As desired by the Fed, interest rates are most likely moving higher and off the near-zero level. Fiscal and monetary stimulus needs to be reined in, but the question remains: how strong is the economy, and will higher rates tip the economy into recession?

We believe economic growth is not red hot, and the satisfying of pent-up demand resulting from the pandemic shutdown is slowing. Economic growth is likely to moderate as the year progresses with near-term volatility due to uncertainty that is generally associated with midterm election years and the Fed's move higher in interest rates.

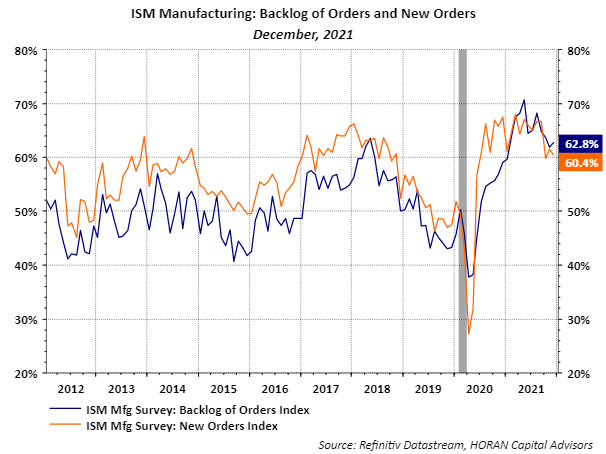

On balance businesses continue to see favorable business prospects. The chart below shows the ISM Manufacturing Indices for the backlog of orders and new orders. Both are at high levels but coming down to more historical levels. At the end of the day, we believe inflationary pressure will subside from its current high level.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more